Property Sell Our Formula In Virginia

Description

Form popularity

FAQ

Virginia law does not require home sellers to hire an attorney, whether a Realtor is part of the process or not. However, legal counsel is useful for all sellers and especially important for FSBO sellers. Real estate transactions are complex, and this is likely to be one of the biggest financial deals of your life.

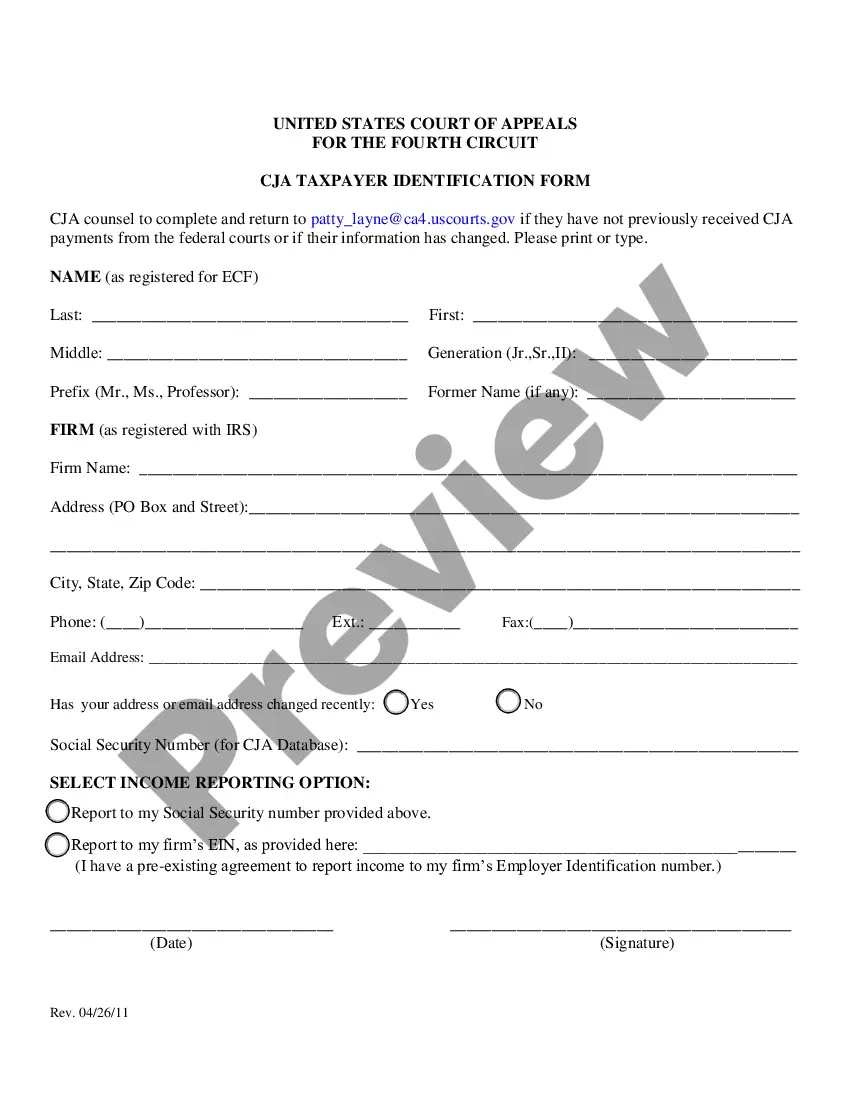

The Form 1099S is the reporting form adopted by the I.R.S. for submitting the seller's gross proceeds information required by law. The information is transferred onto magnetic media by the settlement agent who will make the required report to the I.R.S.

Report the sale on Schedule D (Form 1040), Capital Gains and Losses and on Form 8949, Sales and Other Dispositions of Capital Assets: If you sell the property for more than your basis, you have a taxable gain.

In most cases in Virginia, if your property taxes are delinquent on December 31 following the second anniversary of the due date, the locality can start a foreclosure on your home by filing a lawsuit in court seeking permission to sell the property.

If you sold a personal use asset for more than what you bought it for, then you would generally report that on the Stock or Investment Sale Information screen. You can report any selling expenses by reducing the amount you enter as "Sale Proceeds" by the amount of your selling expenses.

Virginia law does not require home sellers to hire an attorney, whether a Realtor is part of the process or not. However, legal counsel is useful for all sellers and especially important for FSBO sellers. Real estate transactions are complex, and this is likely to be one of the biggest financial deals of your life.

States with no capital gains tax A little more than a handful of states have no capital gains tax. Those include Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, and Wyoming. It's no coincidence that these eight are also states without personal income tax.

Virginia. Taxes capital gains at the same rate as income, a flat rate of 5.75%.