Movable Property Form In Railway In Santa Clara

Description

Form popularity

FAQ

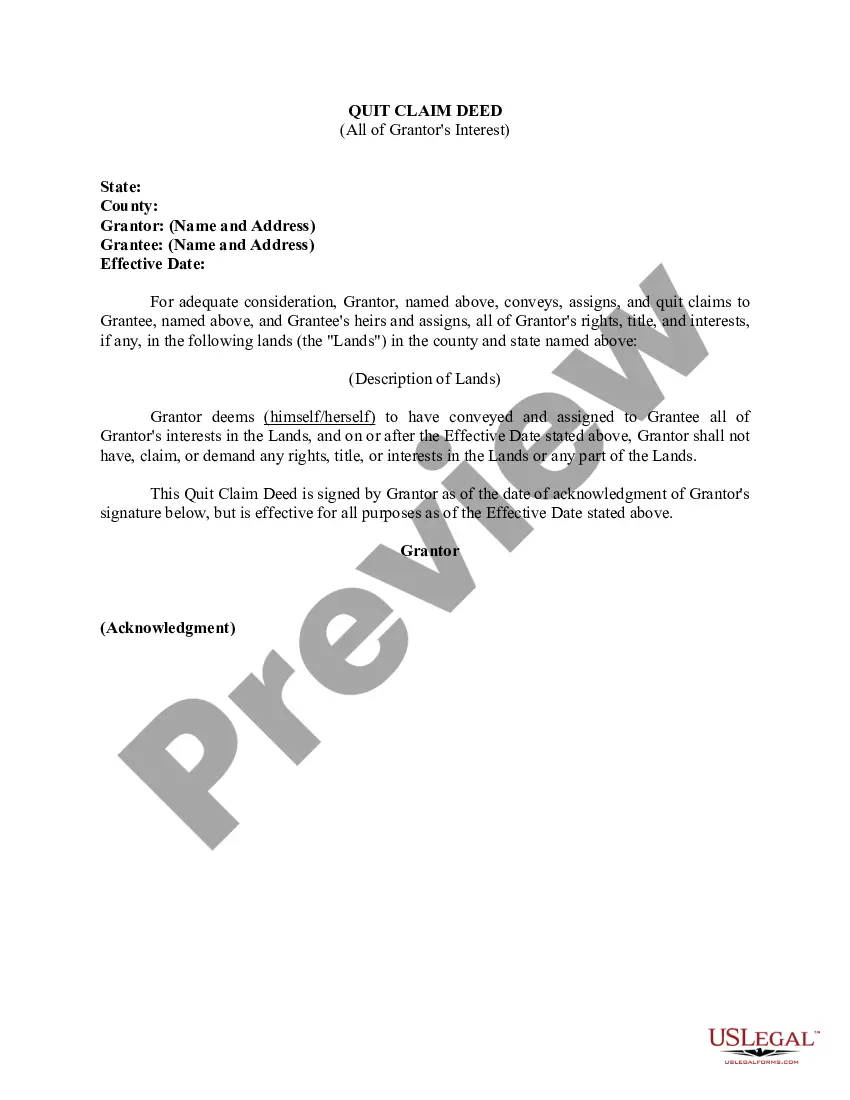

Personal property refers to movable items that people own, such as furniture, appliances, or electronics. Personal property can be intangible, like digital assets, or tangible, such as clothes or artwork.

Personal property refers to movable items that people own, such as furniture, appliances, or electronics. Personal property can be intangible, like digital assets, or tangible, such as clothes or artwork.

Tangible personal property refers to physical and movable possessions owned by individuals. Examples of personal property include clothing, furniture, electronics, and vehicles. Intangible property, on the other hand, covers valuable assets that you can't see or touch, such as bonds, franchises, and stocks.

Examples of personal property include vehicles, furniture, boats, collectibles, etc. Also known as "movable property", "movables" and "chattels."

