Secured Debt Shall With A Sinking Fund In Fulton

State:

Multi-State

County:

Fulton

Control #:

US-00181

Format:

Word;

Rich Text

Instant download

Description

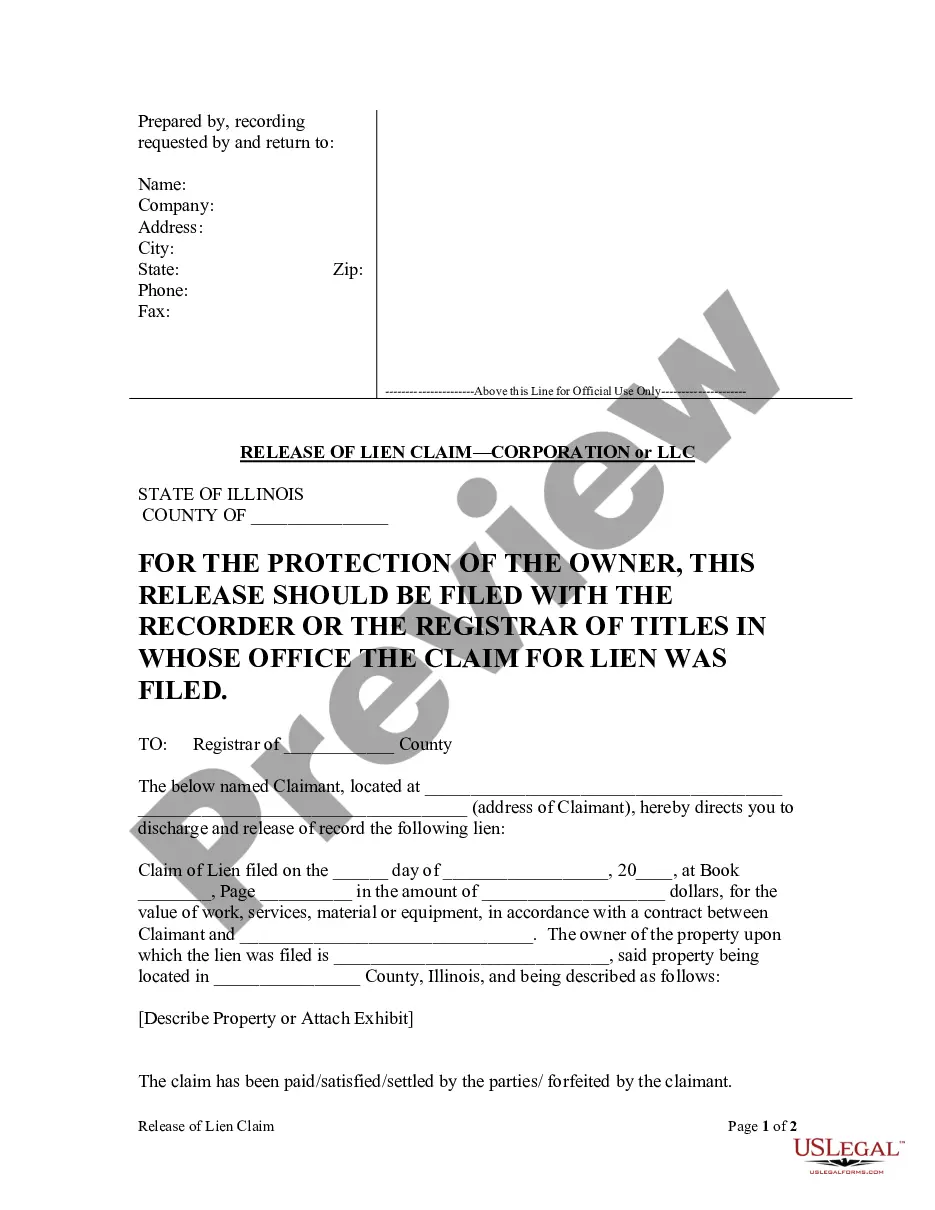

The document, titled Land Deed of Trust, outlines an agreement between a debtor and a secured party, allowing for secured debt with a sinking fund in Fulton. This form facilitates the securing of debt through the conveyance of property, ensuring that the secured party has recourse to the property in case of default. Key features include the establishment of a sinking fund for repayment, responsibility for property maintenance, and the obligation of the debtor to maintain insurance against loss. The form provides clear instructions for completing fields related to the amounts owed and repayment schedules. It is particularly useful for attorneys and paralegals as it articulates the rights and responsibilities of both parties involved in securing a loan against property. Moreover, it emphasizes the importance of compliance with the terms to avoid default and enables landlords and business owners to secure financing while protecting their investments. Legal assistants can reference this form to understand the implications of secured credit transactions and the legal obligations associated with them.

Free preview

Form popularity

FAQ

The sinking fund formula calculates periodic payments needed to accumulate a specific future amount: PMT = FV / {(1 + r)^n – 1 / r}, where FV is the future value, r is the interest rate, and n is the period.

Sinking funds are in 'trust' for the scheme and should not be returned to lessees upon assignment, or at any time. Interest earned on funds should be added to the funds unless the lease states otherwise. If funds are held in 'trust' then a tax will be charged on the interest earned.