Certificate Of Discharge Form With Withholding (form It-2104-e) In Wake

Description

Form popularity

FAQ

The City Sales Tax rate is 4.5%, NY State Sales and use tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total sales and use tax of 8.875 percent.

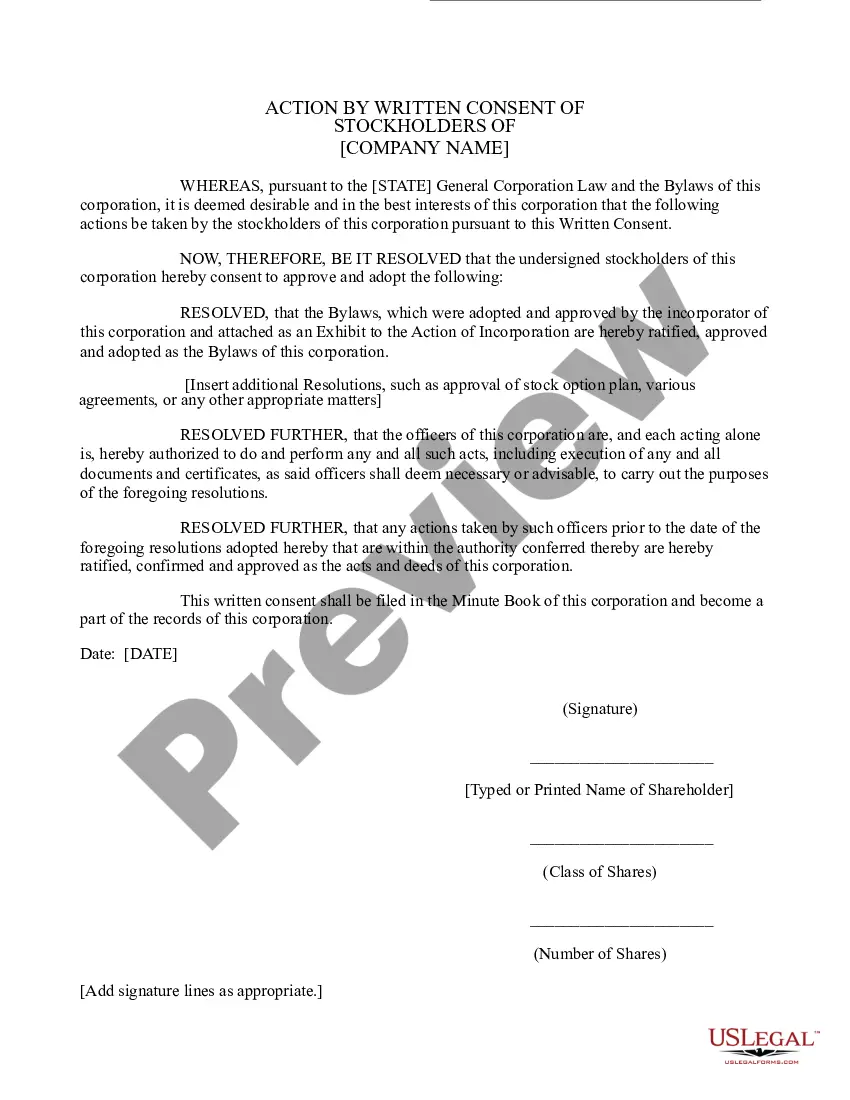

If you have more than one employer, you may submit Form IT‑2104‑E to each employer to claim exemption from withholding, if: • your total expected income will not incur a New York income tax liability for the year 2025, and • you had no liability for 2024.

A Withholding declaration applies to payments made after the declaration is provided to you. The information provided on this form is used to work out the amount of tax to be withheld from payments based on our PAYG withholding tax tables we publish.

