Deed Of Trust Modification With No Maturity Date In Clark

Description

Form popularity

FAQ

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed.

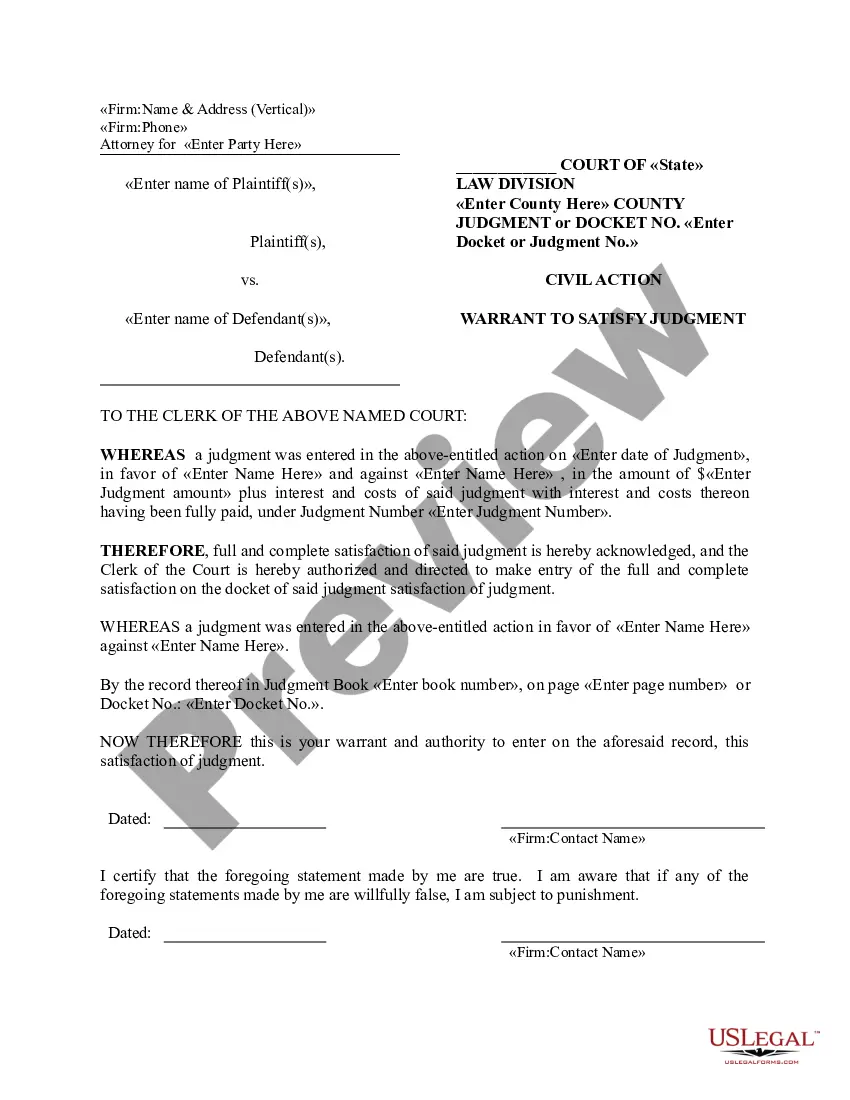

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

If a deed of trust recorded in California does not contain a maturity date, then the lender has up to 60, and possibly even 64 years to foreclose non-judicially, but the longer the lender waits, the more likely it is that a borrower could successfully raise a defense of equitable estoppel or laches.

A trust deed expires and is extinguished from the record: 10 years after the entire debt becomes due; or. 60 years after the trust deed is recorded if the due date cannot be ascertained by records of the transaction.

What is the Nevada statute of limitations on collecting HOA debt? 6 years. The statute of limitations periods for HOA claims are different for every state. In Nevada consumer debt such as HOA & Condo fees have a statute of limitations of 6 years.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Nevada is a Deed of Trust state.