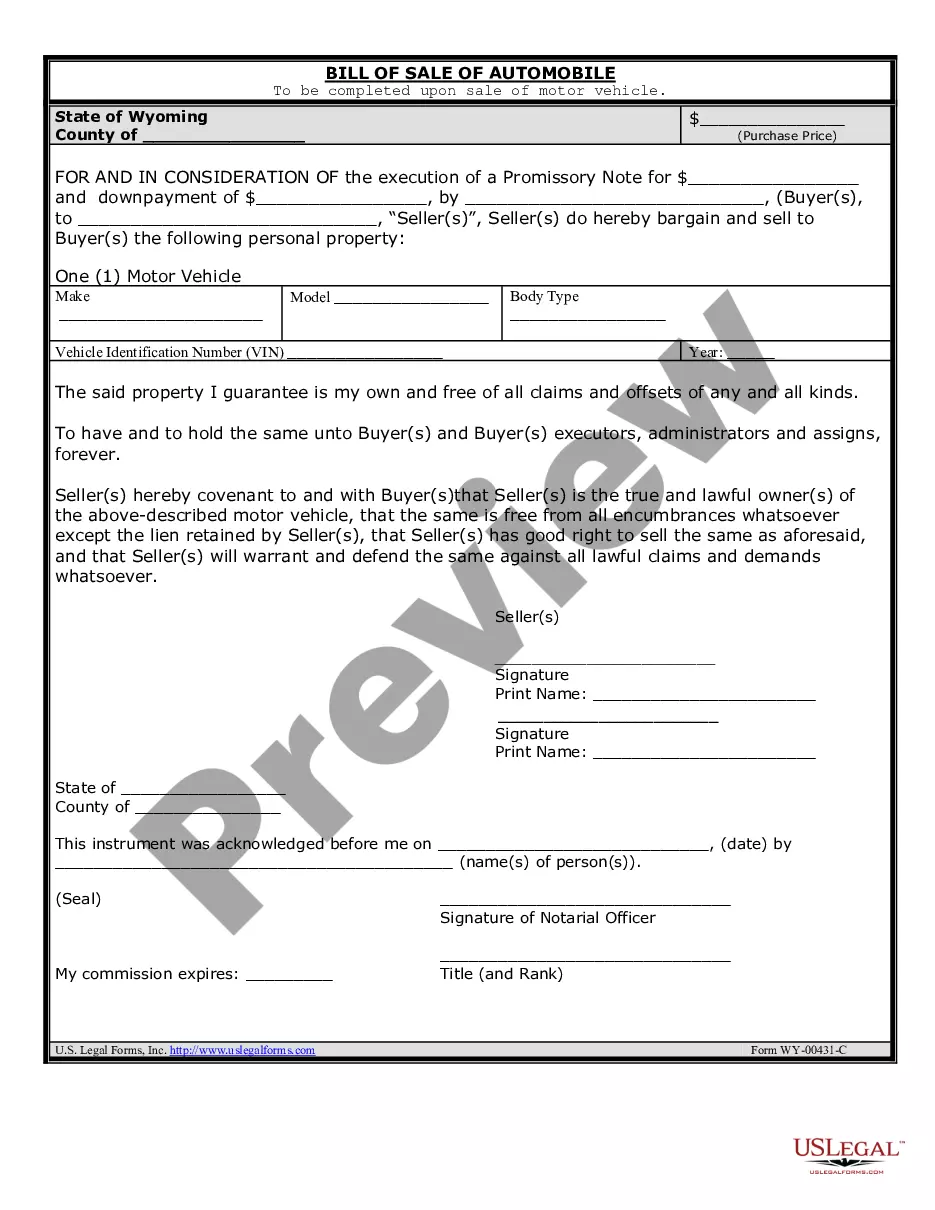

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Tangible Personal Property For Business In Mecklenburg