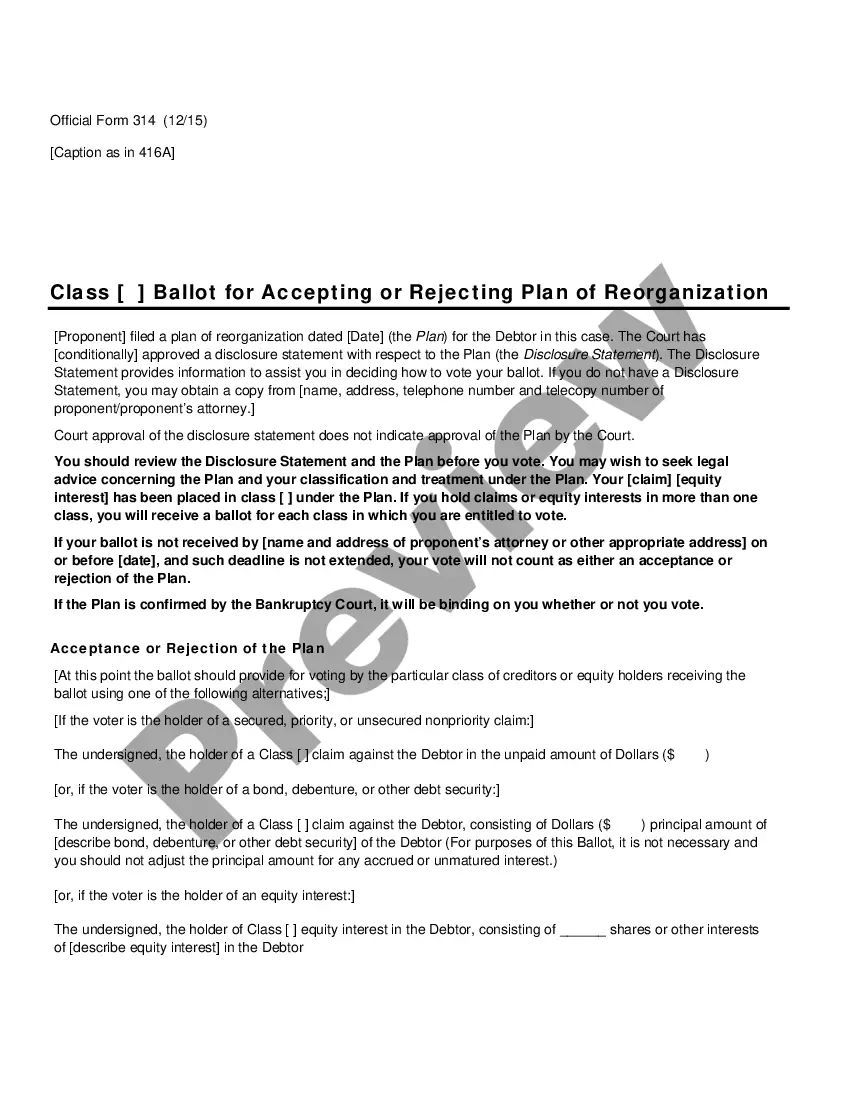

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

While there is no state in the U.S. that doesn't have property taxes on real estate, some have much lower property tax rates than others. Here's how property taxes are calculated. The effective property tax rate is used to determine the places with the lowest and highest property taxes in the nation.

You may be entitled to a tax waiver if one of the following applies: A new Missouri resident. First licensed asset you have ever owned. You did not own any personal property on January 1st of the prior year. You are in the military and your home of record is not Missouri (LES papers are required)

Personal property tax is a type of tax that's imposed by many state and local governments. Personal property generally refers to valuable items like cars and boats but not real estate.

