Consumer Investigative Release Form California In New York

Description

Form popularity

FAQ

If communication does not fall within the definition of 'Consumer Report,' however, it will not be an 'Investigative Consumer Report. '” What's critical to the definition of an Investigative Consumer Report is that information must be obtained through a “personal interview.”

(c) The term “investigative consumer report” means a consumer report in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through any means.

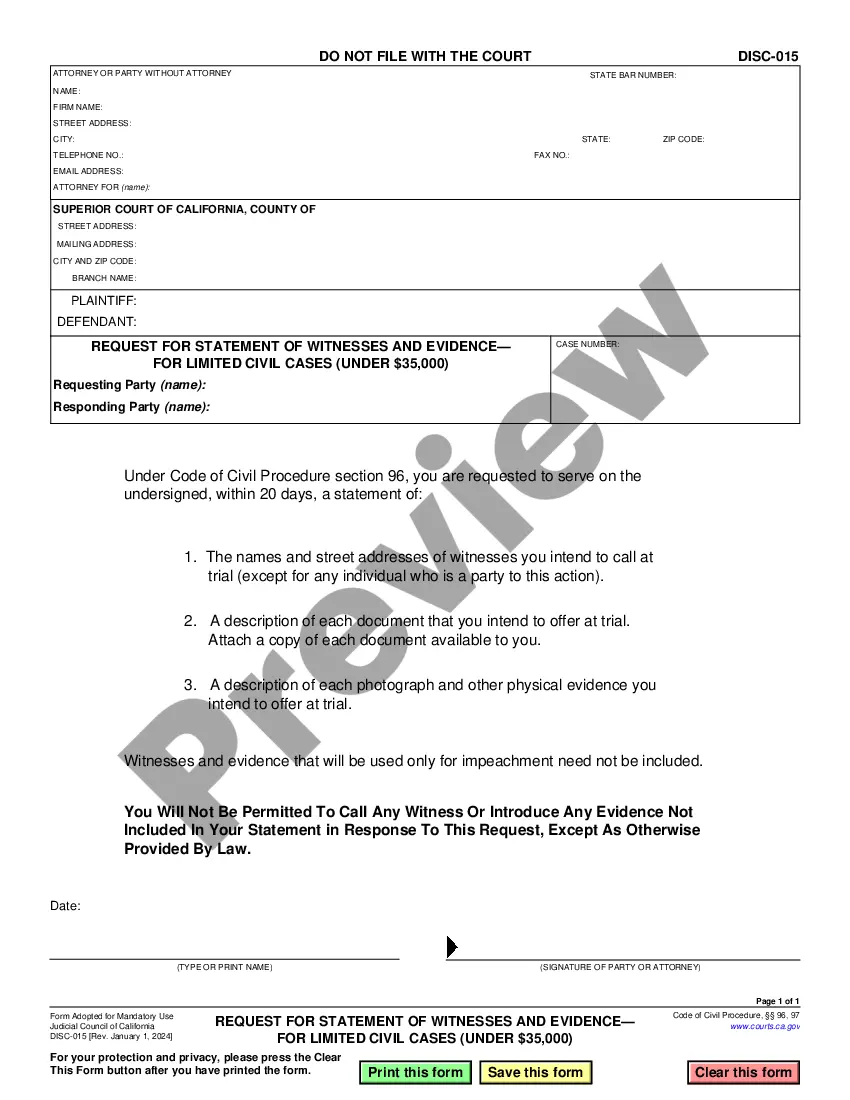

This disclosure shall be made in a writing mailed, or otherwise delivered, to the consumer not later than five days after the date on which the request for such disclosure was received from the consumer or such report was first requested, whichever is the later.

The user must disclose to the consumer that an investigative consumer report may be obtained. This must be done in a written disclosure that is mailed, or otherwise delivered, to the consumer at some time before or not later than three days after the date on which the report was first requested.

By signing this form, you are giving consent to have your consumer/credit reports furnished by consumer reporting agencies as part of an investigation to determine your suitability or fitness for federal employment or fitness to perform work under a contract.

Notification of Investigative Consumer Report ing to federal law, specifically the Fair Credit Reporting Act (FCRA), an insurer must notify a consumer in writing about the acquisition of an investigative consumer report within 3 days of making that request.

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through ...

40 Calendar Days – Your insurer must immediately begin its investigation after receiving proof of claim. It must accept or deny your claim within 40 calendar days after receiving proof of claim unless the investigation cannot be completed within that time.

The purpose of a consumer authorization form is to obtain consent from a consumer or customer for specific actions or transactions related to their personal information or financial accounts.