Private Property For Sale Near Me In Clark

Description

Form popularity

FAQ

Yes, the County Assessor does have the legal authority to access your property in order to make an inspection for valuation in ance with Washington State Law.

Anyone who needs to obtain the property owner name data must submit an email request to the Clark County Treasurer's Office (treasoff@clark.wa) which specifies that they are requesting access to the property owner name data that are maintained by Clark County GIS.

In order to find property ownership, you will need to do a deed search with the Auditor's office.

Check With The County Clerk The county clerk's office has public records of property, deeds, land records and other helpful information that can identify a property's owner. These records also can give you some insight into the history of a property.

Assessed value is computed by multiplying the taxable value by 35%, rounded to the nearest $1.00.

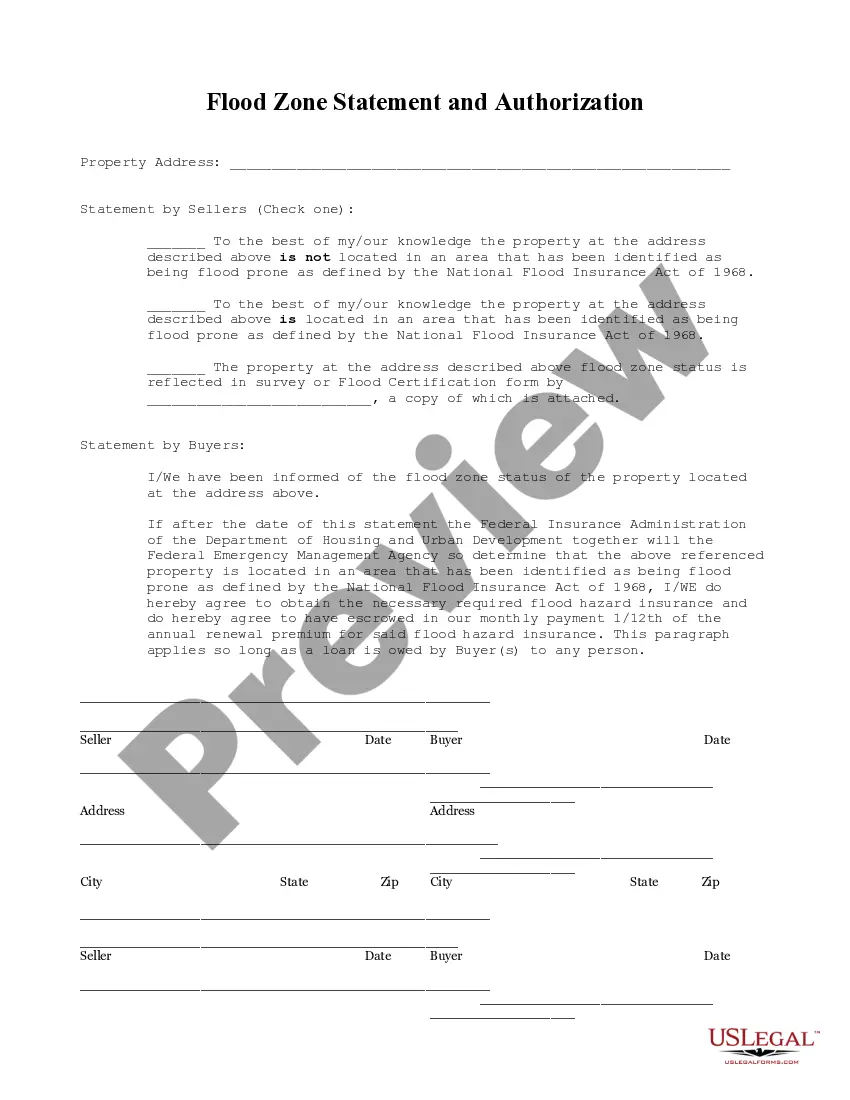

Real Property Transfer Tax RPTT is calculated as $1.95 for each $500.00 of value or fraction thereof. When dealing with the fraction thereof you would round up to the nearest $500.00. Note: Taxable value is market value not the assessed value. If the taxable value is $0.00 to $100.00, there is no RPTT due.

Easily the largest county by population in Nevada, Clark County contains almost 75% of the state's residents and includes Las Vegas. The effective property tax in the county is 0.51%, nearly the same as the statewide average and significantly lower than the national average.

