This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Private Property For Sale In Nassau

Description

Form popularity

FAQ

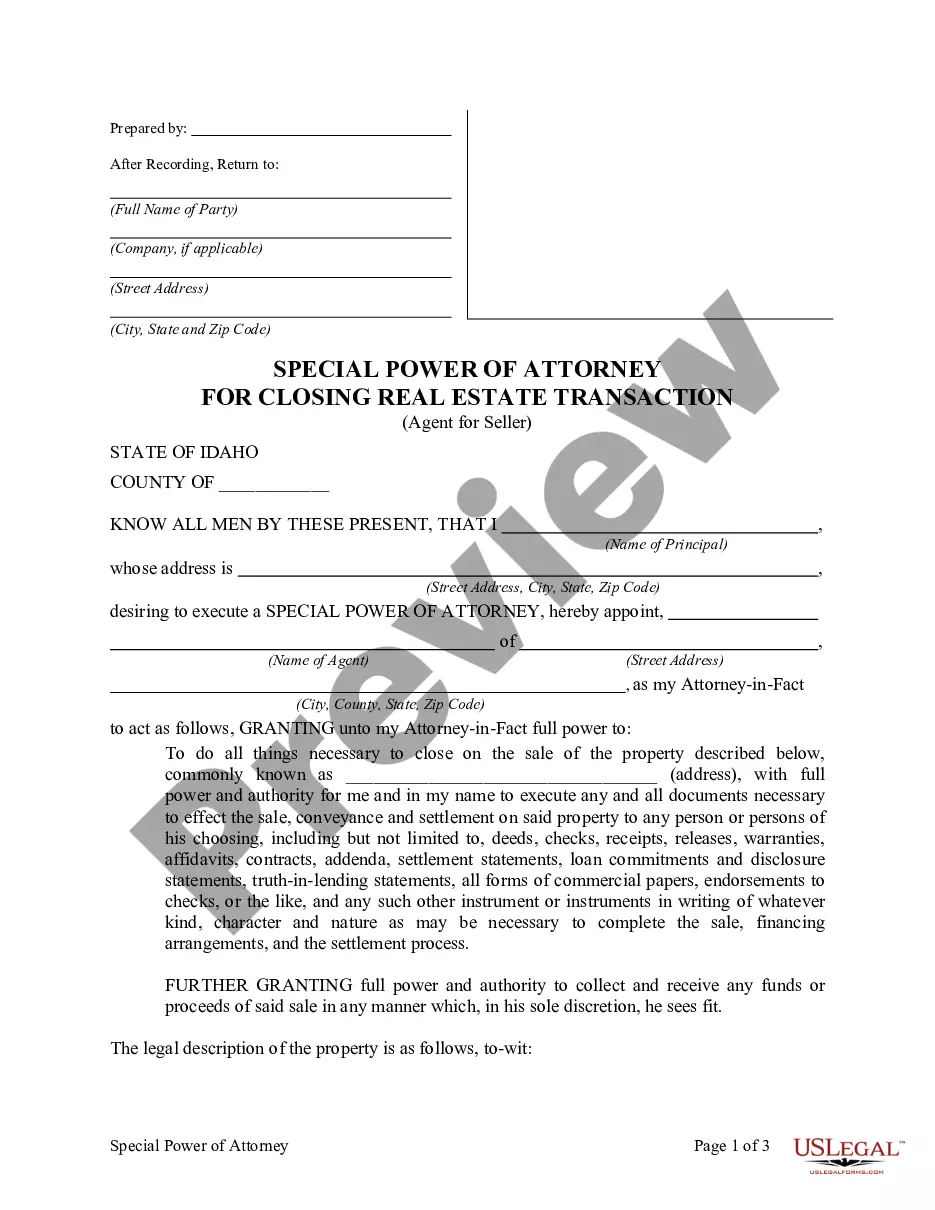

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

How do I add/remove a name on a Deed? You would have to record a new deed adding or removing the person(s) name. Because it is a legal document with legal consequences, we HIGHLY advise you work with an attorney to do so.

How do I add/remove a name on a Deed? You would have to record a new deed adding or removing the person(s) name. Because it is a legal document with legal consequences, we HIGHLY advise you work with an attorney to do so.

You can add someone to the deed. Most people just use a Quit Claim Deed. You should consult a local attorney to see if there will be any additional tax due to the county. You are adding someone - which means giving them something of value - which the county or state will usually want to tax.

The best way is to create a new deed listing all of the owners as “joint tenants with rights of survivorship.” If you simply add someone to your current deed, they become a co-owner, but they may not have rights of survivorship, and the property may still need to go through probate.

These records can be accessed by visiting the County Clerk's Office in person, performing an online search, or submitting a request by mail using their form. Fees for obtaining copies of property records in Nassau County, NY, vary based on the type of document and other services requested.

