Personal Property Business Form With Tax In Bronx

Description

Form popularity

FAQ

The median property tax rate in Bronx, NY is 0.85%, which is lower than both the national median of 0.99% and the New York state median of 2.39%. With the median home value in Bronx at $704,000, the typical annual property tax bill reaches $5,570, surpassing the national median of $2,690.

Include the income from the business on your Form 1040, U.S. Individual Income Tax Return and the appropriate schedule(s): Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship); Schedule E (Form 1040), Supplemental Income and Loss; and/or Schedule SE (Form 1040), Self-Employment Tax.

Property taxes in Westchester County play a crucial role in funding essential local services like public schools, road maintenance, and emergency services. The median tax rate in Westchester County is 2.29%, which is significantly higher than the U.S. national median of 0.99%.

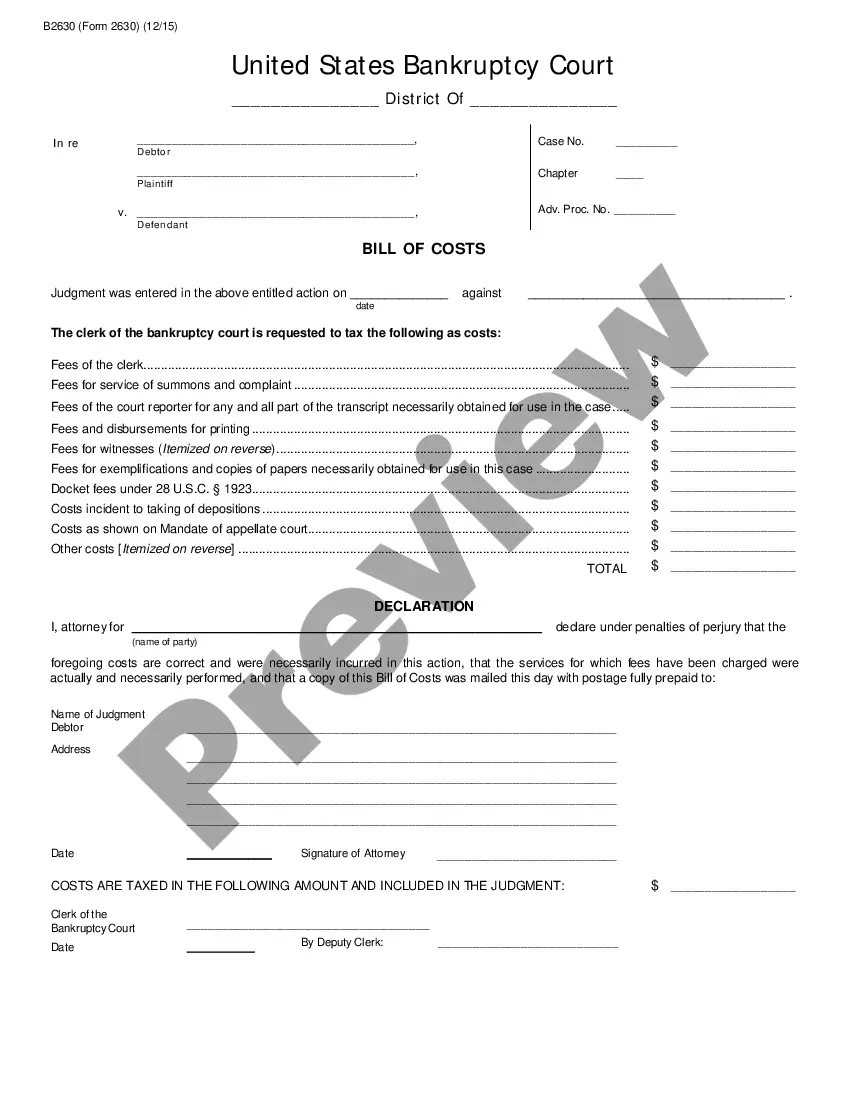

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

Bronx sales tax details The minimum combined 2025 sales tax rate for Bronx, New York is 8.88%. This is the total of state, county, and city sales tax rates. The New York sales tax rate is currently 4.0%.

July 1, 2023 through June 30, 2024: Property with an assessed value of $250,000 or less: 5% Property with an assessed value between $250,000 and $450,000: 8% Property with an assessed value over $450,000: 15%

Include the income from the business on your Form 1040, U.S. Individual Income Tax Return and the appropriate schedule(s): Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship); Schedule E (Form 1040), Supplemental Income and Loss; and/or Schedule SE (Form 1040), Self-Employment Tax.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.