Personal Property Form 2023 In Massachusetts

Description

Form popularity

FAQ

Massachusetts General Laws Chapter 59, Section 18 It is assessed tax separately from real estate, but is taxed at the same rate. The tax rate for Fiscal Year 2025 was set at $11.15 per thousand dollars of value. Personal Property is taxable in the municipality where it is situated on January 1st of that year.

Recent Trends in Tangible Personal Property Taxation State2006 Personal Property2017 Personal Property California 4.11% 5.20% Colorado 12.06% 6.90% Connecticut 6.09% 13.28% Florida 7.43% 7.00%29 more rows •

Mailing Addresses ReturnsExtension PaymentPayment Voucher Form 2: Mass. DOR, PO Box 7018, Boston, MA 02204 Form 2G: Mass. DOR, PO Box 7017, Boston, MA 02204 Form M-8736: Mass. DOR, PO Box 419544, Boston, MA 02241-9544 Form 2-PV: Mass. DOR, PO Box 419544, Boston, MA 02241-9544

You must be 70 or older. For Clauses 41C and 41C½, the eligible age may be reduced to 65 or older, by vote of the legislative body of your city or town. You must own and occupy the property as your domicile.

For tax year 2023, Massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) income. Certain capital gains are taxed at 8.5%.

The tax is calculated by multiplying the assessed value of the property by the personal property tax rate of the city or town. Personal property is assessed separately from real estate where it is located.

Massachusetts levies an excise on each vehicle at the rate of $25 per $1,000 of valuation.

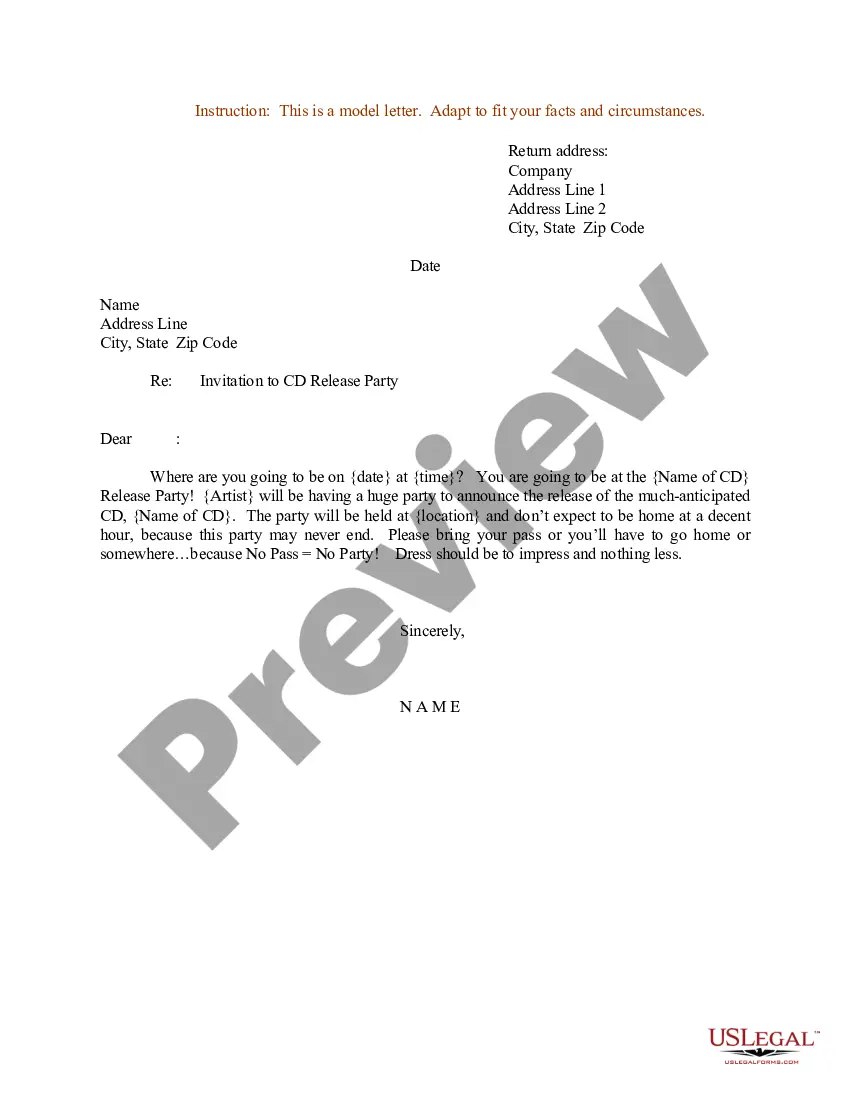

What is the correct form to file? ∎ Individuals, partnerships, associations, trusts and corporations, limited liability companies and other legal entities that own or hold taxable personal property on January 1 of each year must file a Form of List/State Tax Form 2.