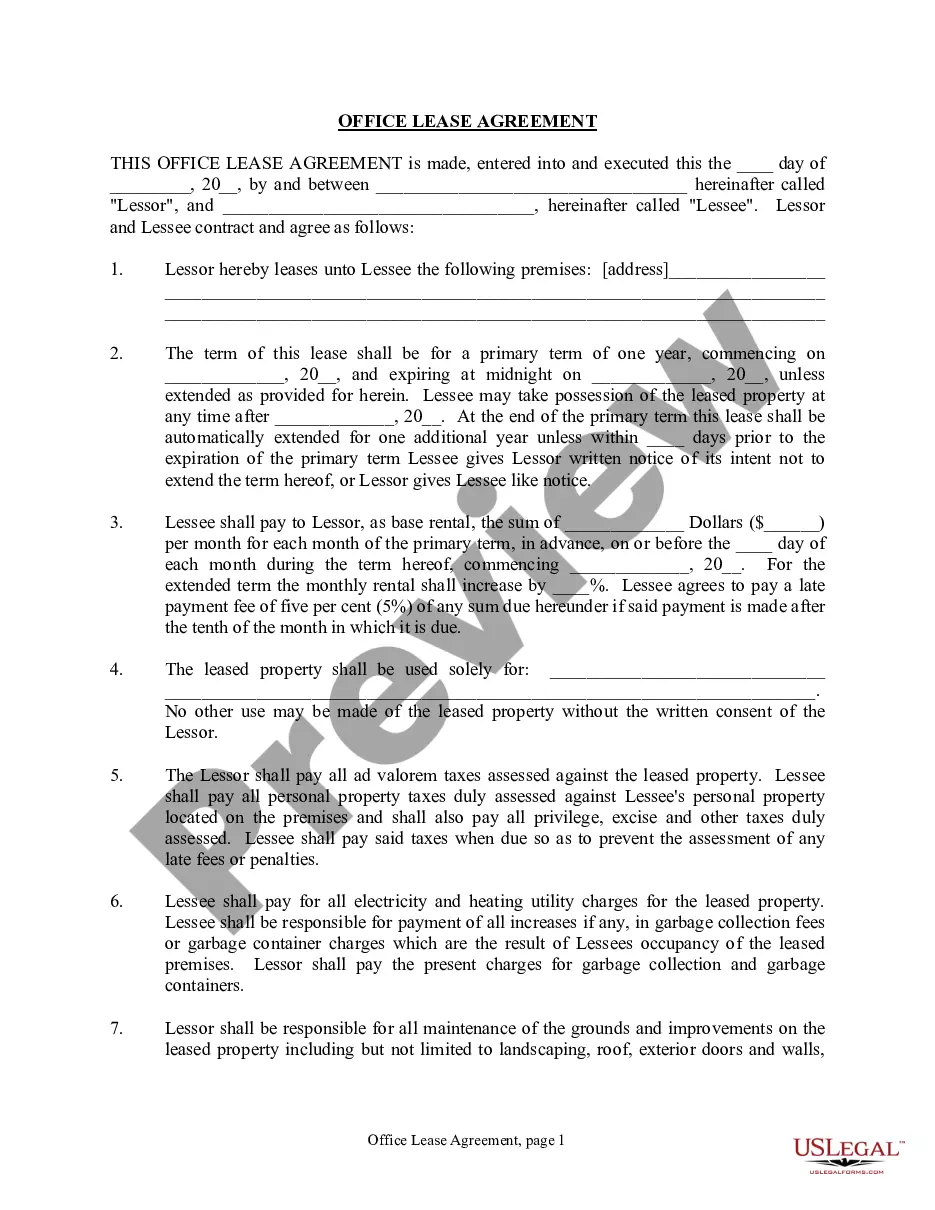

This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property For Sale In Nassau