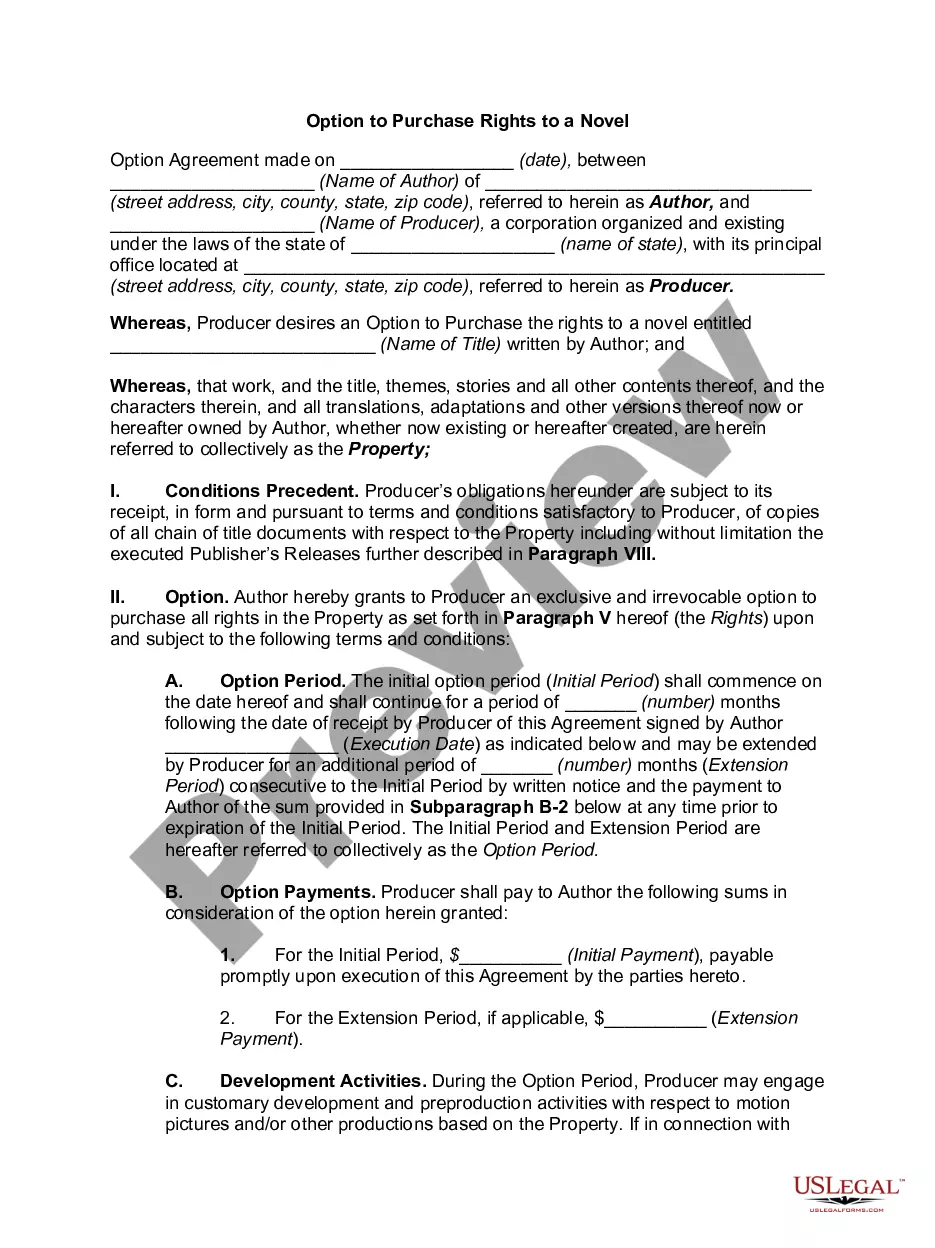

Description

Form popularity

FAQ

Is a bank account considered tangible personal property? No. Your bank accounts fall under intangible personal property.

6016. "Tangible personal property." "Tangible personal property" means personal property which may be seen, weighed, measured, felt, or touched, or which is in any other manner perceptible to the senses.

Business personal property is any tangible property owned, engaged, used, or possessed in the conduct of a trade or business. This includes, but not limited to, machinery, equipment, furniture, fixtures, computers, software, farm equipment, Leasehold improvements, and supplies.

Tangible Personal Property includes all furniture, fixtures, tools, machinery, equipment, signs, leasehold improvements, leased equipment, supplies and any other equipment that may be used as part of the ordinary course of business or included inside a rental property.

Tangible personal property is mainly a tax term which is used to describe personal property that can be felt or touched, and can be physically relocated. For example: cars, furniture, jewelry, household goods and appliances, business equipment.

(14) Tangible personal property. – All personal property that is not intangible and that is not permanently affixed to real property.

Tangible personal property refers to physical assets that individuals own, such as furniture, vehicles, electronics, and jewelry. Adding tangible personal property provisions to your estate plan ensures smooth inheritance, prevents disputes, and helps distribute sentimental items as you wish. ACTEC Fellows Elizabeth A.

Tangible personal property includes equipment, supplies, and any other property (including information technology systems) other than that is defined as an intangible property.

All property used in the connection of the business is taxable in NC no matter the initial purpose of the property. Once the property is used for business purposes it becomes Business Personal Property and is required to be reported as such.

WHICH STATES DO NOT TAX BUSINESS PERSONAL PROPERTY? North Dakota. South Dakota. Ohio. Pennsylvania. New Jersey. New York. New Hampshire. Hawaii.