Security Debt Any With Example In Washington

Description

Form popularity

FAQ

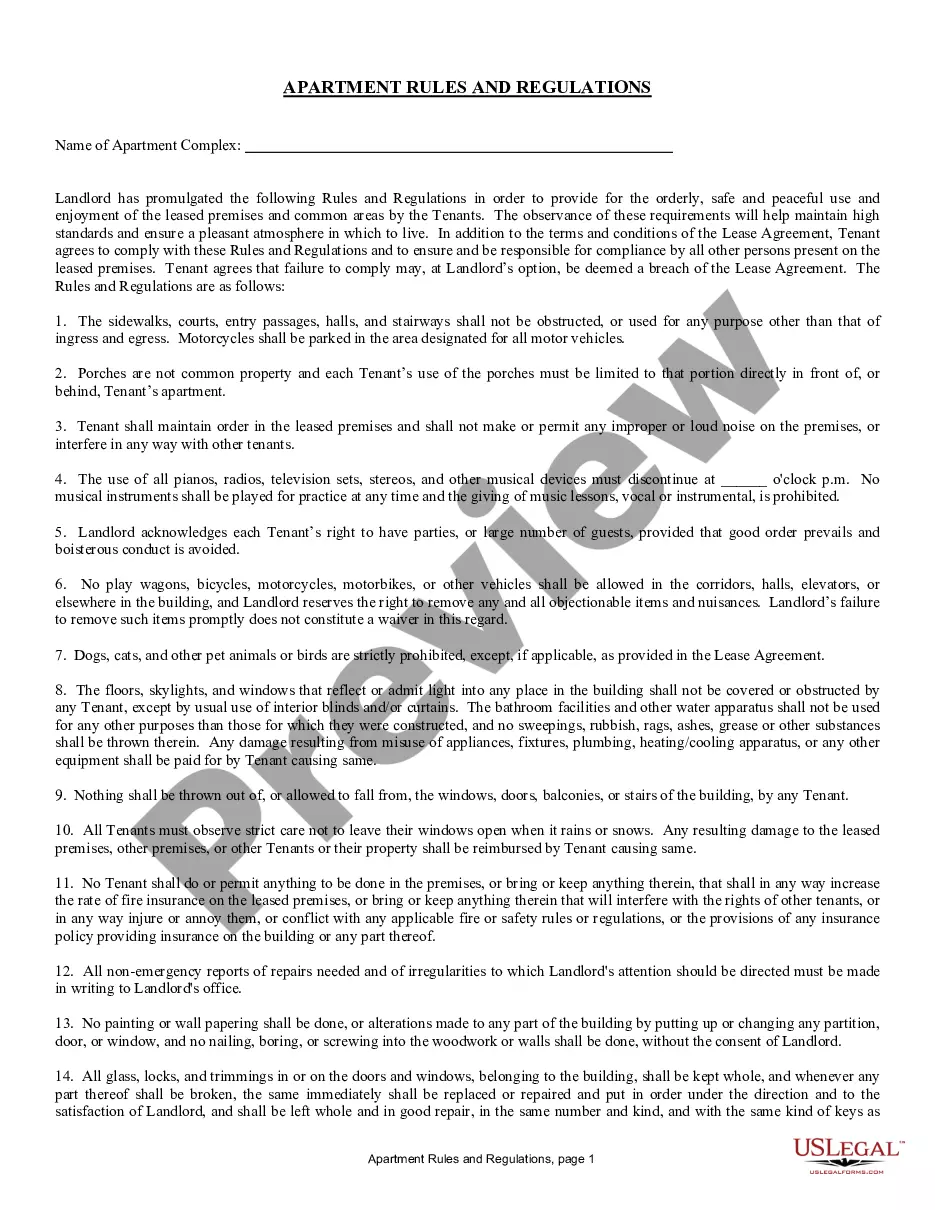

A landlord may not terminate a tenancy or increase rent or change other terms of the rental agreement to retaliate against a tenant who asserts his or her rights under the Landlord-Tenant Act or reports violations of housing codes or ordinances. Attorney General at 800-551-4636.

Generally speaking, this is incorrect. Small nail holes are considered normal wear & tear in Washington state (and many others).

