Personal Property Statement With No Class Life In Contra Costa

Description

Form popularity

FAQ

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

Declaration of Homestead – A document recorded by either a homeowner or head of household on his primary residence to protect his home from forced sale in satisfaction of certain types of creditors' claims. Decree of Distribution – Evidences the distribution of real property from the estate of a deceased person.

Personal-use property is not purchased with the primary intent of making a profit, nor do you use it for business or rental purposes.

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st. Personal Property is all property except real estate and can include business equipment, vessels, aircraft, vehicles and manufactured homes.

Personal property refers to movable items that are not permanently attached to land or structures. Unlike real property, which is immovable, personal property includes everything from household goods like furniture and appliances to vehicles, jewelry, and even intangible assets such as stocks or patents.

Ing to the IRS, tangible personal property is any sort of property that can be touched or moved. It includes all personal property that isn't considered real property or intangible property such as patents, copyrights, bonds or stocks.

Personal property includes: Machinery and equipment. Furniture. Stocks and Bonds: If personal property is sold by a bona fide resident of a relevant possession such as Puerto Rico, the gain (or loss) from the sale is treated as sourced with that possession.

Classifications Intangible. Tangible. Other distinctions.

If you own and occupy your principal place of residence on January 1, you may apply for a Homeowner's Exemption that would exempt $7,000 of your home's assessed value from taxation. This would result in a savings of approximately $70 per year on your property tax bill.

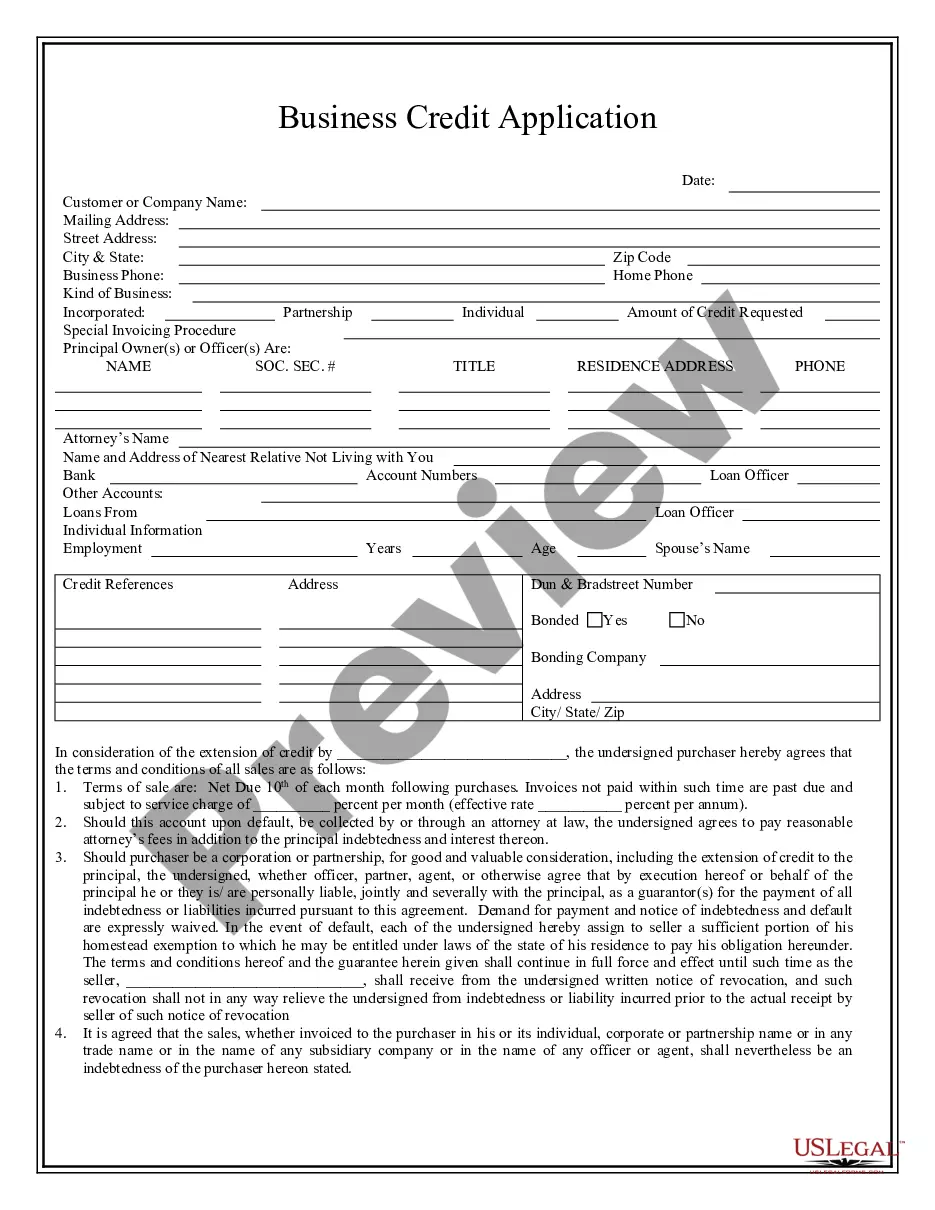

• All businesses are required by law to file the Business Personal Property. • Tax Return (PT-50P) to the Tax Assessor's Office by April 1st of each year. • Personal property includes machinery, equipment, furniture, fixtures, inventory, supplies, and construction in progress.