Description

Form popularity

FAQ

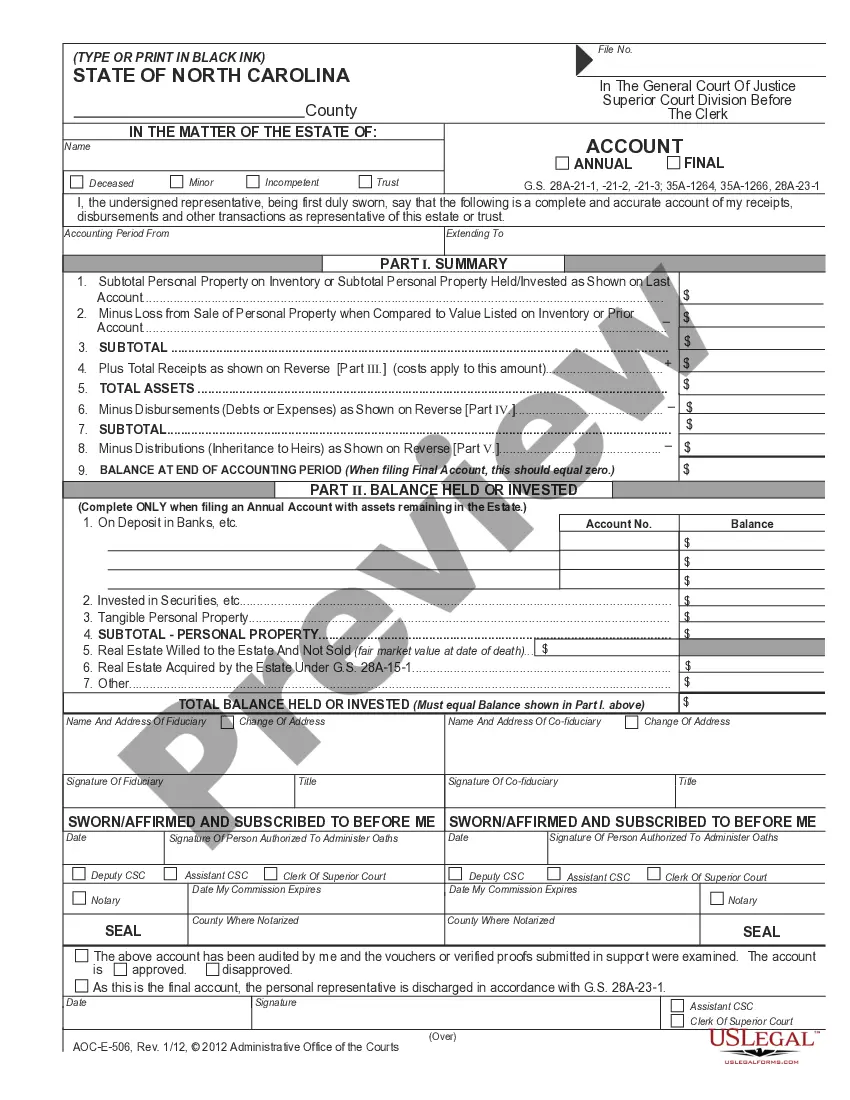

Complete this form if you own property used for commercial purposes that is not included in the assessed value of your business' real property. This may include office furniture, computers, tools, supplies, machines, and leasehold improvements. Return this to your property appraiser's office by April 1.

Anyone in possession of assets on January 1 who has either a proprietorship, partnership, corporation or is a self-employed agent or contractor must file each year. Property owners who lease, lend or rent property must also file.

Every new business owning tangible personal property on January 1 must file an initial tax return. In any year the assessed value of your tangible personal property exceeds $25,000, you are required to file a return. Taxpayers who lease, lend or rent property must also file a return.

Types of Exemptions Government Agency Loans, Industrial Loans, and Aircraft Liens: Certain types of mortgage transactions are exempt from the intangible tax. This includes loans provided by government agencies, mortgages associated with industrial purposes, and those secured by a lien on aircraft.

Tangible personal property (TPP) is all goods, property other than real estate, and other articles of value that the owner can physically possess and has intrinsic value. Inventory, household goods, and some vehicular items are excluded.

Property Tax Rates Across Nassau County, New York The median tax rate in Nassau is 2.10%, which is higher than the U.S. national median of 0.99%. Local government entities within Nassau set these rates annually, and they can vary significantly between different areas within the county.

All Tangible Personal Property accounts are eligible to receive up to a $25,000 exemption if a Tangible Personal Property return (DR-405) has been timely filed with the Property Appraiser. All new businesses are required to file this return in order to receive the exemption.

Tangible personal property can be subject to ad valorem taxes, meaning the amount of tax payable depends on each item's fair market value. In most states, a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no later than April 1 in the same year.

Buying, Owning Or Selling Property In The Bahamas There are no restrictions on foreigners buying property in the Bahamas. Property purchasers are eligible for an annual Home Owners Resident Card, and those buying a property valued at $500,000 and above are given priority in permanent residence applications.

The most budget-friendly rural land for sale by acre currently includes sites across St Lawrence County northwards towards Canada, southern tier counties like Steuben plus outer Central NY tracts spanning Cortland and Madison counties where per acre vacant land asking prices average between just $1,500 - $3,000 ...