Personal Property Document With No Intrinsic Value Called In Orange

Description

Form popularity

FAQ

Tangible personal property can be subject to ad valorem taxes, meaning the amount of tax payable depends on each item's fair market value. In most states, a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no later than April 1 in the same year.

Tangible personal property can be subject to ad valorem taxes, meaning the amount of tax payable depends on each item's fair market value. In most states, a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no later than April 1 in the same year.

“Tangible personal property” exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property.

Ing to the IRS, tangible personal property is any sort of property that can be touched or moved. It includes all personal property that isn't considered real property or intangible property such as patents, copyrights, bonds or stocks.

Intrinsic Value is a term used by appraisers referring to the value created because of a person's personal preferences for a particular type of property or particular features.

In ethics, intrinsic value is a property of anything that is valuable on its own. Intrinsic value is in contrast to instrumental value (also known as extrinsic value), which is a property of anything that derives its value from a relation to another intrinsically valuable thing.

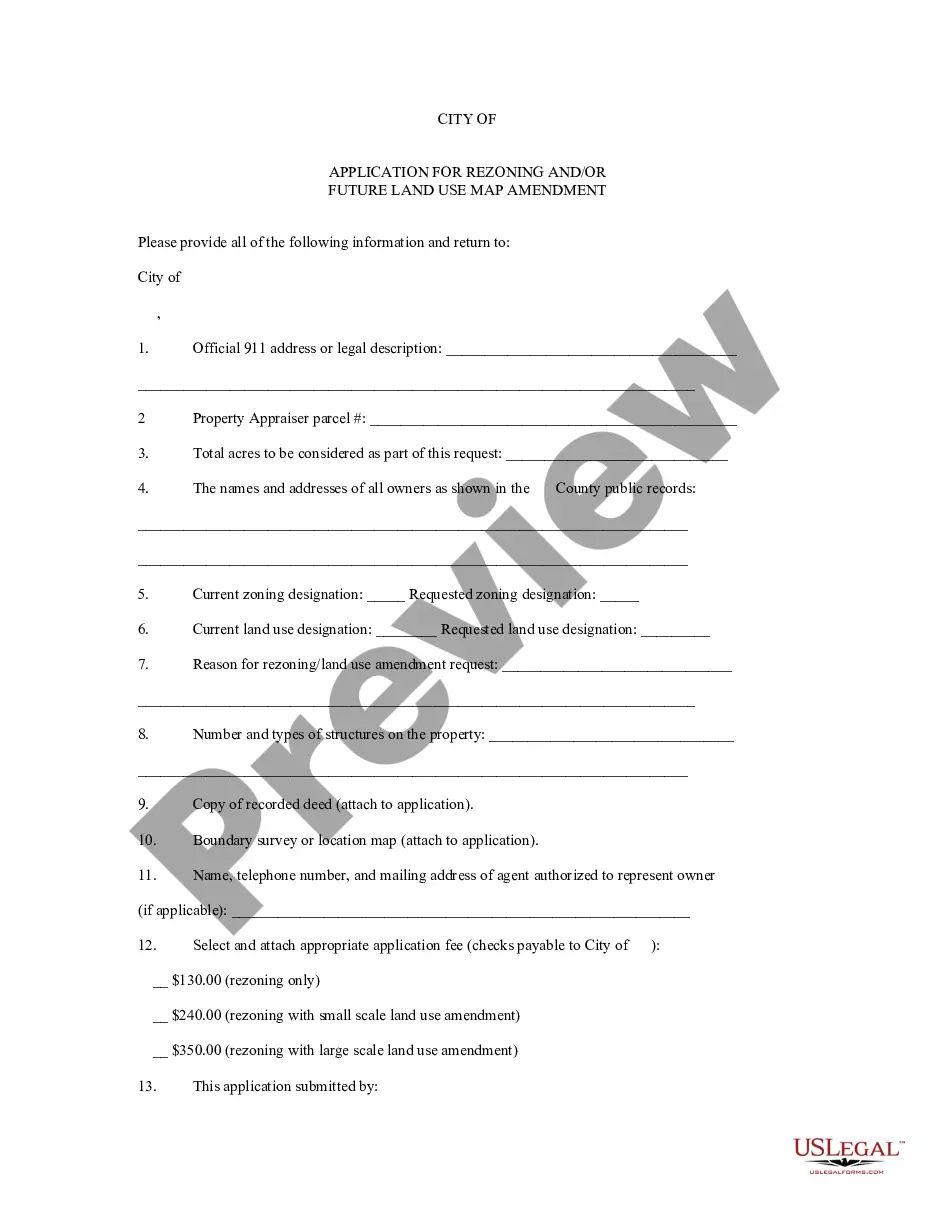

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

Business Personal Property includes all supplies, equipment and any fixtures used in the operation of a business. Exempt from reporting are business inventory, application software and licensed vehicles (except Special Equipment (SE) tagged and off-road vehicles).

Tangible personal property includes equipment, supplies, and any other property (including information technology systems) other than that is defined as an intangible property. It does not include copyrights, patents, and other intellectual property that is generated or developed (rather than acquired) under an award.