Secured Debt Shall Formula In Dallas

Description

Form popularity

FAQ

Unsecured debt can take the form of things like traditional credit cards, personal loans, student loans and medical bills.

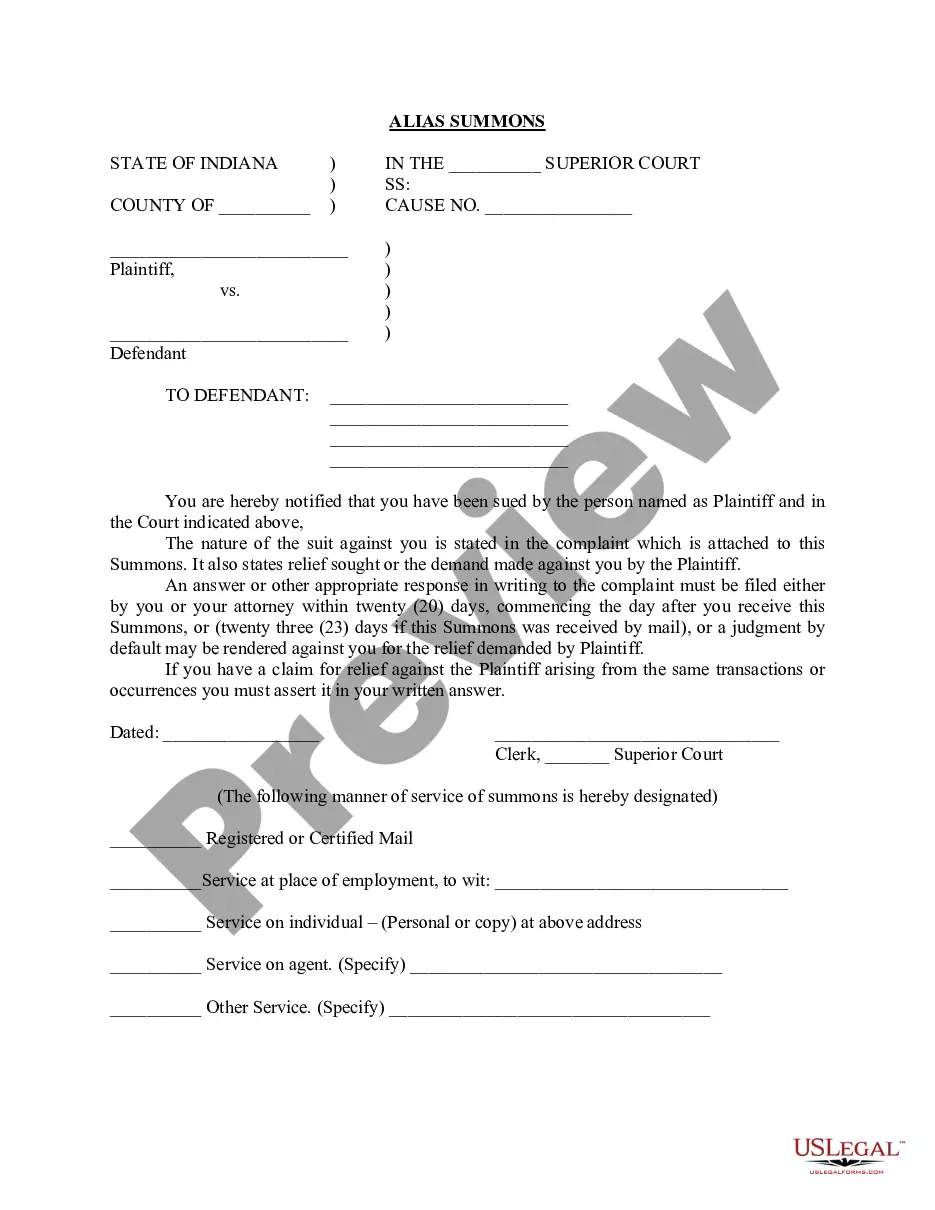

This is done by putting your request in writing and sending it to the court and to the plaintiff. Once you have been served with the citation, you have 14 days to file an answer, which is your response to your lawsuit. You must give your answer to the court and also send it to the plaintiff.

Secured debt - A debt that is backed by real or personal property is a “secured” debt. A creditor whose debt is “secured” has a legal right to take the property as full or partial satisfaction of the debt. For example, most homes are burdened by a “secured debt”.

How To Fill In A Proof Of Debt Form Box 1 – This is your business name. Box 2 – This is your business address. Box 3 – This is the total amount you are owed. Box 4 – List any supporting documents you have. Box 5 – List any un-capitalised interest on the claim.

Ignoring debt collectors might cause further issues. It might make your financial burden larger. You may get served a lawsuit if your creditor believes you owe them a significant debt.

This provision in the Texas Constitution ensures that no person shall ever be imprisoned for debt. These sections of Texas law outline deceptive, threatening, and abusive behavior that debt collectors and original creditors cannot engage in.

If a property owner owes a debt to a creditor, contractor, or collection agency, that party may place a court-ordered lien against the property with the goal of collecting on the debt.

Under California law, debt collectors have the right to place a lien on a person's home once they get a judgment. California law then lets the debt collector force the sale of a person's home to collect the judgment, even if that property is the debtor's only home.

In many states, including California, unsecured creditors can become secured creditors and place a lien on your home.

What Are the Current Chapter 13 Debt Limits? The debt limitations set for cases filed between April 1, 2022, and March 31, 2025, are $1,395,875 of secured debt, and $465,275 of unsecured debt.