Personal Property Form 2023 In Montgomery

Description

Form popularity

FAQ

If you are a Maryland resident, you are required to file a Maryland income tax return if you are required to file a federal income tax return, and your gross income equals or exceeds the level for your filing status in Filing Requirements see above and in Instruction 1 of the Maryland resident tax booklet.

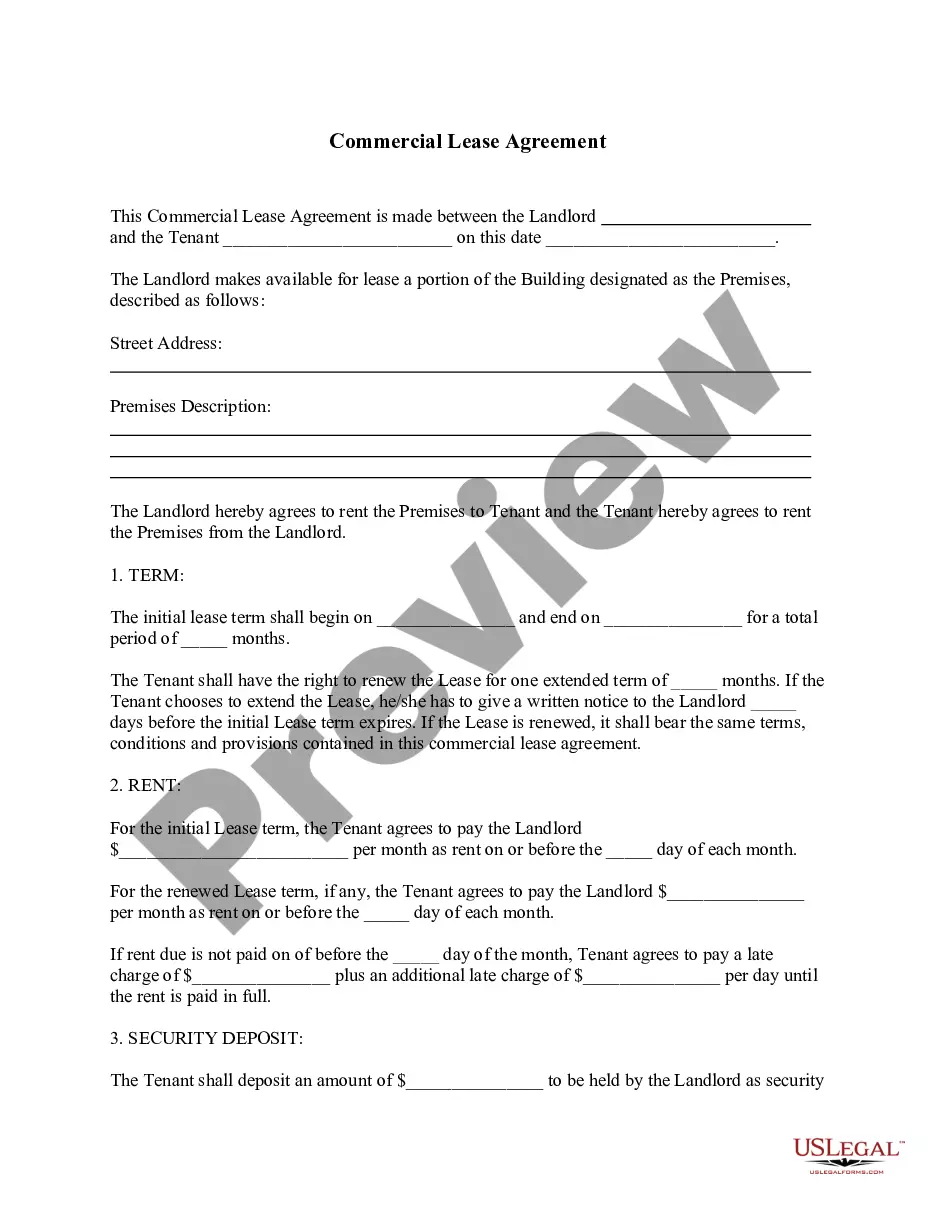

Personal Property Tax Returns are due to the SDAT by April 15th each year. Extensions of the filing deadline up to 60 days can be granted if the requests are made on or before April 15th.

