Property Owned By A Business Is Called In San Bernardino

Description

Form popularity

FAQ

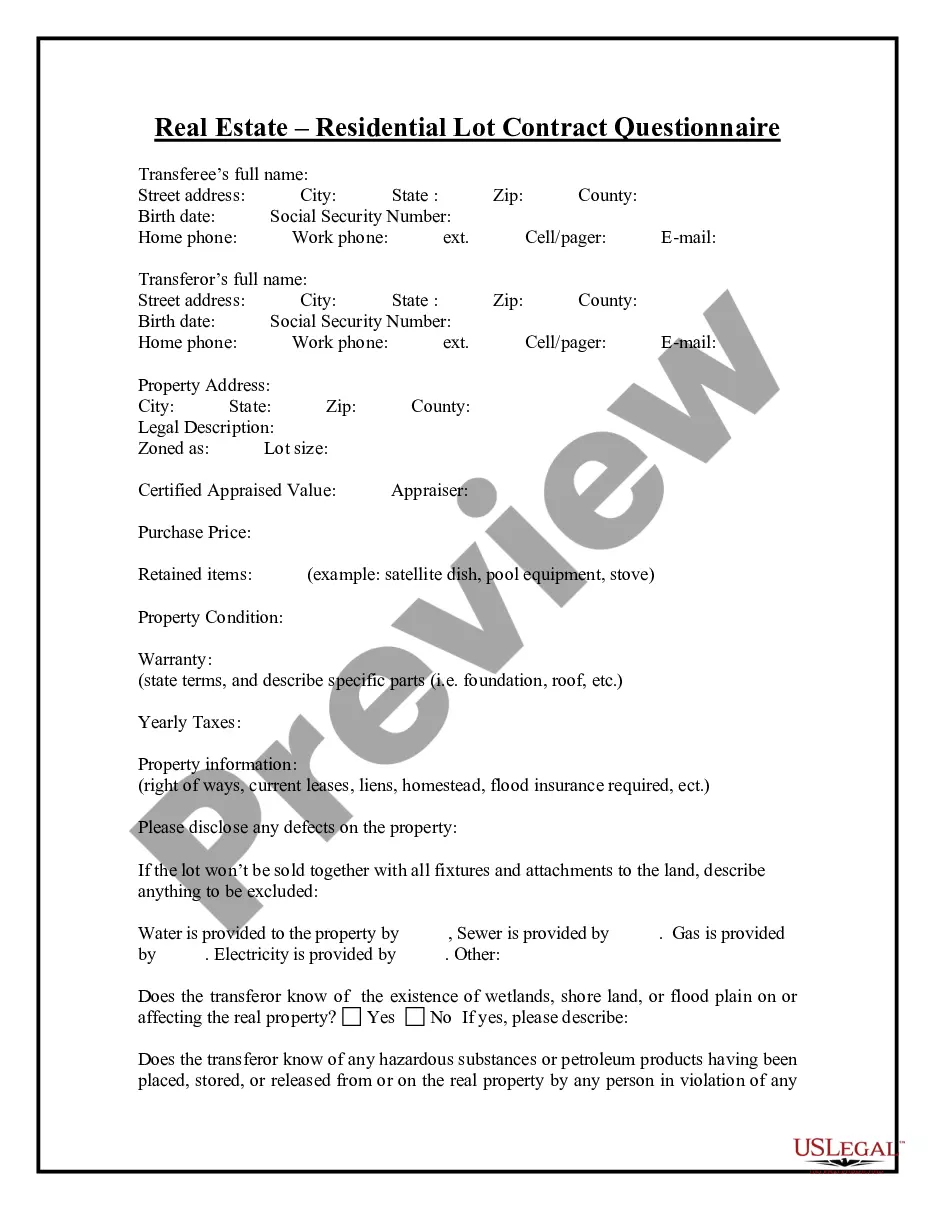

In general, business personal property is all property owned, possessed, controlled, or leased by a business except real property and inventory items. Business personal property includes, but is not limited to: Machinery. Computers. Equipment (e.g. FAX machines, photocopiers)

