This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property In A Trust In Houston

Description

Form popularity

FAQ

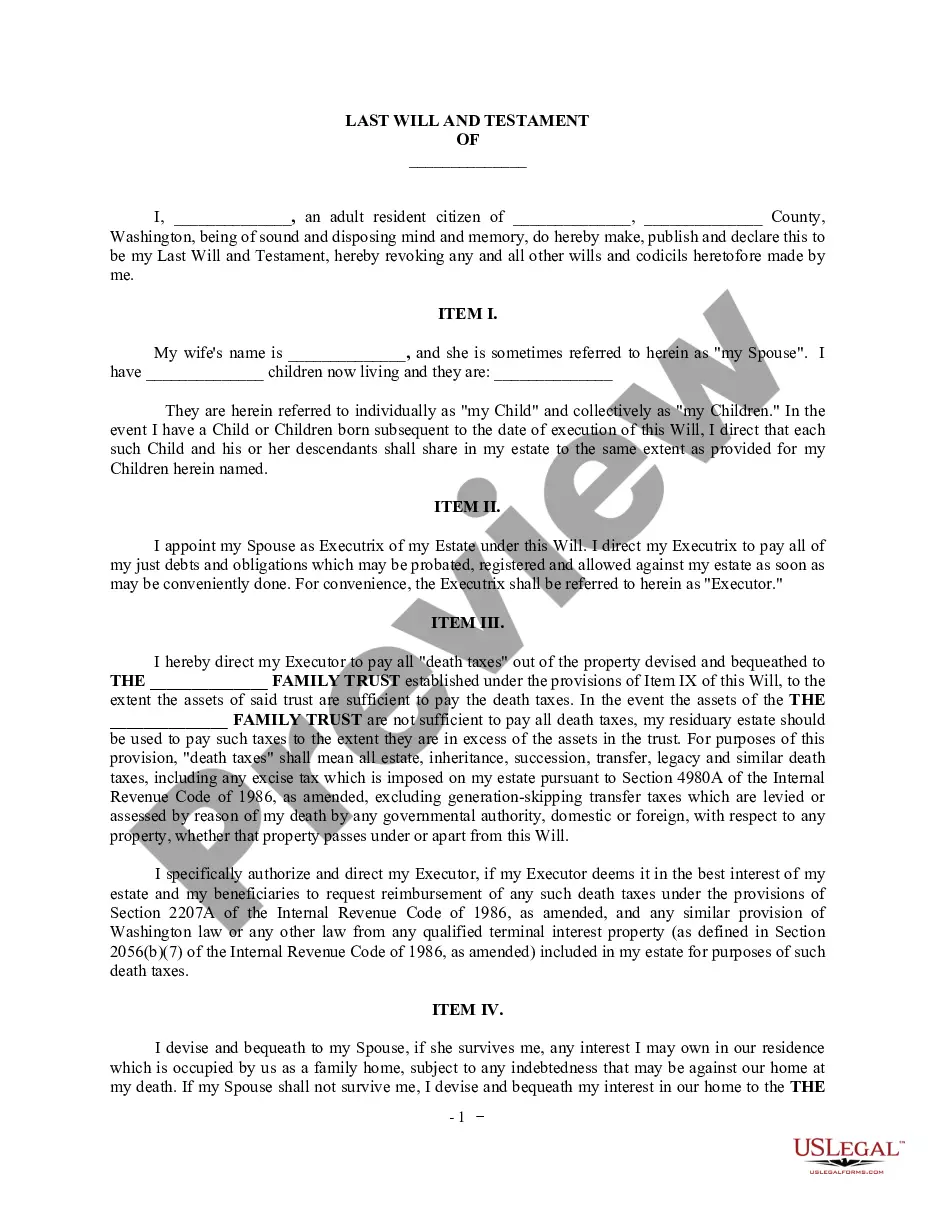

Often, a Trust will be created along with a Will, which stipulates how holdings of the Trustor are to be distributed. Trusts can cover assets like real estate, but there may be other valuables that need to be transferred too. These valuables are known as Personal Property.

Grantors opting for these trusts lose their ownership rights to the assets within them. They lose the ability to decide how to manage or sell these assets.

The transfer document should list assets you're transferring to the Trust. It's good to be specific, but you can use broad categories (like “furniture,” “clothing,” “jewelry,” etc.) without listing every item in each of those categories.

Trusts offer amazing benefits, but they also come with potential downsides like loss of control, limited access to assets, costs, and recordkeeping difficulties.

Trusts also can be very useful for asset protection purposes if the creditors of the beneficiary are prevented from reaching the trust's assets. A trust can be an effective way to place assets outside the reach of creditors.

Transferring real estate to a living trust in Texas involves signing a deed that transfers the interest in the property to the trust and then recording this deed with the county to formalize the transfer. A wide range of financial accounts, including bank accounts, can also be transferred to a living trust.

When a property owner transfers property to their revocable living trust – which they can amend or cancel, in most cases – the property will not be reassessed (see exception, below).