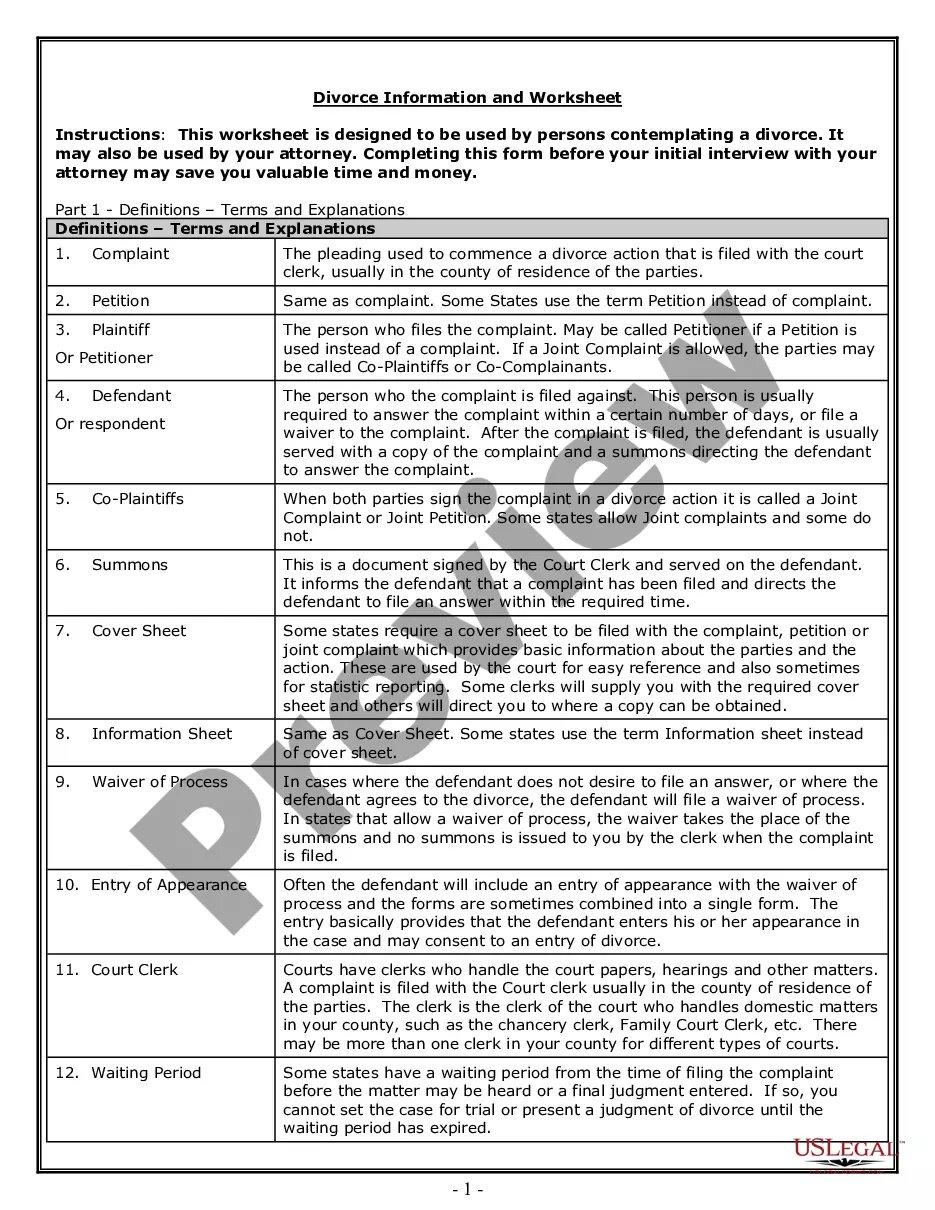

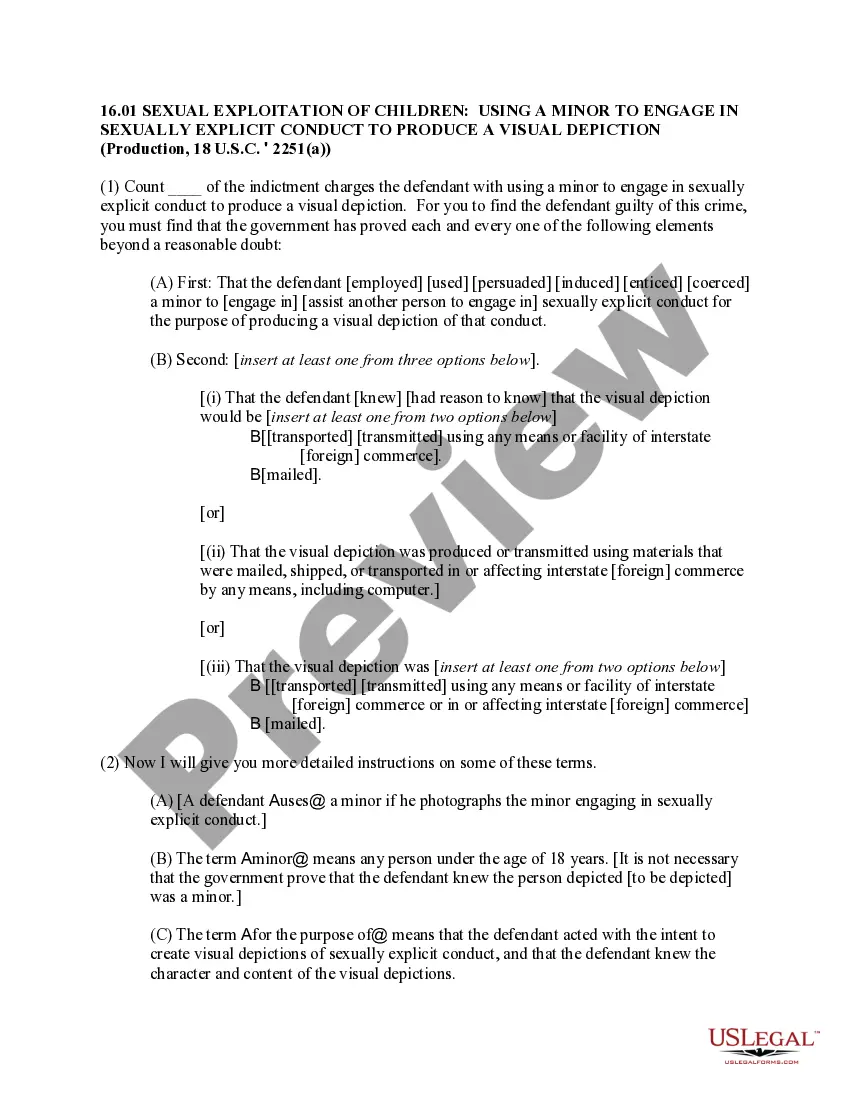

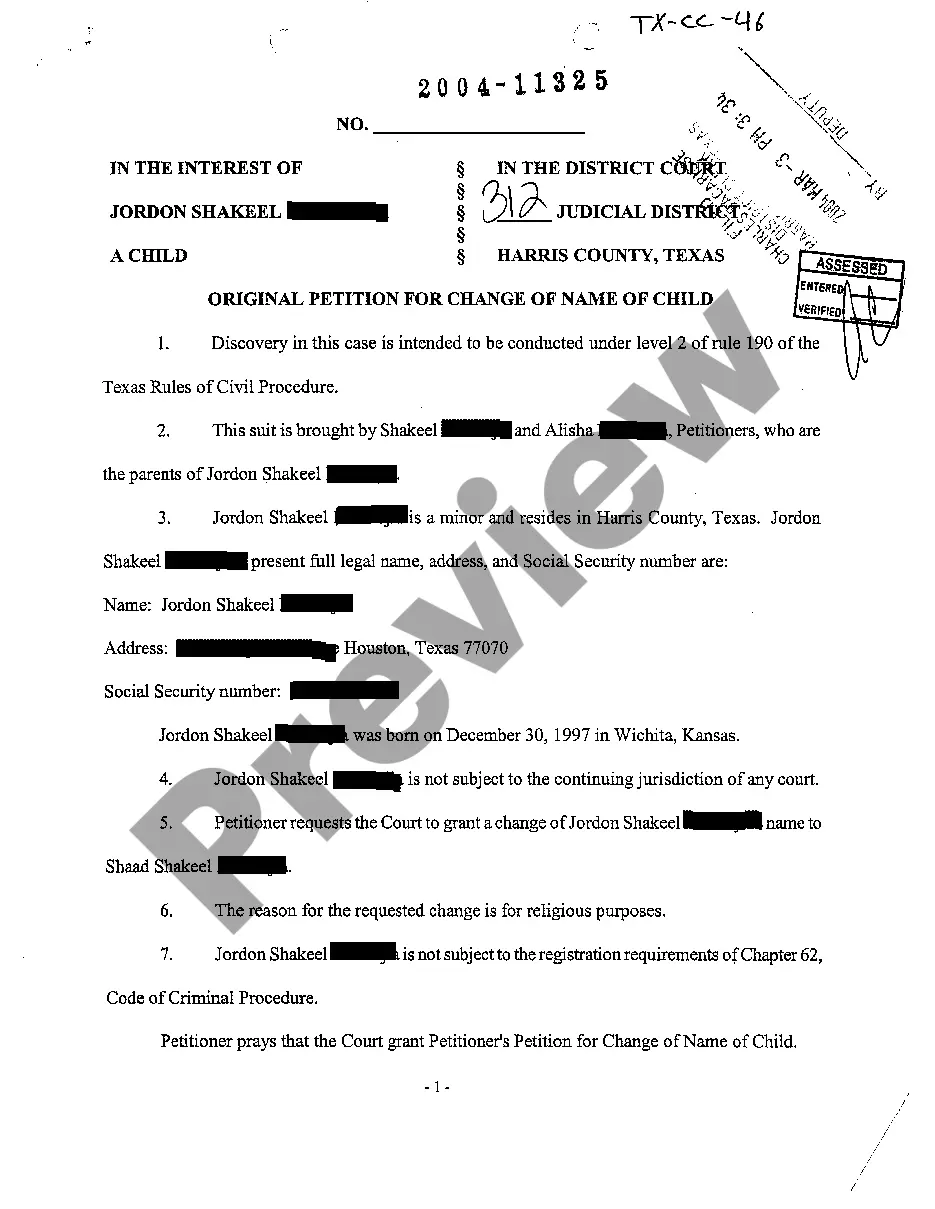

This form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the Assessor's Office by the date cited on the ...