Security Debt Any With Example In Hennepin

Description

Form popularity

FAQ

Debt securities are financial assets that entitle their owners to a stream of interest payments. Unlike equity securities, debt securities require the borrower to repay the principal borrowed. The interest rate for a debt security will depend on the perceived creditworthiness of the borrower.

Examples of these are treasury notes, treasury bills, zero-coupon bonds, municipal bonds, and treasury bonds. Corporate bonds describe the securities that corporations issue to willing buyers. Corporate bonds depict higher interest rates than U.S government bonds due to the higher risk of default associated with them.

Security debt refers to software flaws that remain unfixed for a year or more.

Bonds (government, corporate, or municipal) are one of the most common types of debt securities, but there are many different examples of debt securities, including preferred stock, collateralized debt obligations, euro commercial paper, and mortgage-backed securities.

Bonds (government, corporate, or municipal) are one of the most common types of debt securities, but there are many different examples of debt securities, including preferred stock, collateralized debt obligations, euro commercial paper, and mortgage-backed securities.

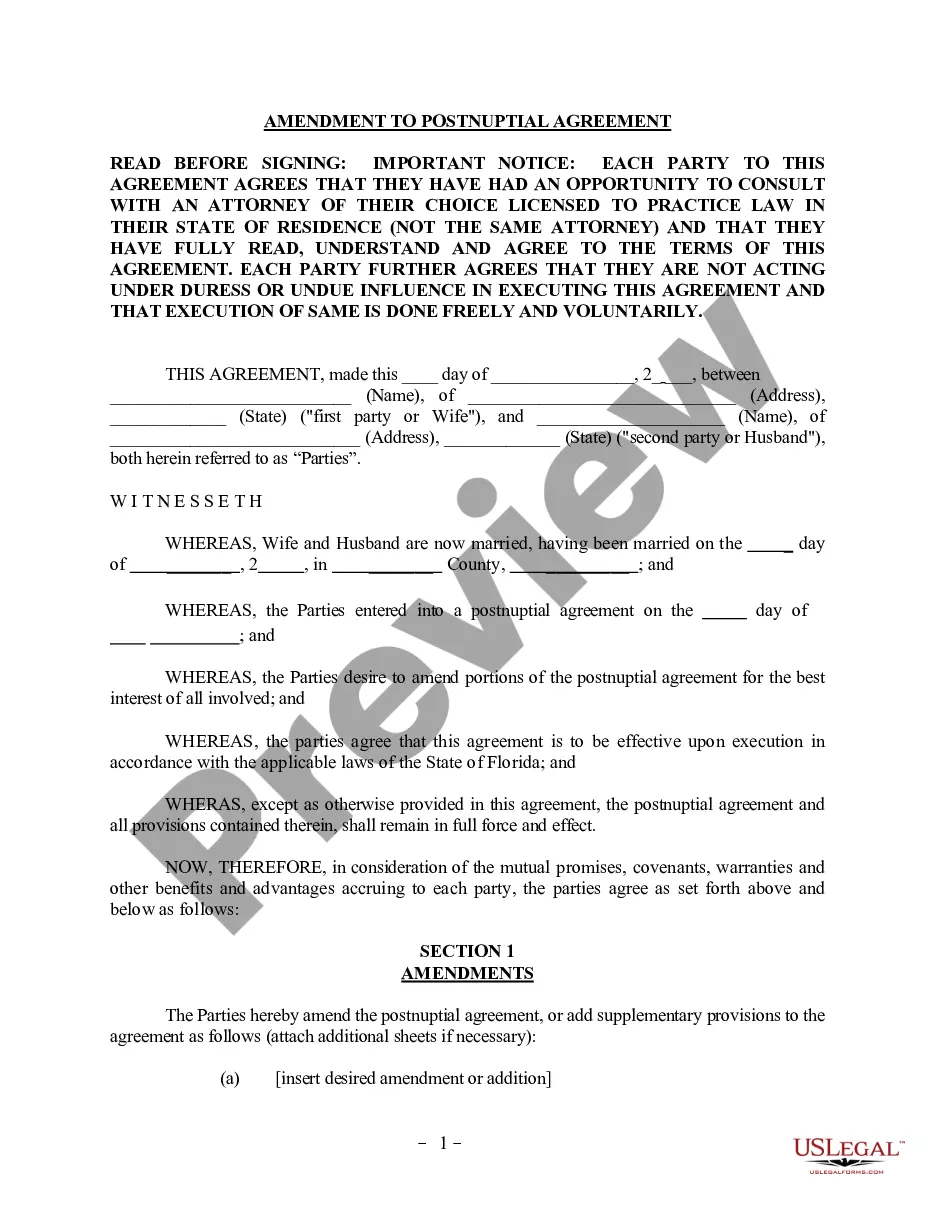

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

If they file it “before or within 20 days after the debtor receives delivery of the collateral, then the security interest takes priority over conflicting interests which arise between the time the security interest attaches and the time of filing.”

Financing statements are sometimes filed prior to the security interest attachment. Creditors often prefer this approach, as it can prevent a lag between attachment and perfection.

If they file it “before or within 20 days after the debtor receives delivery of the collateral, then the security interest takes priority over conflicting interests which arise between the time the security interest attaches and the time of filing.”

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.