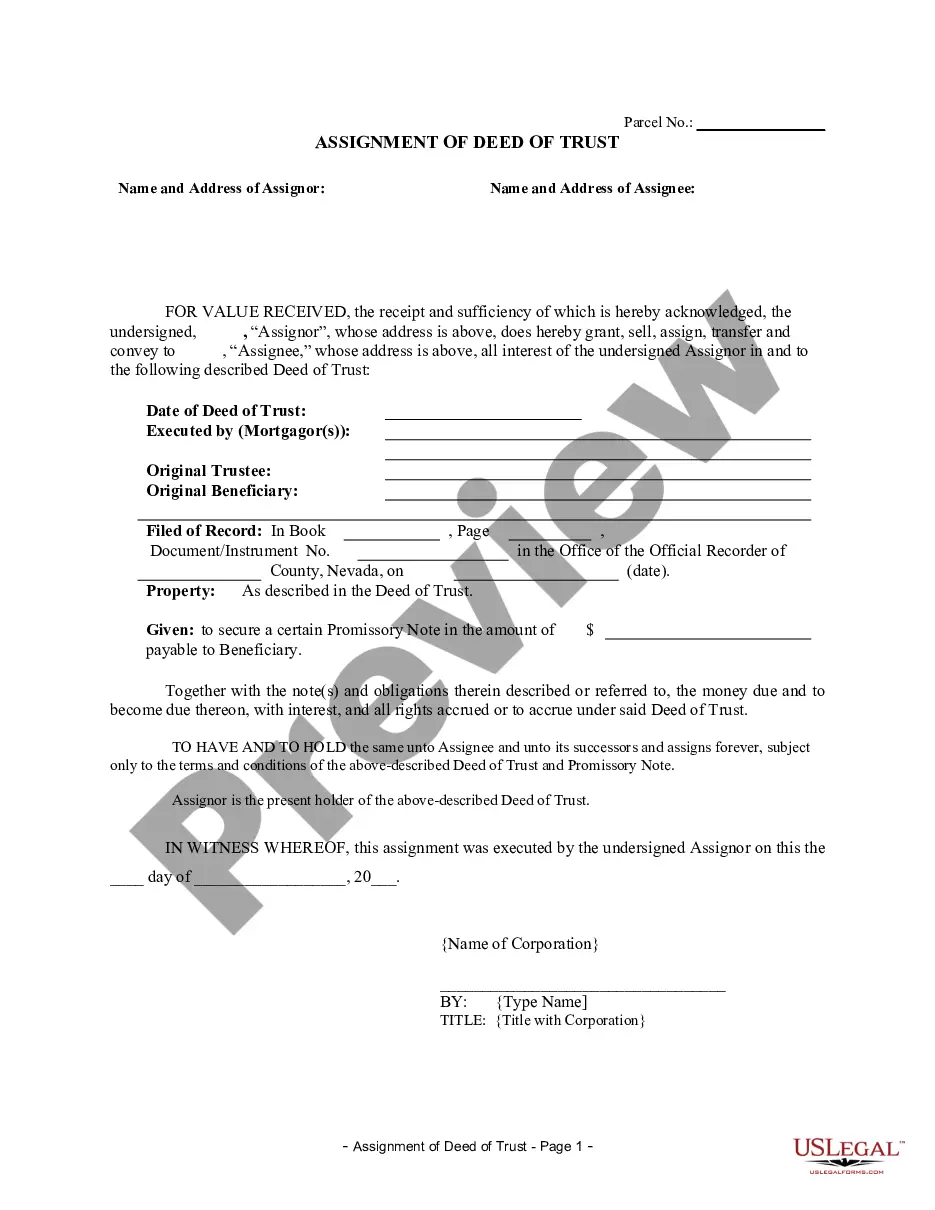

There are no restrictions on foreigners buying property in the Bahamas. Property purchasers are eligible for an annual Home Owners Resident Card, and those buying a property valued at $500,000 and above are given priority in permanent residence applications.

Start Your Home Search Between January and April Although inventory is increasing (an 8% increase is predicted for 2024), it won't be enough to keep up with projected demand. That means buyers will likely face multiple offers and increased competition for the most desirable Long Island homes.

Buying, Owning Or Selling Property In The Bahamas There are no restrictions on foreigners buying property in the Bahamas. Property purchasers are eligible for an annual Home Owners Resident Card, and those buying a property valued at $500,000 and above are given priority in permanent residence applications.

For savvy investors, the Bahamas can be a profitable venture. Investing in Bahamian real estate can yield promising returns thanks to its booming tourism industry, stable economy, and capital growth. From beachfront condos to luxury villas, a diverse range of properties suit your investment strategies.