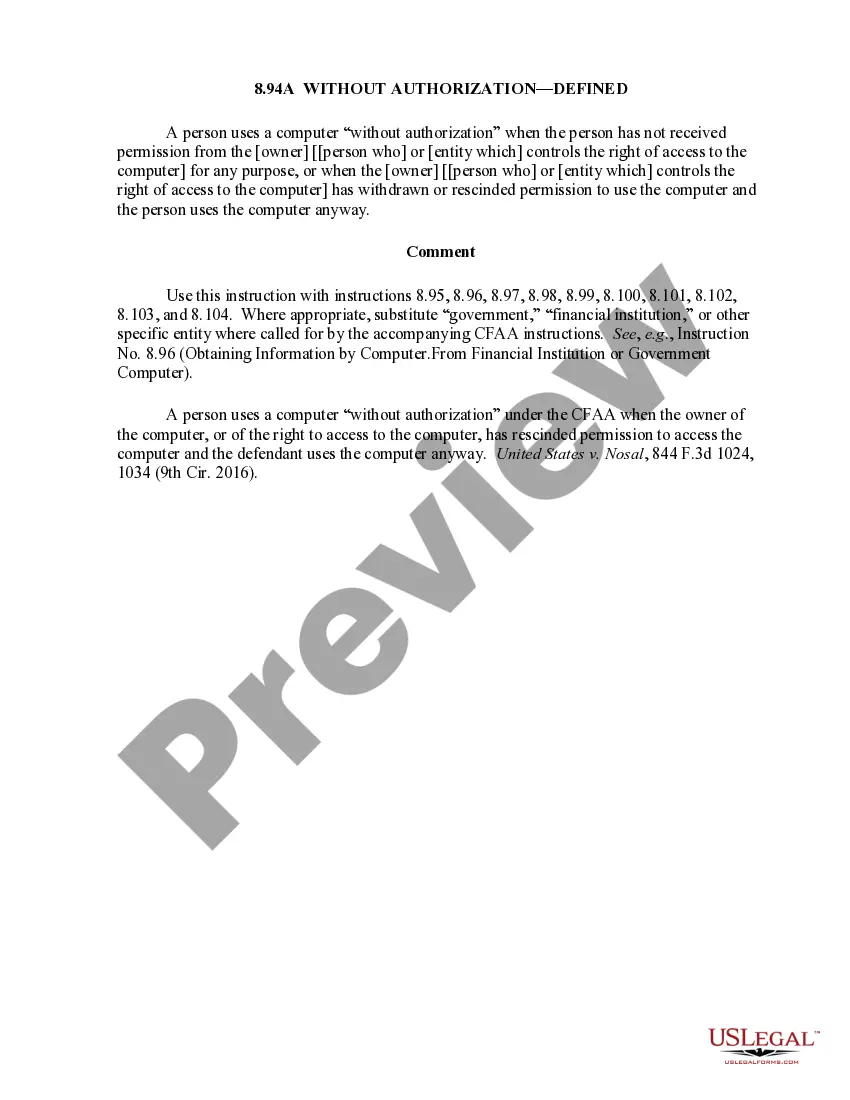

A property right is the exclusive authority to determine how a resource is used, whether that resource is owned by government or by individuals. Society approves the uses selected by the holder of the property right with governmental administered force and with social ostracism.

Your property–your house, your car, your pets–are items you buy and own. There are also intellectual property rights such as copyright, patents, etc. In the United States, we take our right to own property for granted.

Commercial property, also called commercial real estate, investment property or income property, is real estate (buildings or land) intended to generate a profit, either from capital gains or rental income.

Adopted in June 1978 by the California voters, Proposition 13 substantially changed the taxation of real property. As a result of this constitutional amendment, the Assessor is required to appraise real property as of the date of the change-in-ownership or when new construction occurs.

A business asset is an item of value owned by a company. Business assets span many categories. They can be physical, tangible goods, such as vehicles, real estate, computers, office furniture, and other fixtures, or intangible items, such as intellectual property.

Business Assets: As a business owner, you possess proprietary rights over the assets that contribute to your company's operations. This includes tangible assets like machinery, equipment, and inventory, as well as intangible assets such as trademarks, trade secrets, and proprietary software.

An annual filing of a Business Property Statement is a requirement of section 441(d) of the California Revenue and Taxation Code.

Every corporation and limited liability company is required to file a Statement of Information either every year or every two years as applicable.