Publication 783 Withholding

Description

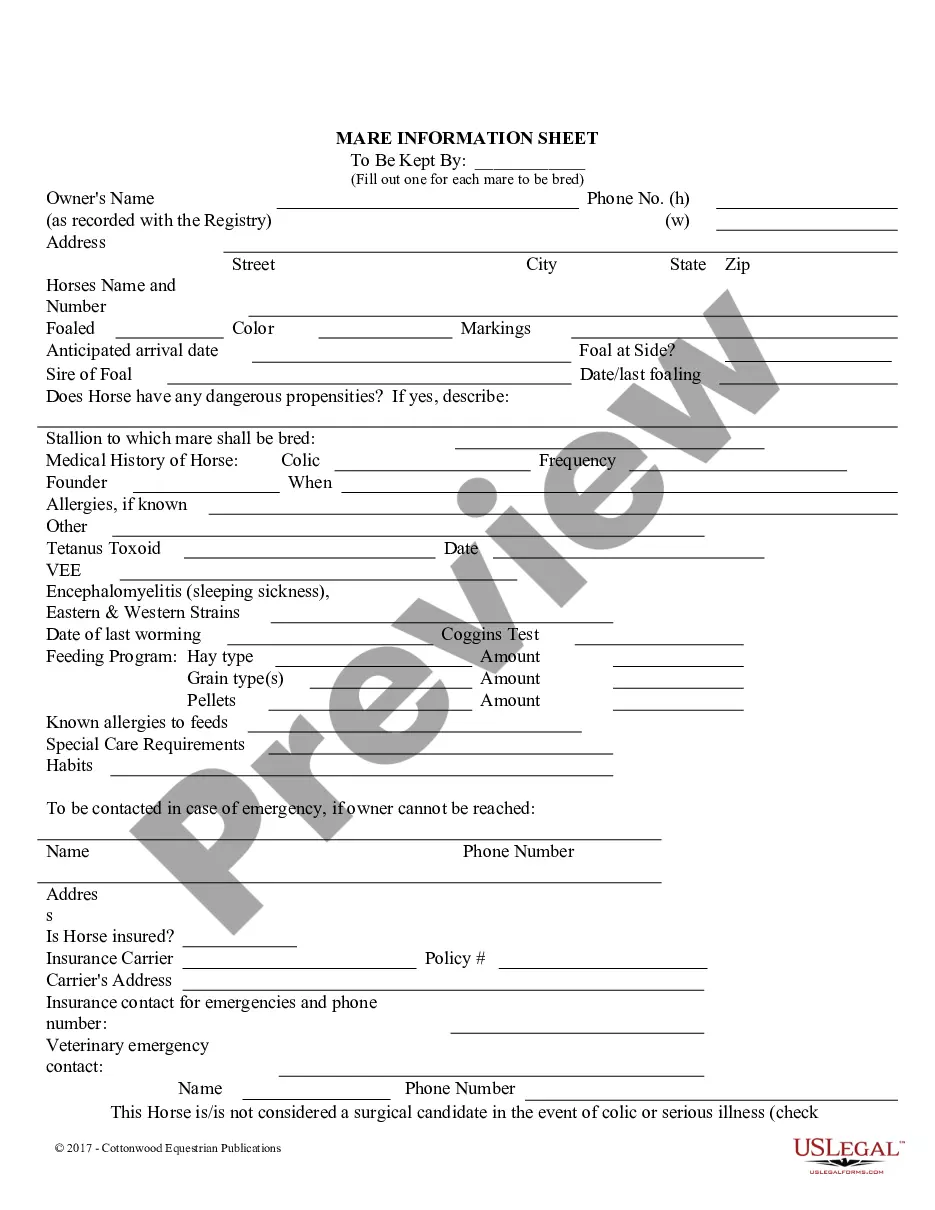

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Working with legal documents and procedures might be a time-consuming addition to the day. Publication 783 Withholding and forms like it often require you to search for them and understand how you can complete them effectively. Consequently, if you are taking care of economic, legal, or individual matters, having a extensive and convenient web library of forms at your fingertips will go a long way.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you complete your documents effortlessly. Explore the library of pertinent documents available with just one click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Safeguard your papers management procedures with a high quality support that lets you put together any form within minutes without extra or hidden charges. Just log in to the profile, find Publication 783 Withholding and acquire it immediately from the My Forms tab. You may also access formerly downloaded forms.

Would it be your first time utilizing US Legal Forms? Sign up and set up up an account in a few minutes and you will have access to the form library and Publication 783 Withholding. Then, follow the steps listed below to complete your form:

- Ensure you have the proper form by using the Review option and looking at the form information.

- Select Buy Now when ready, and select the subscription plan that fits your needs.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience helping users deal with their legal documents. Discover the form you need today and improve any process without having to break a sweat.

Form popularity

FAQ

File Form 945, Annual Return of Withheld Federal Income Tax, with the IRS to report federal income tax withheld (or required to be withheld) from nonpayroll payments. If you deposited all withheld income taxes when due, then you have 10 additional calendar days to file.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488. For individual taxes call 1-888-301-8885.

Station Overview. The Notice of Federal Tax Lien (NFTL) can affect the sale of different types of property, like a house, boat, car, or equipment. Applying for a Certificate of Discharge, if granted, will remove the effect of the NFTL from the property named in the discharge document.