Personal Property Document With Tax In Orange

Description

Form popularity

FAQ

Overview of Orange County, CA Taxes The average effective property tax rate in Orange County is 0.79%, while the median annual property tax bill is $5,588.

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

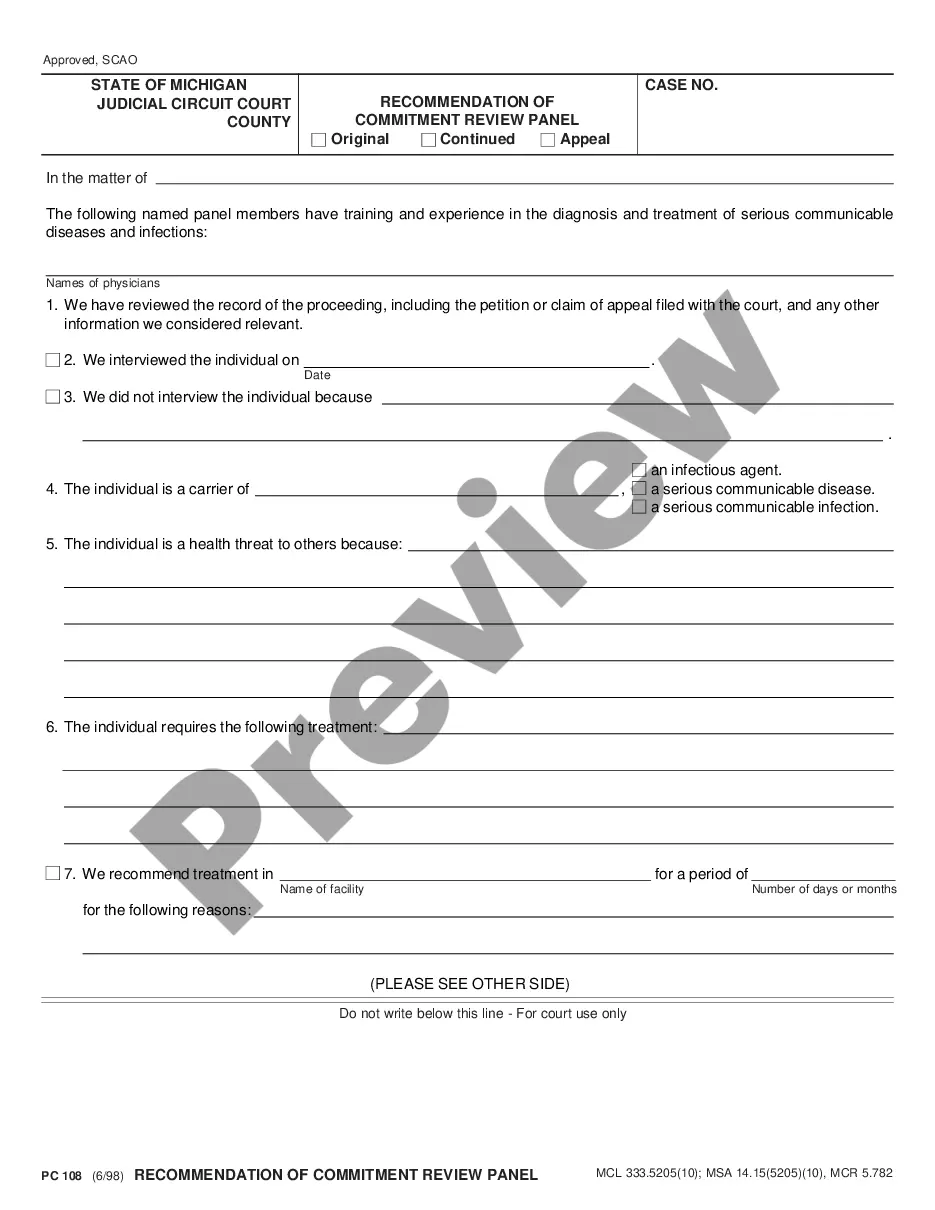

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st.

