Secured Debt Any With A Sinking Fund In Nassau

State:

Multi-State

County:

Nassau

Control #:

US-00181

Format:

Word;

Rich Text

Instant download

Description

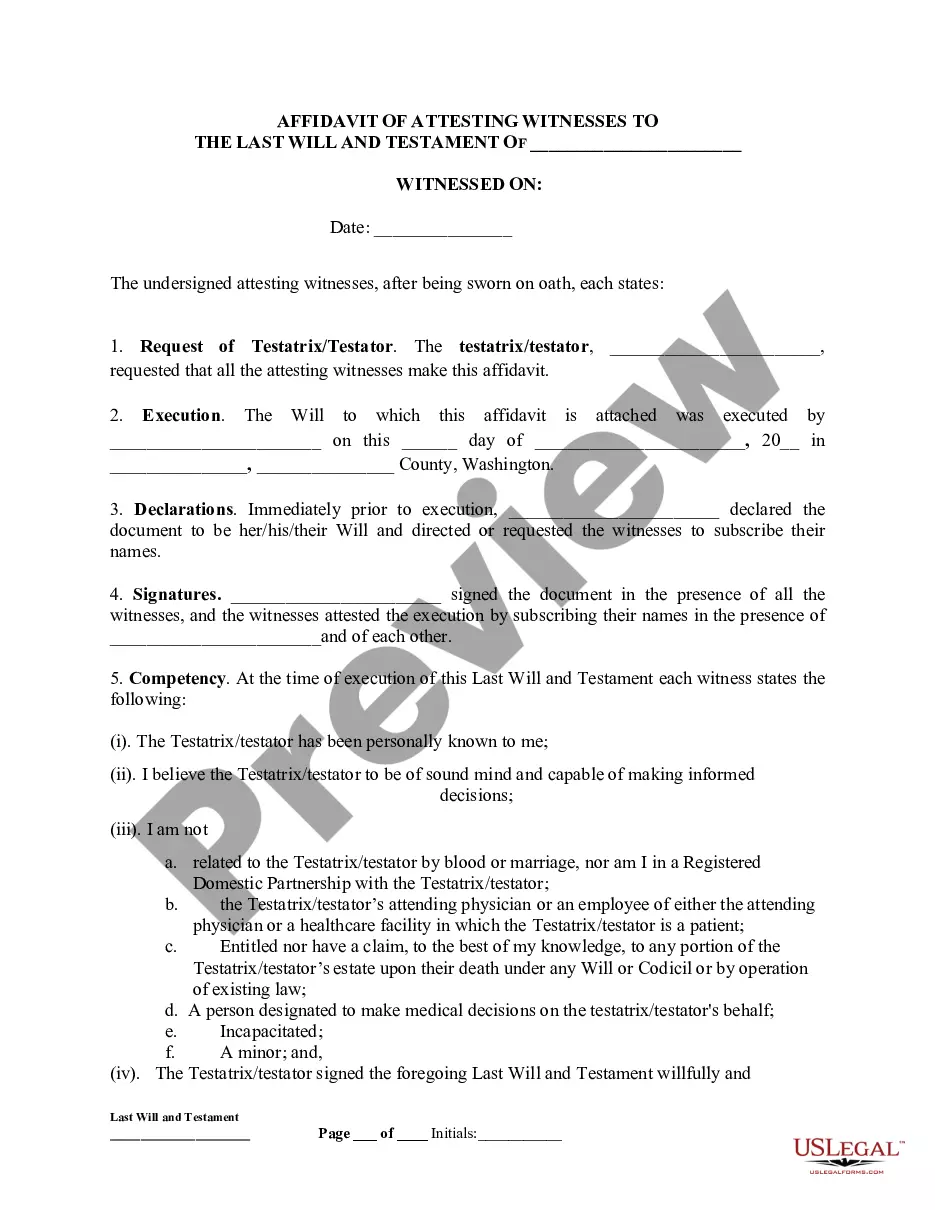

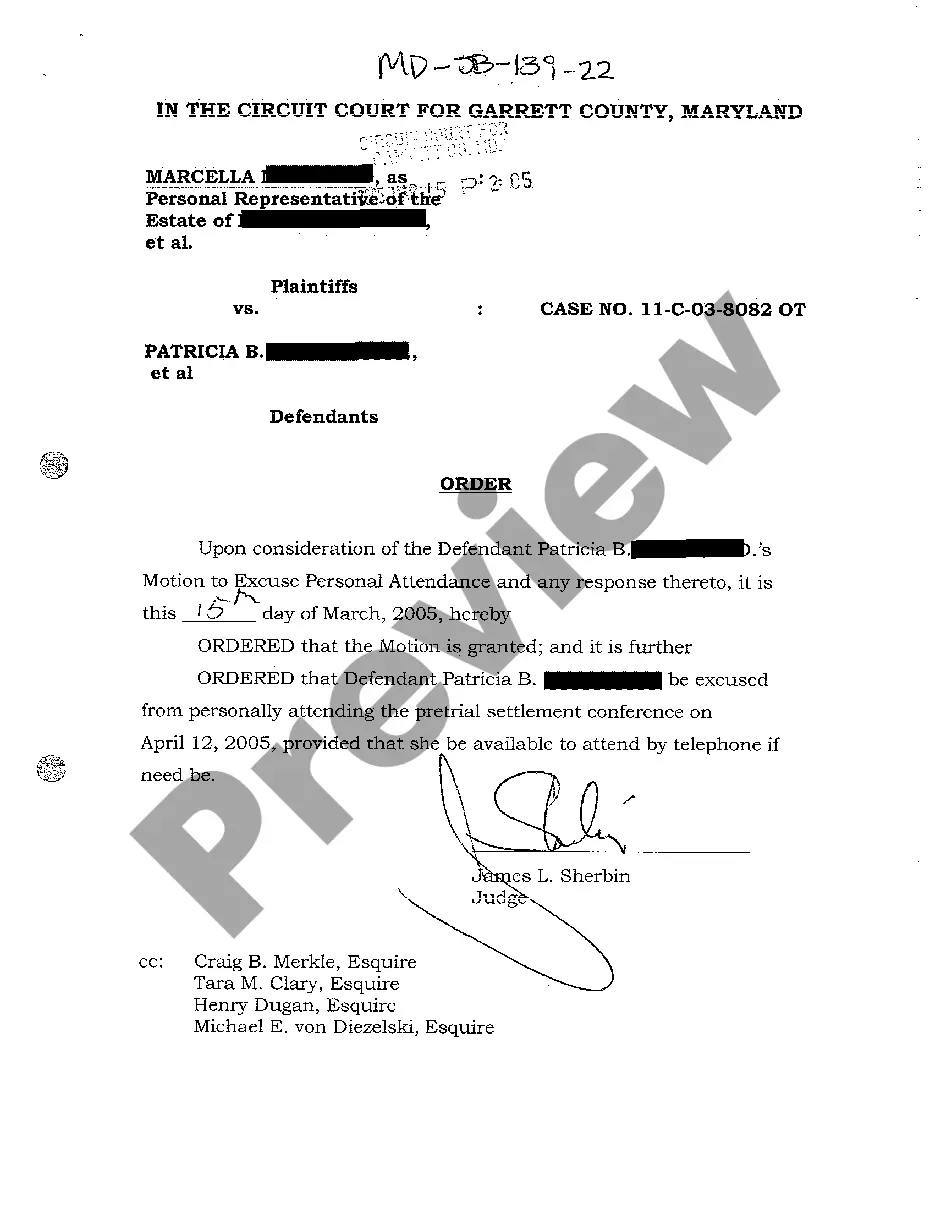

The Secured Debt Any With a Sinking Fund in Nassau form is designed to formalize a trust arrangement wherein a debtor secures their indebtedness to a secured party through real property. Key features of this form include the outlining of payment structures, specifying installments, and detailing conditions under which the property may be sold in the event of default. Users must fill in personal information regarding the debtor, trustee, and secured party, alongside the amount of debt and installment details. It is crucial that the debtor maintains all required insurance and pays related taxes to prevent default. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants as it clarifies the responsibilities and rights concerning property in case of loan defaults, thereby providing assurance and structure to outdoor transactions. Additionally, the form supports legal compliance with conditions set forth by constitutional law and provides mechanisms for initiating foreclosure if obligations are not met, making it an essential tool in property financing within Nassau.

Free preview

Form popularity

FAQ

Sinking funds are in 'trust' for the scheme and should not be returned to lessees upon assignment, or at any time. Interest earned on funds should be added to the funds unless the lease states otherwise. If funds are held in 'trust' then a tax will be charged on the interest earned.