Security Debt Shall Forgiveness

Description

How to fill out Land Deed Of Trust?

It’s clear that you can’t become a legal expert instantly, nor can you determine how to rapidly prepare Security Debt Shall Forgiveness without possessing a specialized background.

Drafting legal documents is a labor-intensive task that necessitates specific training and expertise. So why not entrust the preparation of the Security Debt Shall Forgiveness to the specialists.

With US Legal Forms, one of the most comprehensive legal document databases, you can access everything from court documents to templates for internal corporate communication.

Begin your search anew if you require any other form.

Establish a free account and select a subscription plan to purchase the template.

- We understand how crucial compliance and adherence to federal and state laws and regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can initiate your journey on our website and acquire the document you require in just a few minutes.

- Locate the document you need by utilizing the search bar at the top of the page.

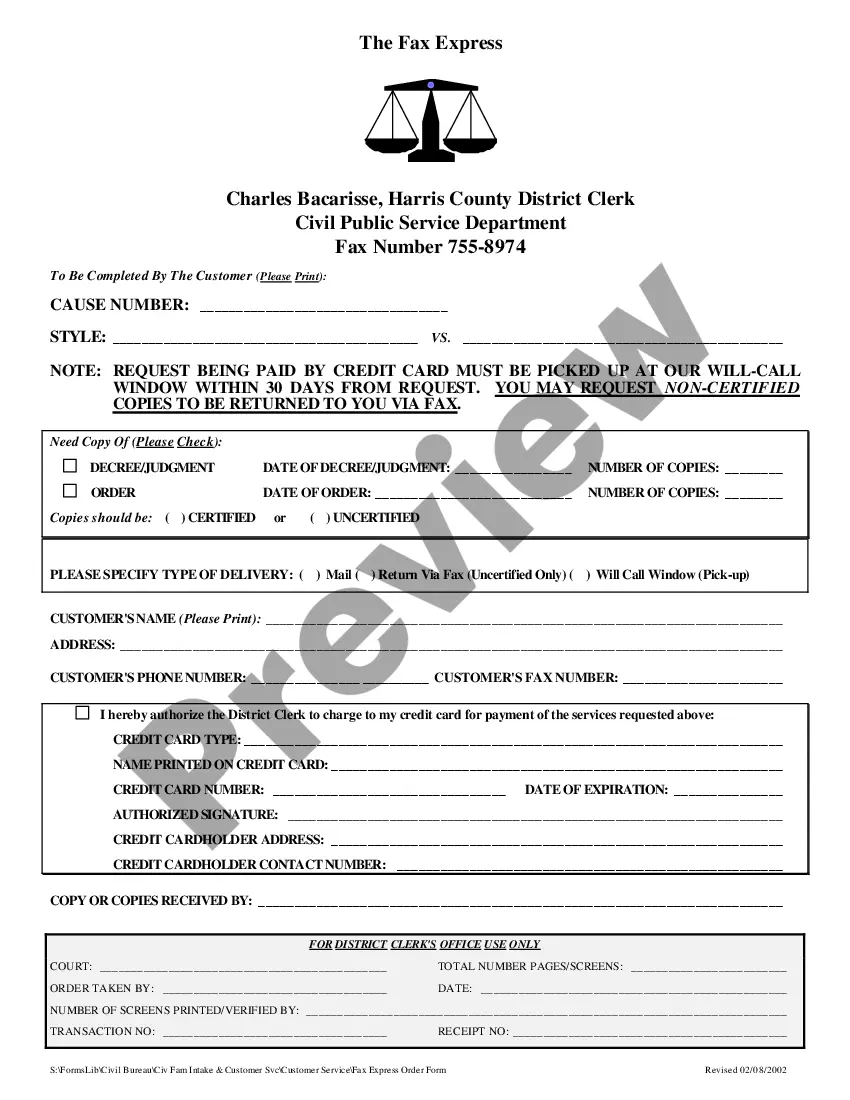

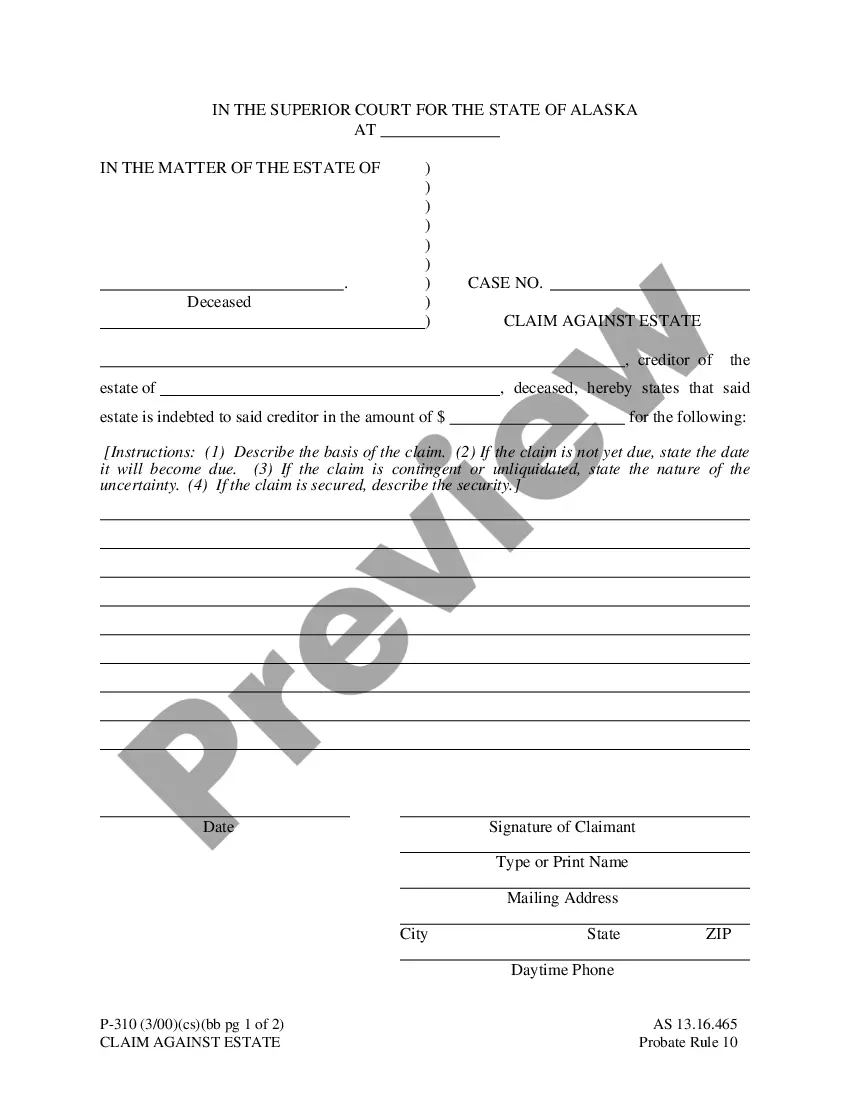

- Preview it (if this option is available) and read the accompanying description to ascertain whether Security Debt Shall Forgiveness is what you’re looking for.

Form popularity

FAQ

Form 982 is designed for taxpayers who have had debt canceled or forgiven and want to exclude that amount from their taxable income under certain conditions. Generally, you may qualify if you are insolvent or if the debt was discharged in bankruptcy. Understanding your eligibility for security debt shall forgiveness can be complex, so seeking advice from a tax professional is advisable.

To report debt forgiveness, you typically need to include the information from the 1099-C on your tax return. This involves adding the forgiven amount to your taxable income. Properly reporting security debt shall forgiveness helps ensure compliance with IRS regulations and avoids future complications. Utilizing tools available on platforms like US Legal Forms can assist you in this process.

The impact of a 1099-C on your taxes can vary based on the amount of debt forgiven and your overall income. Generally, the forgiven amount is added to your taxable income, which can increase your tax bill. Understanding security debt shall forgiveness is key to managing your tax responsibilities efficiently. Consulting with a tax advisor can provide tailored advice based on your circumstances.