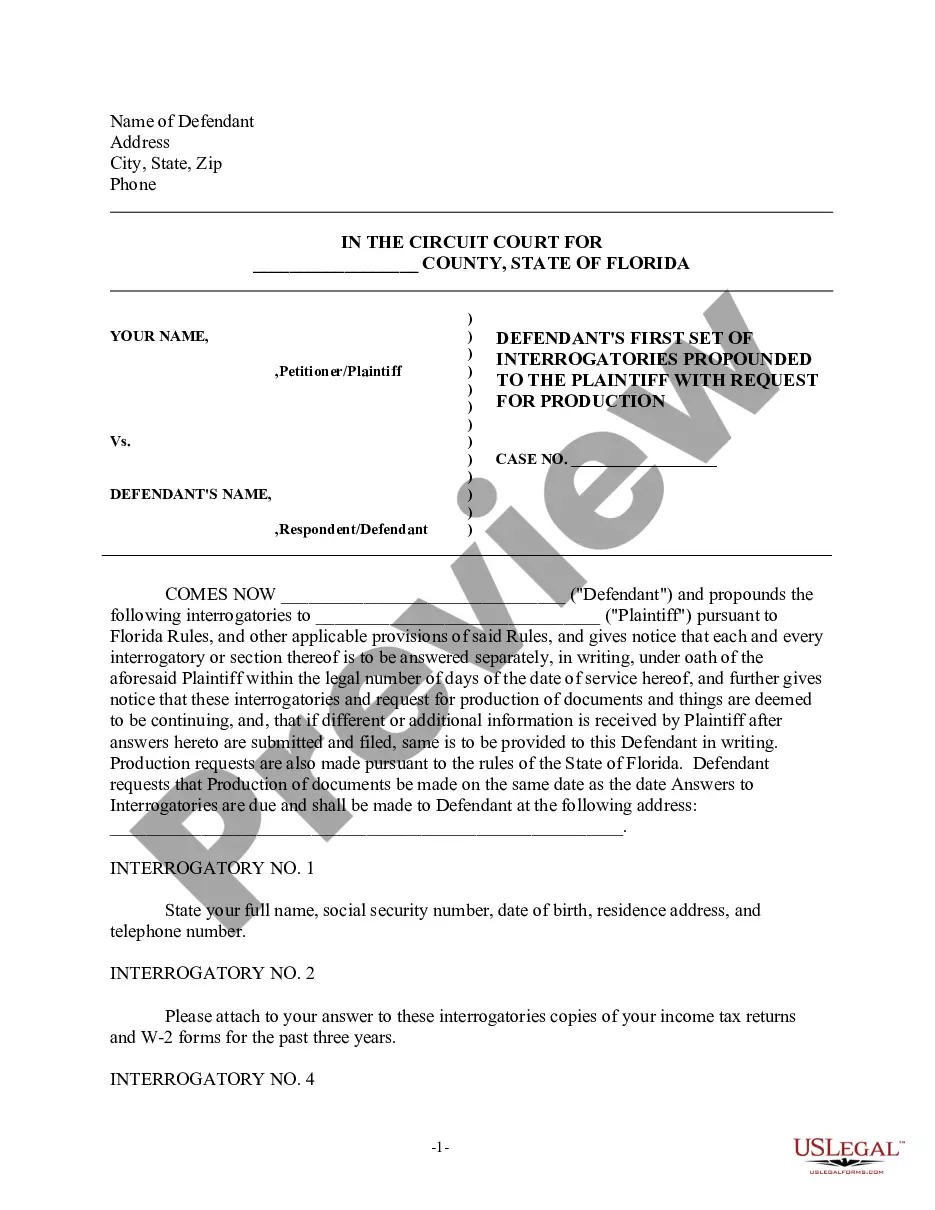

Florida Tangible Personal Property Tax This tax is in addition to your annual Real Estate or Property Tax. The return is due by April 1st. Penalties are assessed monthly on the value of your property and can result in a 25% increased value being added to your personal property values.

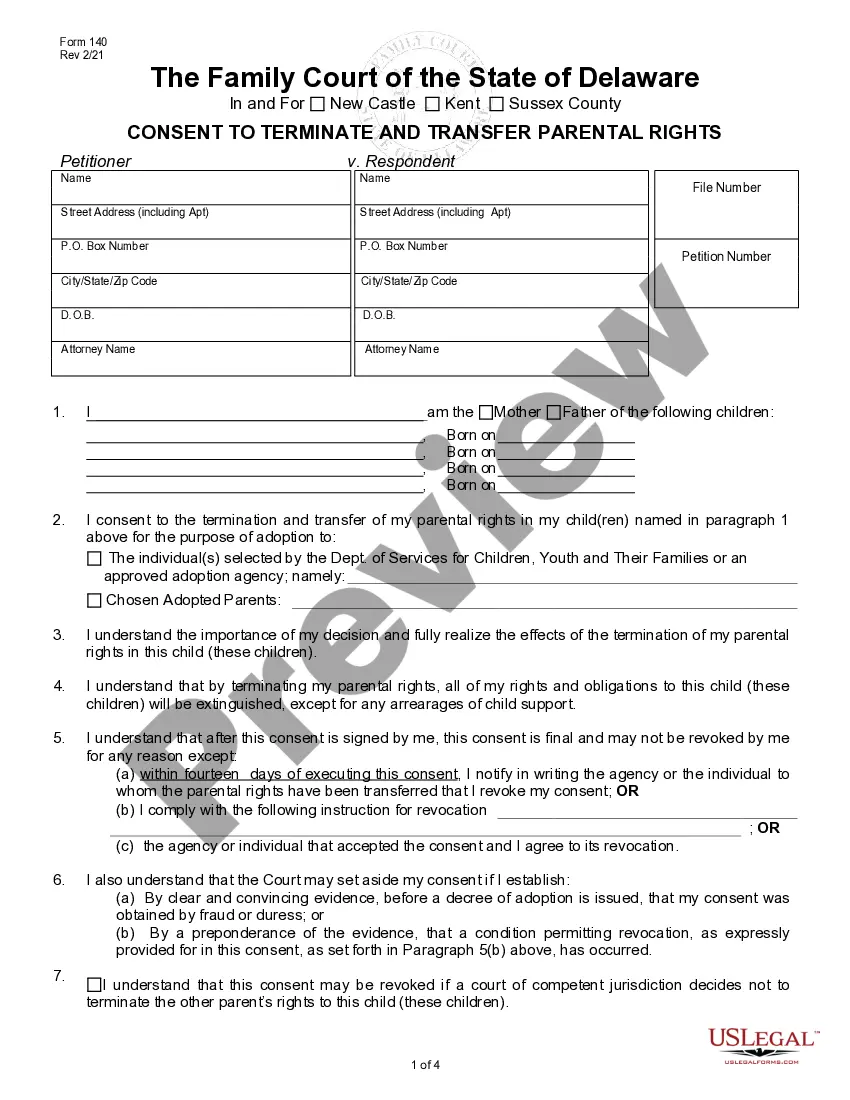

Orange County levies a personal property tax on the following types of personal property: Automobiles. Trucks. Motor homes.

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

To be eligible for SCHE, you must be 65 or older, earn no more than $58,399 for the last calendar year, and the property must be your primary residence. The exemption must be renewed every two years. Learn more and get answers to frequently asked questions.

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st. Personal Property is all property except real estate and can include business equipment, vessels, aircraft, vehicles and manufactured homes.