This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property On Purchase Agreement In Houston

Description

Form popularity

FAQ

If you're using a real estate agent: Interview agents until you find the one you want to use. Find a property. Consult with the agent on what to offer and what terms to request. The agent submits the contract. If the other party/parties sign the contract, you've now put the property under contract.

As a buyer, you put an offer on a house that's under contract just as you would if you were the first interested party, negotiating until you reach terms and a contract with the seller. If the first deal falls through for any reason, you're next in line to get the house.

Classifications Intangible. Tangible. Other distinctions.

"Personal property" in Texas refers to items that a person owns. These things can be tangible—like a vehicle or household furniture—or intangible, like intellectual property. Personal property is not attached to real property and can be moved.

The attachment method is the most important in determining the two. If the object has formed part of the home and has been used by the initial tenants, then it is considered a fixture and not personal property, for example, built-in electronics like a microwave or a fan.

Personal property may not be included as additional security for any mortgage on a one-unit property unless otherwise specified by Fannie Mae. For example, certain personal property is pledged when the Multistate Rider and Addenda ( Form 3170) is used.

How to write a letter of agreement Title the document. Add the title at the top of the document. List your personal information. Include the date. Add the recipient's personal information. Address the recipient. Write an introduction paragraph. Write your body. Conclude the letter.

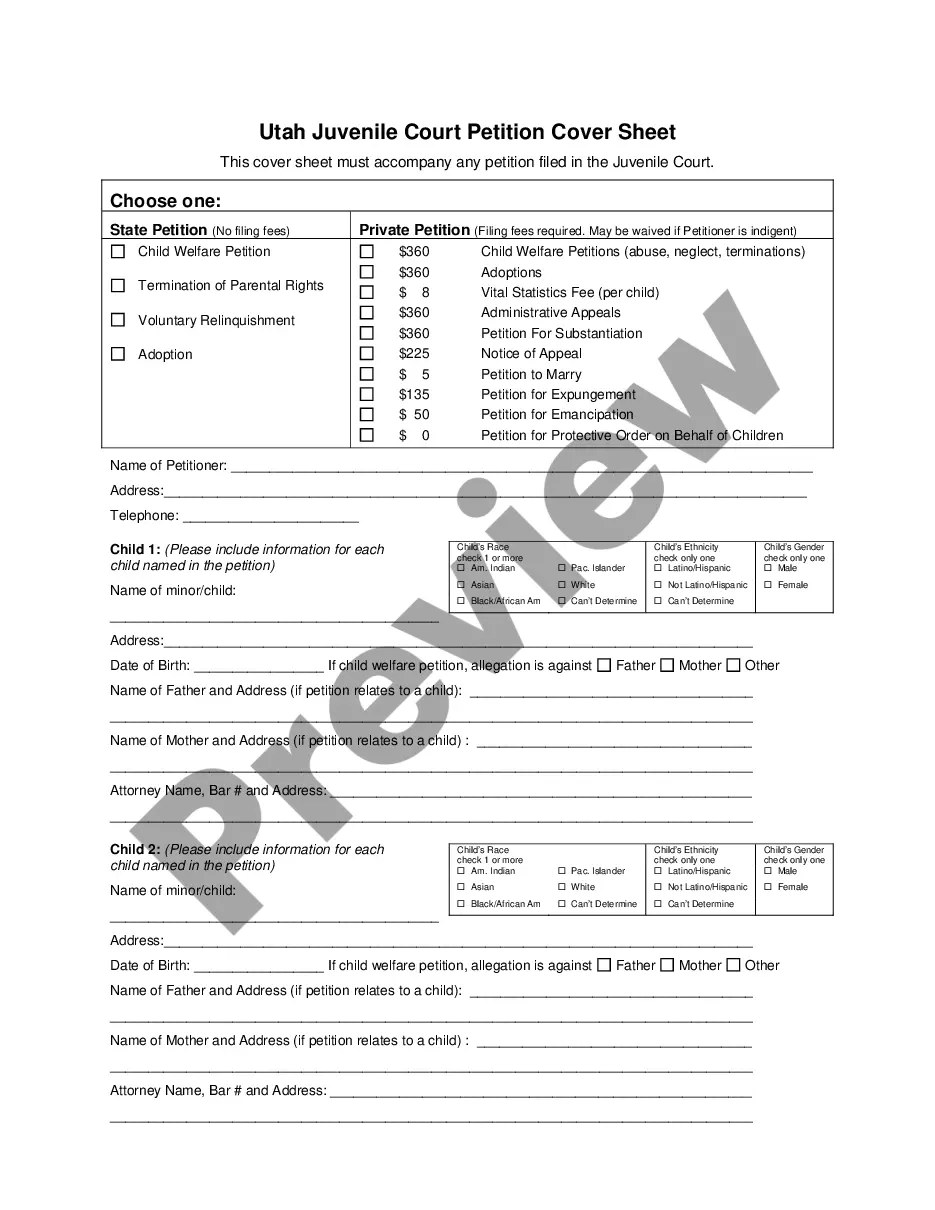

The State of Texas has jurisdiction to tax personal property if the property is: Located in the state for longer than a temporary period. Temporarily located outside the state and the owner resides in this state. Used continually, whether regularly or irregularly in the state.

Personal property includes items like Machinery equipment and vehicles. And and in Texas. The termMorePersonal property includes items like Machinery equipment and vehicles. And and in Texas. The term or property taxi generally refers to taxes on real estate. However.

Section 42.002 - Personal Property (a) The following personal property is exempt under Section 42.001(a): (1) home furnishings, including family heirlooms; (2) provisions for consumption; (3) farming or ranching vehicles and implements; (4) tools, equipment, books, and apparatus, including boats and motor vehicles used ...