Personal Items With In Virginia

Description

Form popularity

FAQ

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

All intangible property held for the owner by any state or federal court that has remained unclaimed by the owner for more than one year after it became payable is presumed abandoned.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.

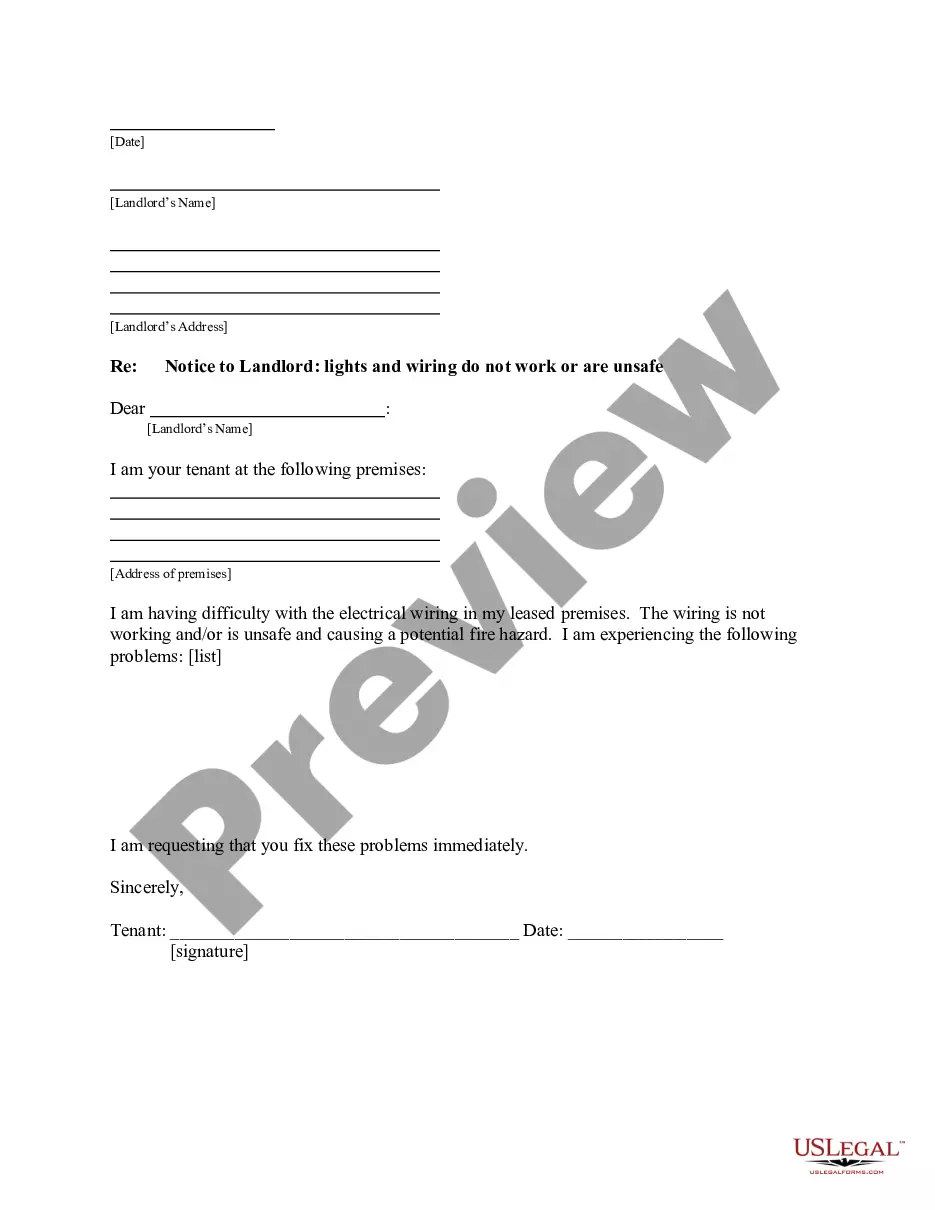

§ 55.1-1254. Disposal of property abandoned by tenants. If any items of personal property are left in the dwelling unit, the premises, or any storage area provided by the landlord after the rental agreement has terminated and delivery of possession has occurred, the landlord may consider such property to be abandoned.

Personal use property is used for personal enjoyment as opposed to business or investment purposes. These may include personally-owned cars, homes, appliances, apparel, food items, and so on.

Personal Property Personal belongings such as clothing and jewelry. Household items such as furniture, some appliances, and artwork. Vehicles such as cars, trucks, and boats. Bank accounts and investments such as stocks, bonds, and insurance policies.

What is considered individual personal property? Virginia State Code Section § 58.1-3503 defines personal property as automobiles, trucks, manufactured homes, motorcycles, recreational vehicles, boats, trailers, and aircraft.

What is considered individual personal property? Virginia State Code Section § 58.1-3503 defines personal property as automobiles, trucks, manufactured homes, motorcycles, recreational vehicles, boats, trailers, and aircraft.

Appealing a Personal Property Tax Assessment Any taxpayer may submit an appeal to the Commissioner or the Revenue regarding the assessment of their taxable personal property including, but not limited to, airplanes, boats, mobile homes, motorcycles, motorized vehicles, trailers and trucks.