Arrendamiento Bienes Forma In Pima

Description

Form popularity

FAQ

Each document must be an original or a copy of the original, and shall be sufficiently legible for recorder to make certified copies from the photographic or micrographic record. SIGNATURES: Each document must have original signatures or carbon copies of original signatures, except when otherwise provided by law.

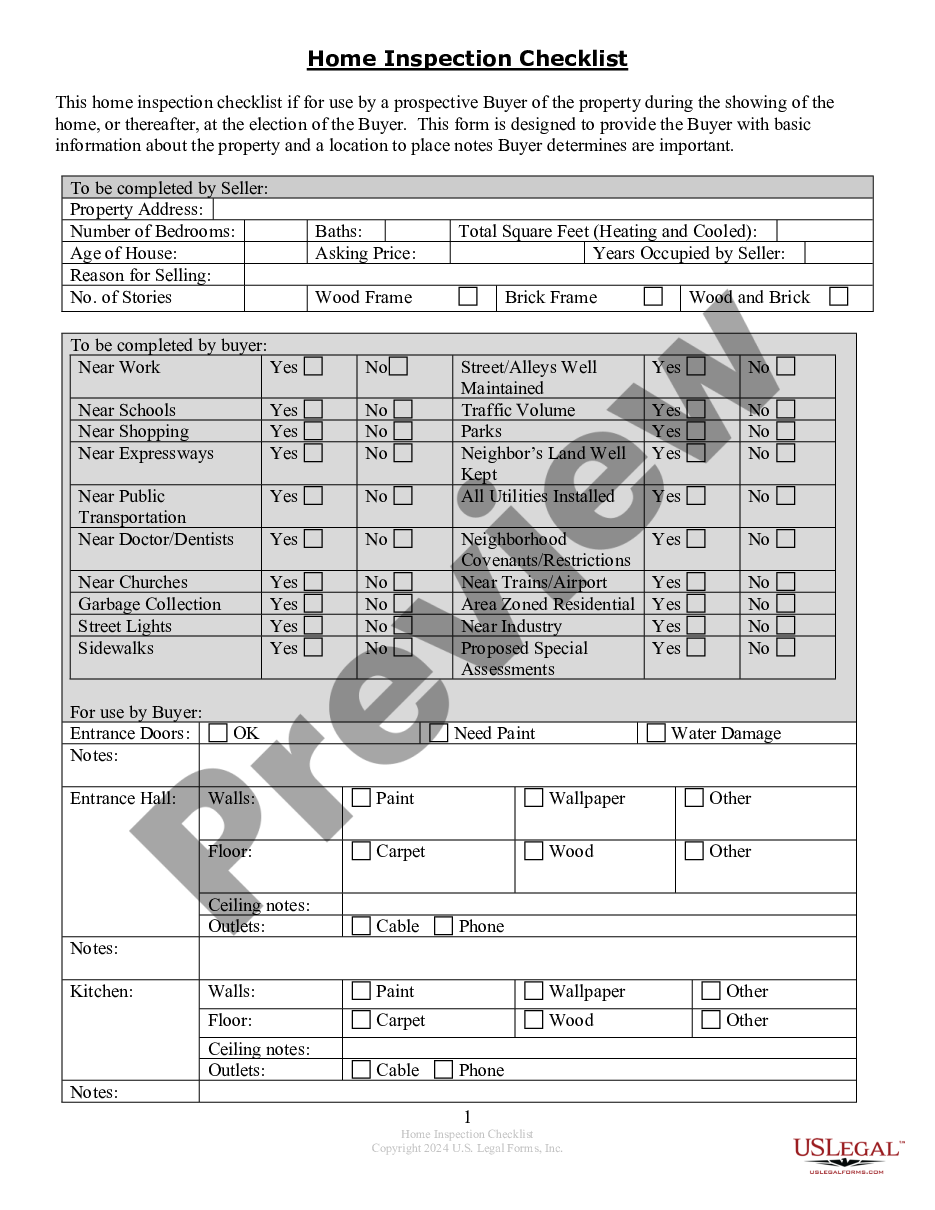

The Pima County Assessor's Office created the Senior Property Valuation Protection program to help seniors save on property taxes. Homeowners can apply to the "Senior Freeze Program" in order to freeze the limited property value of their home for three years.

Arizona allows a $4,476 Assessed Value property exemption to Arizona resident property owners qualifying as a widow/widower, or a person with total and permanent disability, or a veteran with a service or non-service connected disability.

As a senior in Arizona, you may be eligible for a Tax Freeze on the taxable market value of your home. This includes Phoenix's active adult communities, as well as, homes outside of those communities. The intent is to help low-income seniors. Let's explore Arizona senior homeowner's tax relief in more detail below.

As a senior citizen, you probably will end up paying property taxes for as long as you are a homeowner. However, depending on the state you live in and often once you hit your 60s (usually around the ages of 61 to 65), you may be eligible for a property tax exemption.

Lo cierto es que por regla general todos los bienes que puedan usarse sin consumirse, pueden ser arrendados, tanto los inmuebles como los antes mencionados, así como también los muebles, como por ejemplo, los vehículos, muebles del hogar, obras de arte, equipos de oficina, maquinaria, joyas, ropa, etcétera.

En primer lugar, el alquiler es un contrato a corto plazo entre terrateniente e inquilino, mientras que el arrendamiento es un contrato a largo plazo entre el arrendador y el arrendatario. Por consiguiente, las partes que entran en juegos en ambos tipos de contratos tienen una denominación diferente.

El contrato de arrendamiento de inmuebles es un documento importante en el mundo de los negocios inmobiliarios, ya que ayuda a prevenir muchos conflictos. Por ejemplo, el impago de las cuotas establecidas, el dao a la propiedad o que te hagan exigencias no contempladas en el acuerdo.

Arrendamiento: Es un acuerdo donde una persona (propietario) permite a otra (inquilino) usar una propiedad, como una casa o un coche, a cambio de un pago regular.

Arrendamiento es un acuerdo por el que el arrendador cede al arrendatario, a cambio de percibir una suma única de dinero, o una serie de pagos o cuotas, el derecho a utilizar un activo durante un periodo de tiempo determinado.