Personal Property Examples In Franklin

Description

Form popularity

FAQ

How much are my personal property taxes? Same as real property, approximately 1.4% of the assessed value per year. How much are my personal property delinquent taxes? Contact the Franklin County Treasurer at 509-545-3518.

Types of personal property include: Furniture - Items such as sofas, chairs, tables, and beds that can be easily moved from one location to another. Appliances - Freestanding appliances like refrigerators, washers, dryers, and microwaves that are not built into the home's structure.

A fixture is something that is physically attached to the property – such as a chandelier or a built-in wall cabinet. A refrigerator is not a fixture.

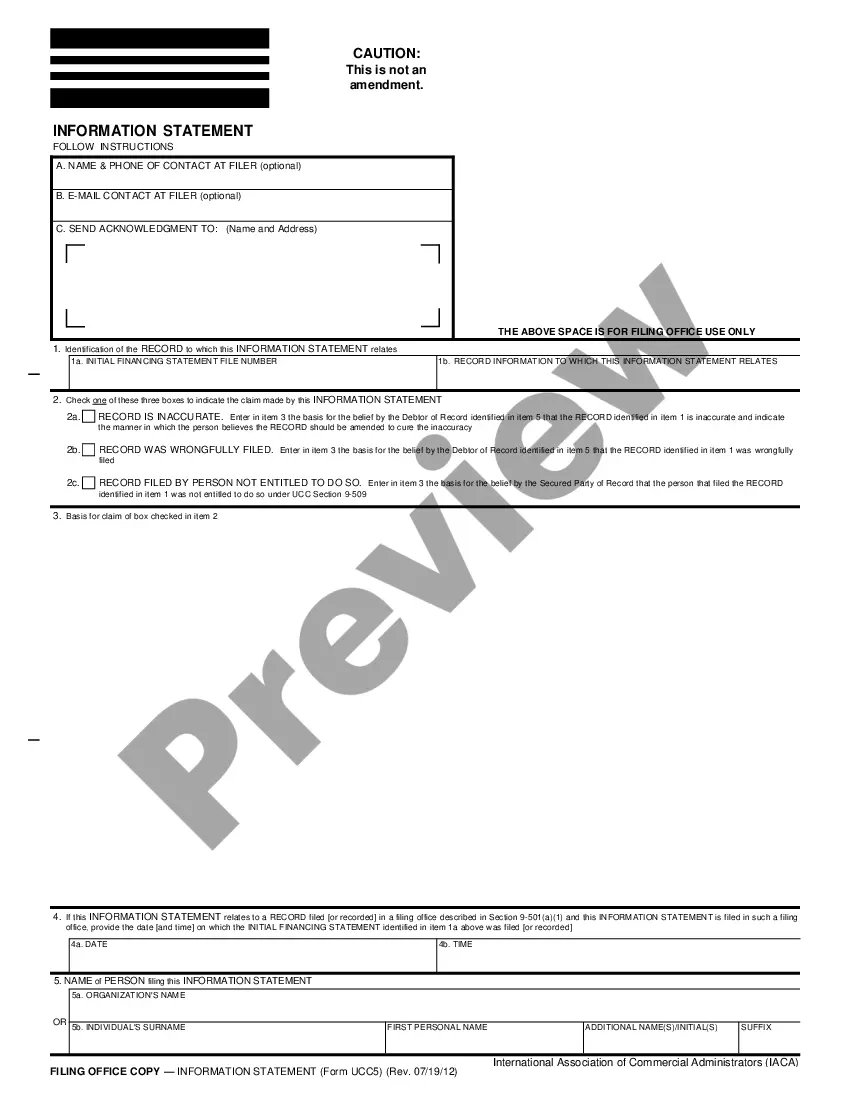

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

At its most basic, an assignment of personal property is a document or a portion of a document that assigns your interests in personal property to someone else. The assignment is often meant to take place at a point in the future, such as after you pass away.

Types of personal property include: Furniture - Items such as sofas, chairs, tables, and beds that can be easily moved from one location to another. Appliances - Freestanding appliances like refrigerators, washers, dryers, and microwaves that are not built into the home's structure.

Under most circumstances, unless stated otherwise, the fridge that was there, and was ``included `` in the sale must remain. If the contract doesn't include the fridge however, they didn't need to leave anything at all. Check the contract and call your Realtor.

Personal property coverage: Covers appliances that can be plugged into an outlet, including refrigerators, ovens, microwaves, and dishwashers. Dwelling coverage: Covers built-in appliances, such as a furnace or hot water heater.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.

Personal property refers to movable items that are not permanently attached to land or structures. Unlike real property, which is immovable, personal property includes everything from household goods like furniture and appliances to vehicles, jewelry, and even intangible assets such as stocks or patents.