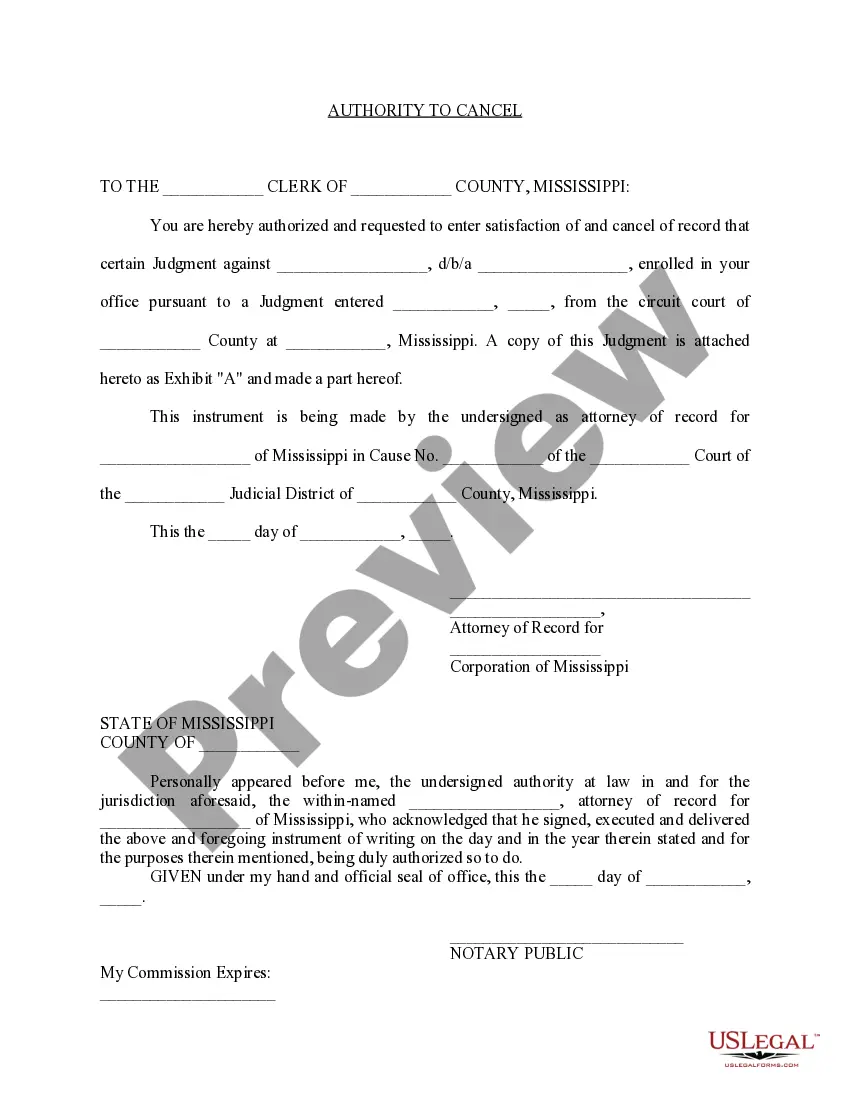

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Certificate Of Discharge Form Withdrawal In Cook

Description

Form popularity

FAQ

A discharge is a type of sentence imposed by a court whereby no punishment is imposed. An absolute discharge is an unconditional discharge whereby the court finds that a crime has technically been committed but that any punishment of the defendant would be inappropriate and the case is closed.

A Certificate of Discharge under Internal Revenue Code Section. 6325(b) removes the United States' lien from the property. named in the certificate.

A quick definition of certificate of discharge: A certificate of discharge is a written statement that says one person has fulfilled their obligation to another person, who agrees that the obligation has been met.

A certificate of discharge is a written statement that one party has discharged its obligation to the other party who accepts the discharge. It is also known as satisfaction piece or satisfaction.

A Certificate of Discharge under Internal Revenue Code Section. 6325(b) removes the United States' lien from the property. named in the certificate.

You'll only be notified of a tax lien after it's already been filed. The IRS sends taxpayers an official Notice of Federal Tax Lien. These liens go into effect 10 days after the IRS issues a record of an existing obligation.

A "discharge" removes the lien from specific property.

If the debt is $10,000 or more (up from $5,000 before the IRS Fresh Start program), then the IRS will file a federal tax lien as early as ten days after you receive your notice.

Centralized Lien Operation — To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.