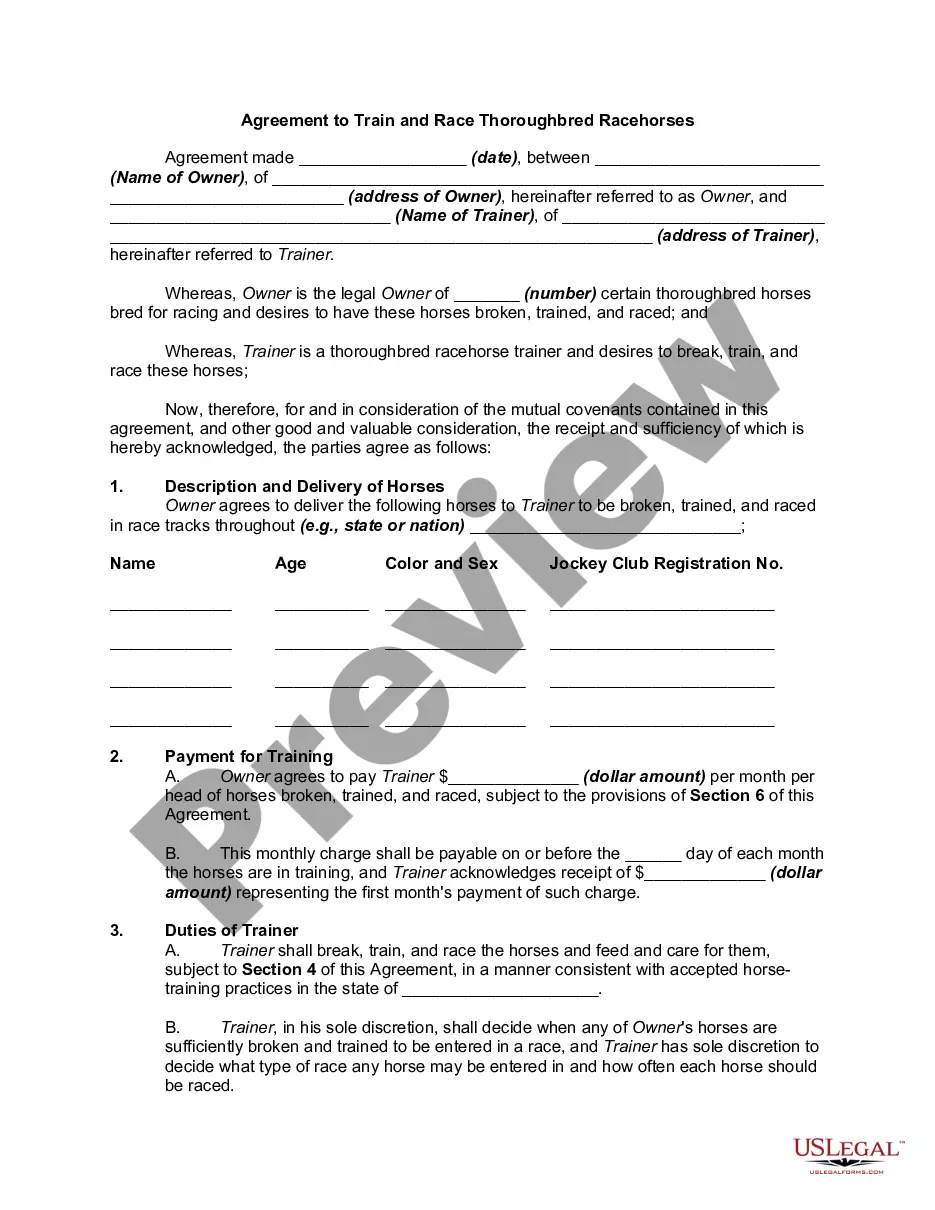

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Modification With Mortgage In Arizona

Description

Form popularity

FAQ

You can transfer a property with an existing mortgage into a living trust, and this is a common practice for estate planning purposes.

The main benefit of putting your house in a trust is to bypass probate when you pass away. All your other assets, regardless of whether you have a will, will go through the probate process.

Summary. Placing a mortgaged property in a trust is possible and common, although key considerations must be taken into account. Some considerations to keep in mind are mortgage payments, refinancing, and the due-on-sale clause.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Disadvantages of Putting Your House in a Trust Loss of Direct Ownership. Potential Complexity and Administrative Burden. Potential for Increased Costs. No Asset Protection Benefits. Limited Tax Advantages. No Protection Against Creditors.

In many states, lenders use conventional mortgages as the primary security document for the underlying property during a real estate transaction. However, if you are buying a home in Arizona, you are likely to use a Deed of Trust as security for the property.

Mortgage or Deed of Trust? StateMortgage StateDeed of Trust State Alabama ✅ ✅ Alaska ❌ ✅ Arizona ✅ ✅ Arkansas ✅ ✅47 more rows •