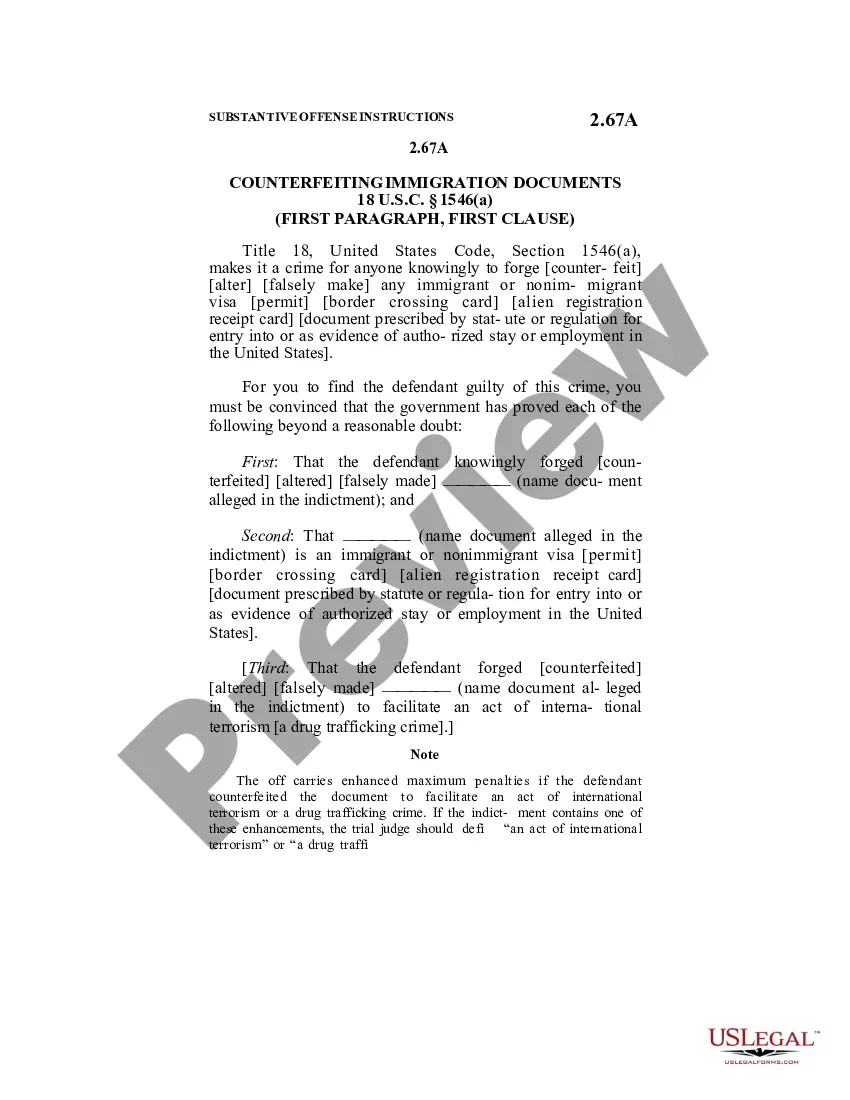

State Property Tax Exemption- Disabled Veterans and Surviving Spouses. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real property taxes on the dwelling house and surrounding yard.

