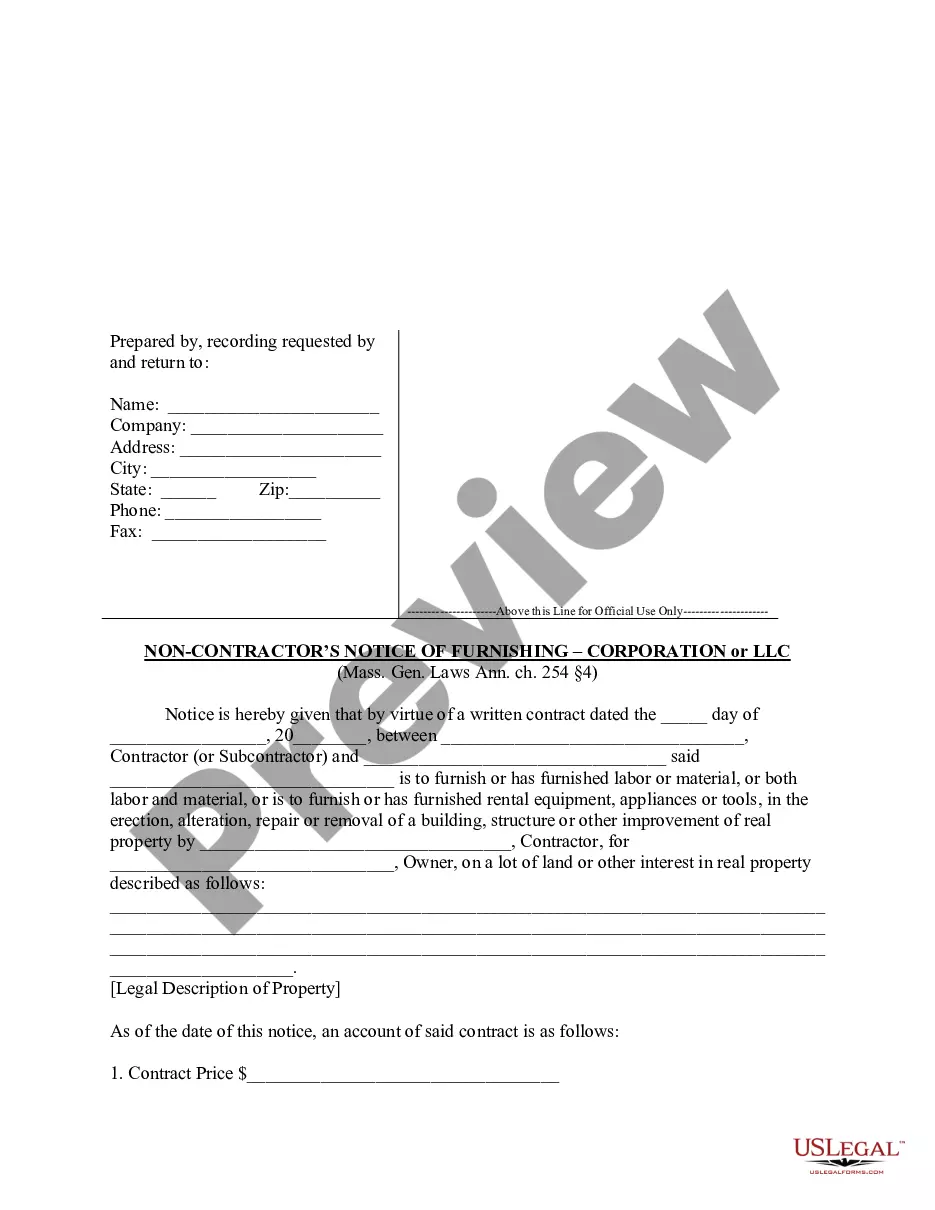

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Personal Property Business Form Without In Cuyahoga

Description

Form popularity

FAQ

All Vendor Licenses can be obtained immediately through the Ohio Business Gateway. Businesses must first establish an account with Gateway before using it to request a vendor's license.

There are only two types of vendor's licenses: County and Transient. A County Vendor's License is required for selling taxable goods or services at a fixed location of business. A Transient Vendor's License is for the sale of goods at various shows and markets throughout the state of Ohio.

The twelve states that do not tax business personal property are: North Dakota. South Dakota. Ohio.

Deeds and additional ownership documentation (circa 1810 to present) is available online or in person at the Recorder's Office, located on the 4th floor of the Cuyahoga County Administration Building. Circa 1860-1945, available at the Cuyahoga County Archives.

Personal property includes anything other than land that can be the subject of ownership. This is divided into two subcategories: tangible and intangible property. Animals, merchandise, jewelry, and other physical items are considered tangible property.

Twelve states currently do not tax business personal property. These states include Delaware, Hawaii, Illinois, Iowa, Minnesota, New Hampshire, New Jersey, New York, North Dakota, Ohio, Pennsylvania, and South Dakota.

The twelve states that do not tax business personal property are: North Dakota. South Dakota. Ohio.

Include gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation (or lease payments) attributable to the portion of the total miles driven that are business miles.