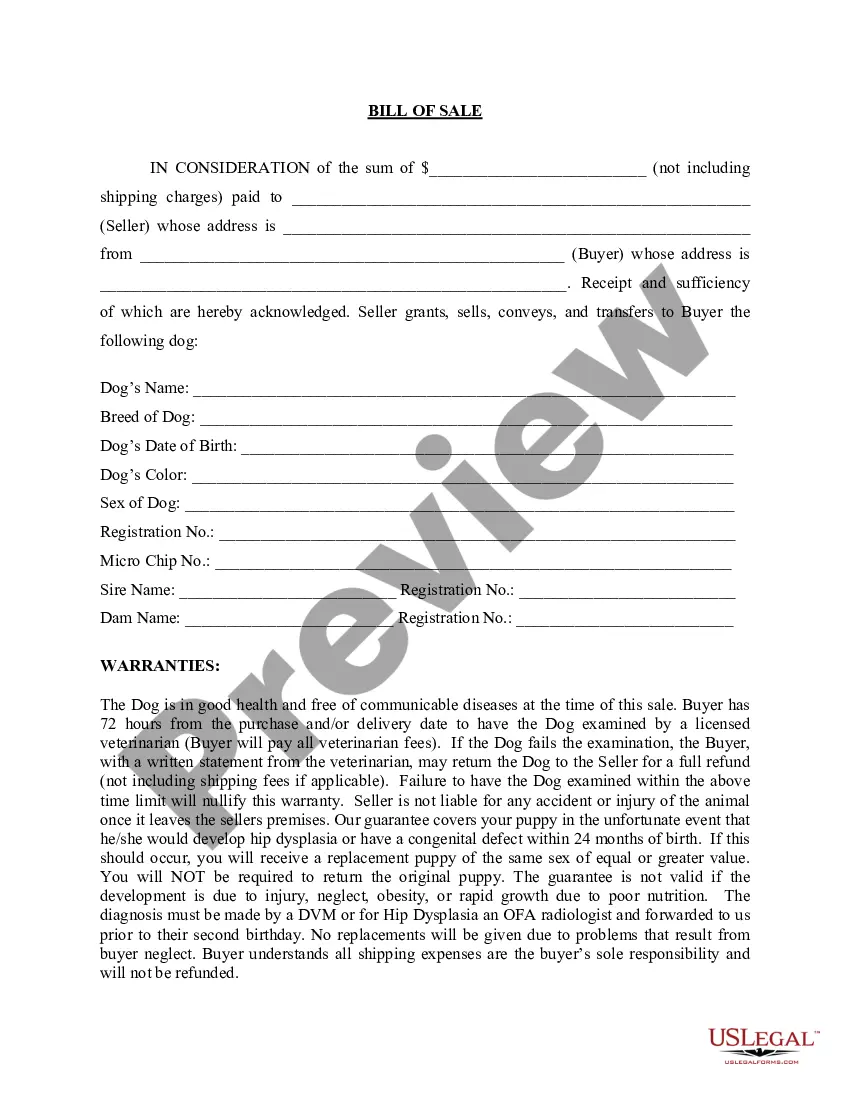

This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Personal Sale With Power Of Attorney In Broward

Description

Form popularity

FAQ

Limitations of a Power of Attorney in Florida The POA agent cannot change the agreement or break their fiduciary duty, otherwise they can be held liable for fraud and negligence. The agent also cannot transfer the POA to another individual or make decisions for the principal after death.

What a power of attorney can't do Change a principal's will. Break their fiduciary duty to act in the principal's best interests. Make decisions on behalf of the principal after their death. (POA ends with the death of the principal. Change or transfer POA to someone else.

Risk of Mismanagement or Abuse Since the legal instrument grants considerable authority to these individuals, they might potentially use this power for personal gain. For instance, an untrustworthy agent could mismanage or steal financial assets, leading to significant asset loss or debt accumulation.

Yes. If the power of attorney has been executed with the formalities of a deed and authorizes the sale of the principal's homestead, the agent may sell it. If the principal is married, however, the agent also must obtain the authorization of the spouse.

A Durable Power of Attorney is a powerful and sustainable estate planning instrument. Important to note, the Durable Power of Attorney is effective as soon as you (i.e., the Principal) sign the document.

An agent cannot make a gift of his principal's property to himself or others unless it is expressly authorized in the power. James v. James, 843 So. 2d 304, 308 (Fla.

A power of attorney gives one or more persons the power to act on your behalf as your agent. The power may be limited to a particular activity, such as closing the sale of your home, or be general in its application. The power may give temporary or permanent authority to act on your behalf.