The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded. The Grantor and Grantee are jointly and severally liable for the payment of the tax.

The title transfer process in Nevada involves several steps: completing necessary forms based on the property type, obtaining required signatures (notarization for real estate), calculating applicable fees, and submitting all documentation to the appropriate county office or DMV.

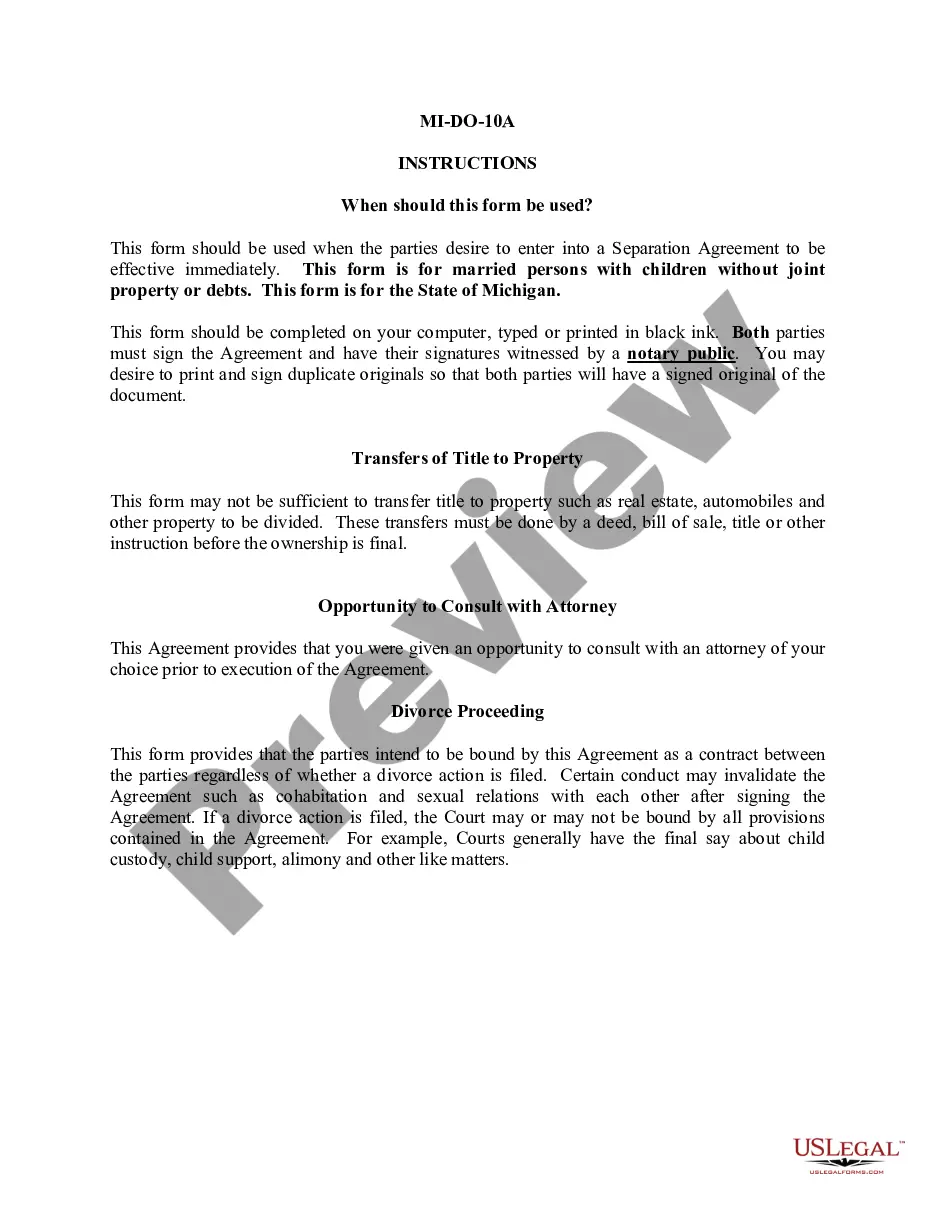

The seller must complete the “Seller's Real Property Disclosure” form, detailing the condition of the property, known defects, and any other aspects of the property which may affect its use or value. A real estate licensee, unless he is the seller of the property, may not complete this form.