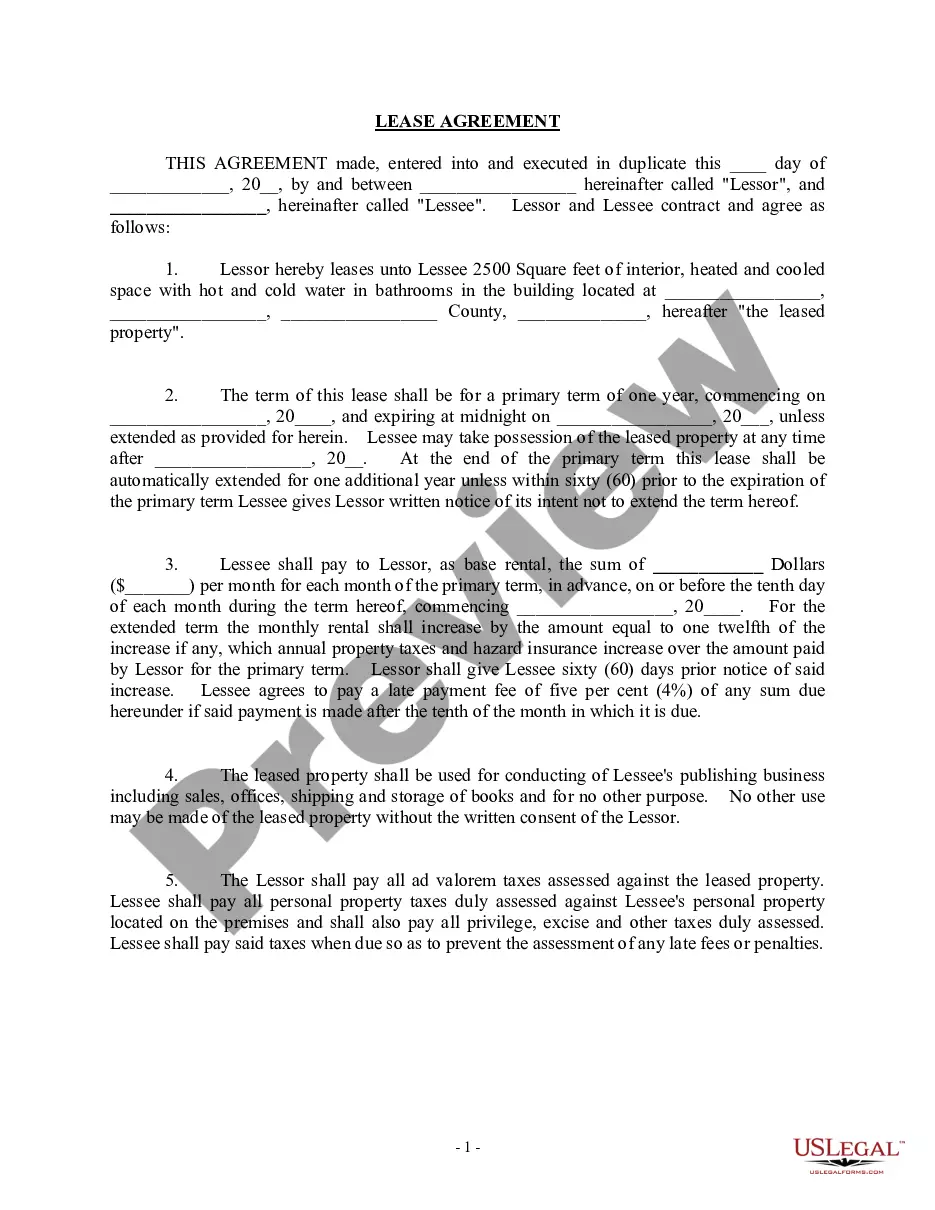

Personal property is considered Class II property and is taxed at 20 percent of market value. Market value multiplied by 20 percent equals the assessment value, which is then multiplied by the appropriate jurisdiction's millage rates to determine the amount of tax due.

