Certificate Of Discharge Form With Withholding (form It-2104-e) In Nassau

Description

Form popularity

FAQ

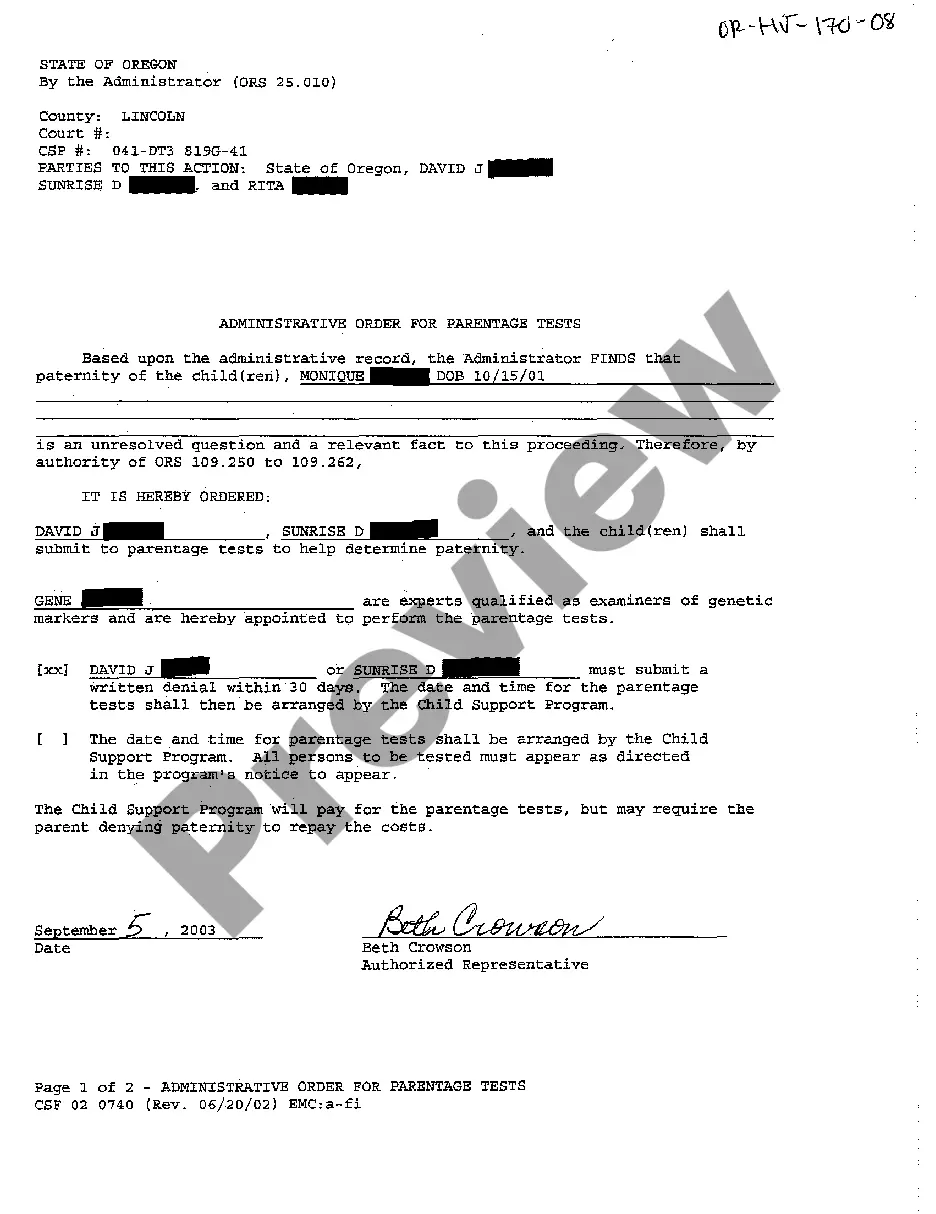

To claim an exemption from withholding you must meet all of the conditions below: I am under age 18, or over age 65, or a full-time student under age 25; AND. Last year I did not have a New York income tax liability; AND. This year I do not expect to have a New York State income tax liability.