C cancellation of debt can be viewed as both good and bad. On one hand, it relieves you of financial obligations, providing immediate relief. On the other hand, it may lead to unexpected tax implications due to the security debt shall forgiveness. Evaluating your financial situation can help you determine whether the benefits outweigh the drawbacks.

Yes, cancellation of debt does affect your tax return because the IRS treats forgiven amounts as income. This can increase your taxable income and potentially push you into a higher tax bracket. It's important to correctly report any security debt shall forgiveness to avoid issues with the IRS. Proper documentation and reporting can mitigate negative effects on your tax return.

Receiving a 1099-C can significantly impact your taxes, as the IRS views forgiven debt as income. This means you may owe taxes on the amount reported, affecting your overall tax liability. It's essential to consider your specific situation regarding security debt shall forgiveness to understand the full implications. Consulting a tax professional can provide clarity and guidance.

Legally forgiving a debt typically involves formal documentation that states the debt is forgiven. This process ensures clarity and protects both parties involved. Utilizing resources like the US Legal Forms platform can streamline this process by providing templates and guidance for security debt shall forgiveness. Always consult a legal professional to ensure compliance with relevant laws.

If you don't report a 1099-C, the IRS may still consider the forgiven debt as taxable income. This can lead to penalties and interest on any unpaid taxes. Therefore, it is crucial to understand how security debt shall forgiveness impacts your tax obligations. Reporting the 1099-C helps you stay compliant and avoid unexpected tax bills.

To ask for debt forgiveness, begin by researching your creditor's policies and preferred communication methods. Next, formulate a clear and concise request, emphasizing your financial challenges and your desire for relief through security debt shall forgiveness. You can utilize platforms like uslegalforms to find templates and resources that guide you through the process. This preparation can make your request more compelling and may lead to a favorable outcome.

Qualifying for debt forgiveness often depends on your financial situation and the policies of your creditor. Generally, factors such as income level, financial hardships, and your overall ability to repay the debt play significant roles. Additionally, demonstrating a commitment to managing your finances responsibly can strengthen your request under the framework of security debt shall forgiveness. Always check with your creditor for specific guidelines to ensure you meet their criteria.