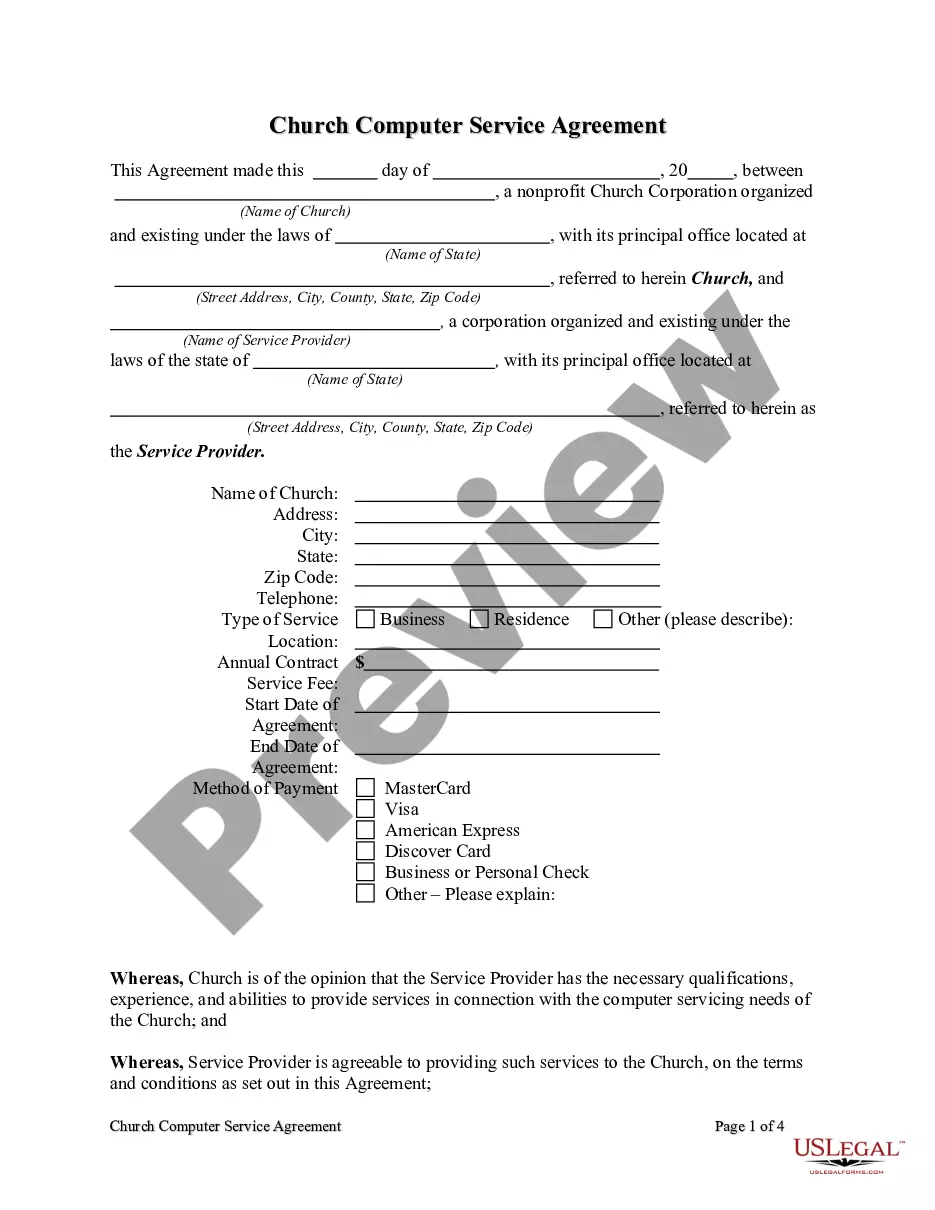

A Maryland personal property return (Form2) must be filed by all sole proprietorships and general partnerships if they possess (own, lease, rent, use or borrow) business personal property or need a business license. A business which fails to file this return will likely receive an estimated assessment.

If there is more than one personal representative, the return must be made jointly by all. If there is no personal representative appointed, every person in actual or constructive possession of any property of the decedent is required to make and file a return.

The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence (see the HOTC page for details); Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT).

A Maryland personal property return (Form2) must be filed by all sole proprietorships and general partnerships if they possess (own, lease, rent, use or borrow) business personal property or need a business license. A business which fails to file this return will likely receive an estimated assessment.

Personal property tax is an annual tax on business owned personal property. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory, and any other property not classified as real property.