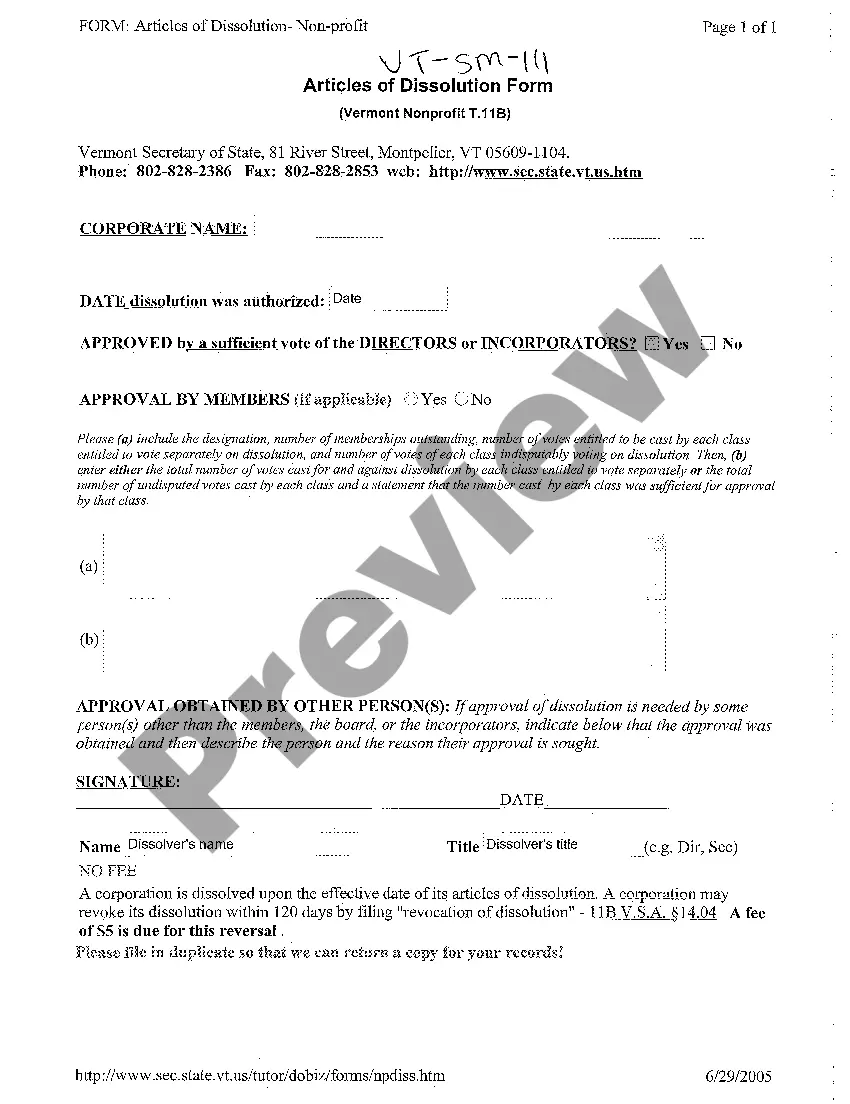

If you meet the criteria for state exemption, file an IT-2104-E Certificate of Exemption from Withholding form instead of the IT-2104 Employee's Withholding Allowance Certificate form. Learn more about exemptions criteria on the NYS Department of Taxation and Finance website.

When you use the form IT-2104 Employee's Withholding Allowance Certificate for your state and city taxes, you may claim as many allowances as are justified by your circumstances. However, if you claim more than 14 allowances, you must complete the Withholding Certificate Affirmation.

To claim an exemption from withholding you must meet all of the conditions below: I am under age 18, or over age 65, or a full-time student under age 25; AND. Last year I did not have a New York income tax liability; AND. This year I do not expect to have a New York State income tax liability.

Calculating Your Withholding Tax Marginal Tax Rates for 2024 10% $11,600 or less $23,200 or less 12% $11,601 to $47,150 $23,201 to $94,300 22% $47,151 to $100,525 $94,301 to $201,050 24% $100,526 to $191,950 $201,051 to $383,9004 more rows

New York recently released the 2024 IT-2104 (Employee's Withholding Allowance Certificate) and IT-2104-E (Certificate of Exemption from Withholding). A QR code has been added to the bottom of the IT-2104.

Here's how to complete the form: Step 1: Provide Your Personal Information. Fill out your personal details, including your name, address, Social Security number, and filing status. Step 2: Specify Multiple Jobs or a Working Spouse. Step 3: Claim Dependents. Step 4: Make Additional Adjustments. Step 5: Sign and Date Your W-4.

Are allowances the same as dependents? No, but they affected each other depending on the number of allowances you claimed.