In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

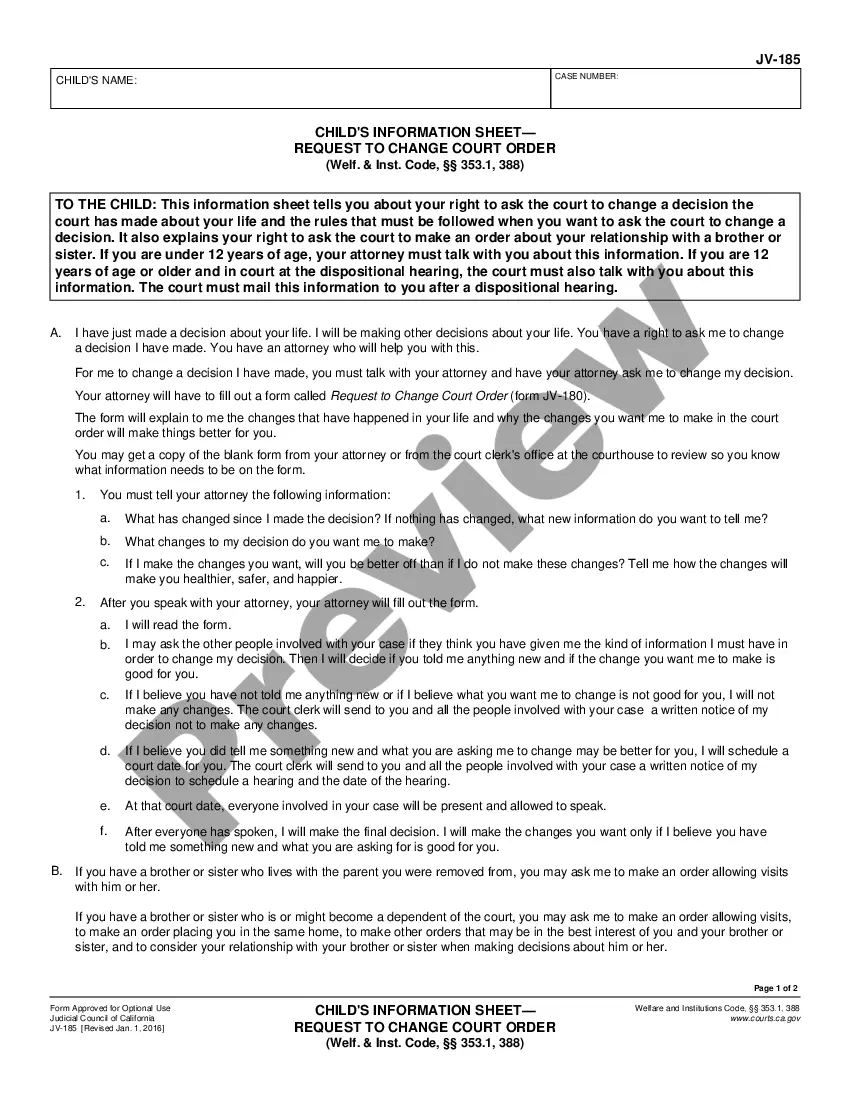

To claim exemption from income tax withholding, you must file one of the following with your employer: Form IT-2104-E, Certificate of Exemption from Withholding. Form IT-2104-IND, New York State Certificate of Exemption from Withholding.

Here's how to complete the form: Step 1: Provide Your Personal Information. Step 2: Specify Multiple Jobs or a Working Spouse. Multiple Jobs Worksheet. Step 3: Claim Dependents. Step 4: Make Additional Adjustments. Step 5: Sign and Date Your W-4.

Thus, claiming ``0'' results in the smallest paycheck, but a larger tax refund at tax time. The larger the number (ie 1, 2, 3, etc...) will result in larger paychecks, but will reduce tax withholdings which may result in a smaller tax refund or owing at tax time.