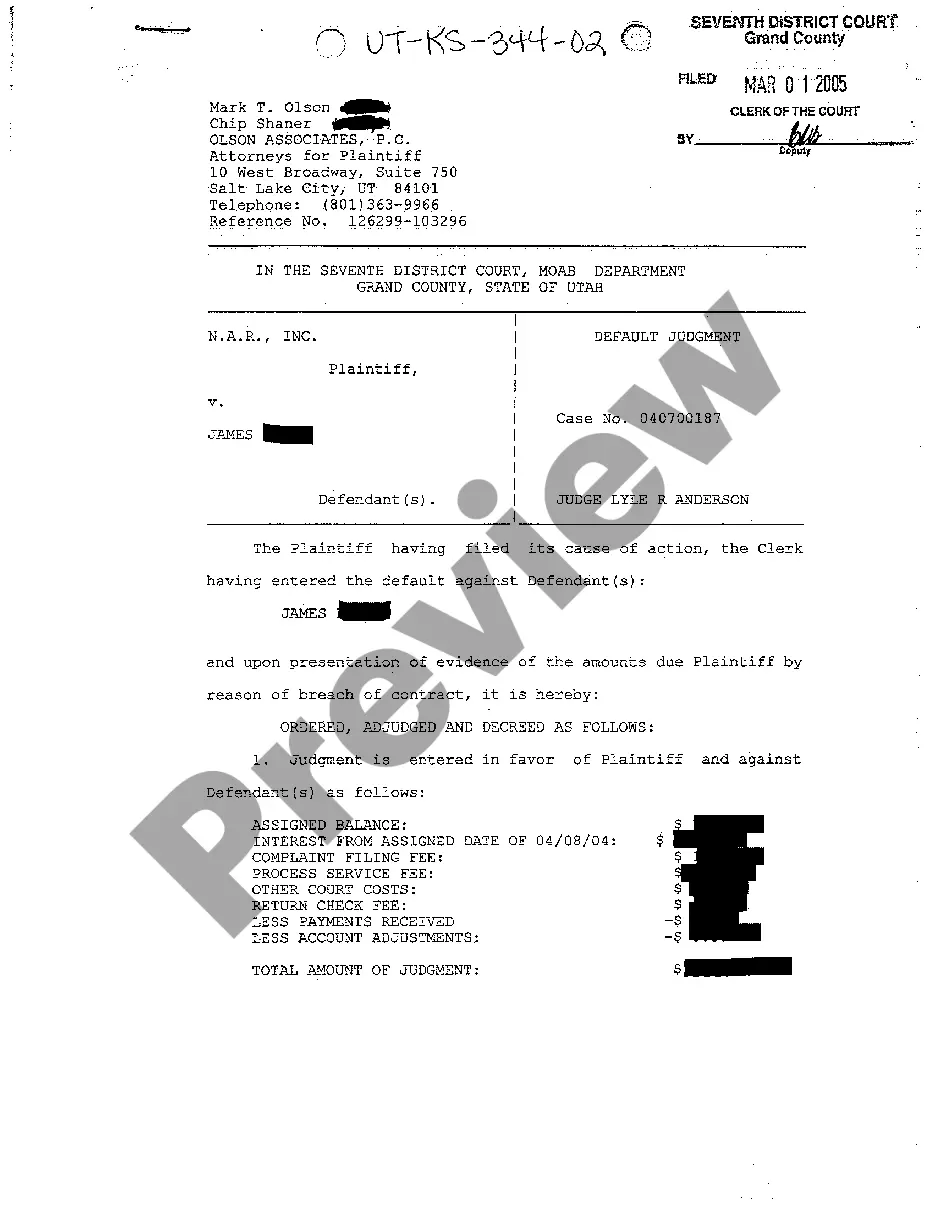

Unless you take steps to protect them, most assets are not protected in a lawsuit. One of the few exceptions to this is your employer-sponsored IRA, 401(k), or another retirement account. At Bratton Estate and Elder Care Attorneys, our lawyers recommend putting an asset protection plan in place before you need it.

Maybe. A Judgment Creditor may try to have the sheriff sell your real property (land, house, and other buildings). The homestead law protects up to $125,000 of equity in your home from most Judgment Creditors. If you live on the property claimed as a homestead, the exemption is automatic.

When a Collection Agency Contacts You A collection agency cannot call or write to you more than three times a week. A collection agency cannot harass, intimidate, threaten, or embarrass you; A collection agency cannot threaten violence, criminal prosecution, or use offensive language; and.

(i) All household goods, appliances, furniture, and home and yard equipment, not to exceed $6,500 in value for the individual, said amount to include provisions and fuel for comfortable maintenance; (ii) In a bankruptcy case, any other personal property, except personal earnings as provided under RCW 6.15.

Generally, all debts either spouse incurred during the marriage are community debts. Both spouses are equally responsible for them. Debts you incur before the marriage or after separation are separate debts. You are not responsible for your spouse's separate debts or vice versa.

In Washington, the homestead exemption is $40,000 and includes land, mobile homes, and improvements. If you have a life insurance policy where the beneficiary is not yourself, the proceeds and avails are exempt from creditor claims.

In the fiscal year of 2024, Washington's state debt stood at about 26.86 billion U.S. dollars. Comparatively, the state's debt was approximately 11.73 billion U.S. dollars in 2000. The national debt of the United Stated can be found here.

What are some ways to protect my assets? Supplemental Needs Trust. This type of trust can be created by any individual who needs government benefits in the future or someone who requires assistance with asset protection. Washington living trust. Testamentary Trust.