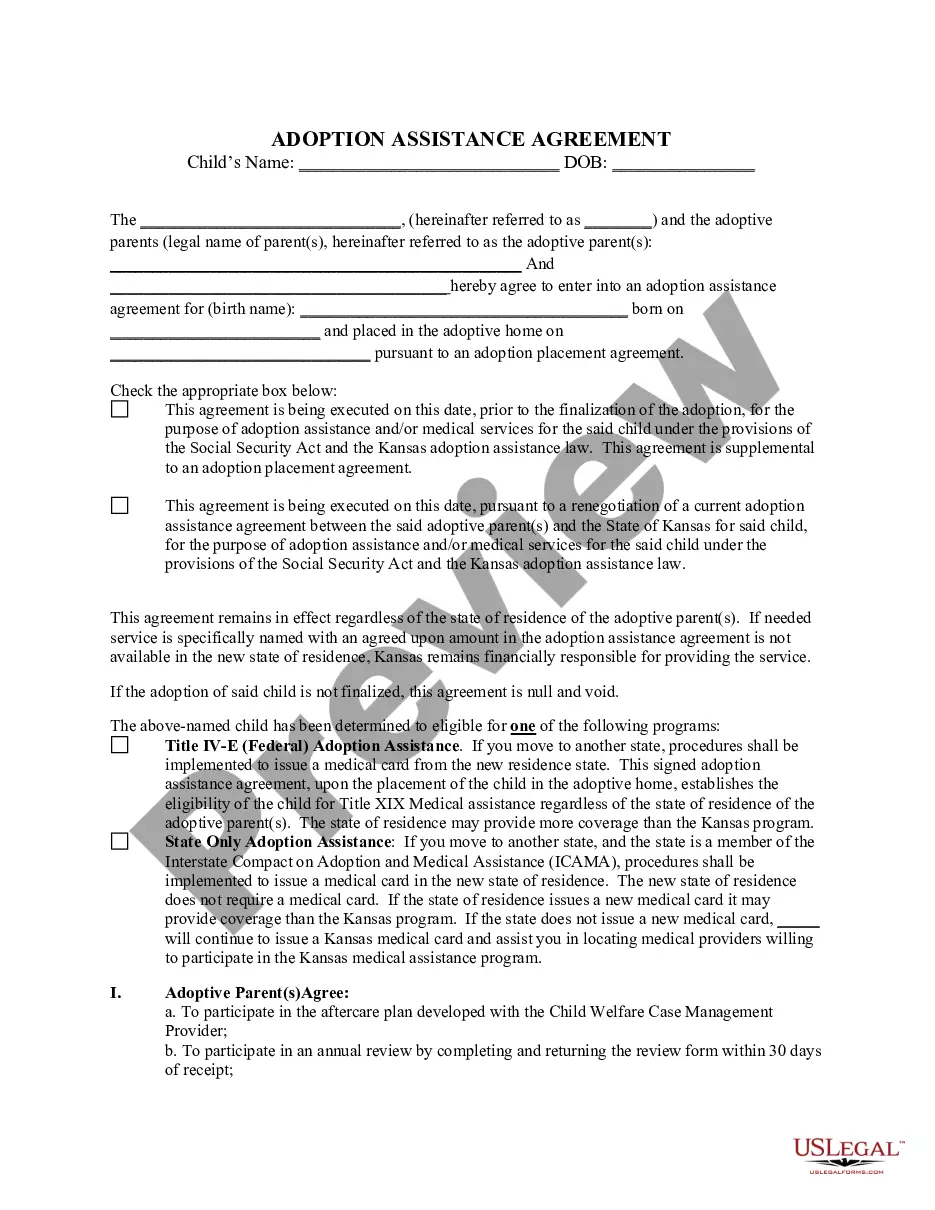

Submit new W-4 and IT-2104-E forms annually To continue to claim full exemption, you need to submit new forms annually before the following deadlines: For federal taxes submit a new W-4 form by February 16. For state and city taxes submit a new IT-2104-E form by April 30.

How to fill out a W-4 form: Step-by-step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

New York recently released the 2024 IT-2104 (Employee's Withholding Allowance Certificate) and IT-2104-E (Certificate of Exemption from Withholding). A QR code has been added to the bottom of the IT-2104.

And step five sign and date the form frequently asked questions why did the IRS change the w4p. FormMoreAnd step five sign and date the form frequently asked questions why did the IRS change the w4p. Form the IRS redesigned the w4p form to simplify your withholding. Made tax withholding more accurate.

You cannot use Form IT-2104 to claim exemption from withholding. To claim exemption from income tax withholding, you must file one of the following with your employer: Form IT-2104-E, Certificate of Exemption from Withholding.