Publication 783 With Scope In California

Description

Form popularity

FAQ

Any person who knowingly buys, sells, receives, disposes of, conceals, or has in his possession a sniperscope shall be guilty of a misdemeanor, punishable by a fine not to exceed one thousand dollars ($1,000) or by imprisonment in the county jail for not more than one year, or by both such fine and imprisonment.

A: Yes, here in the United States, U.S. Persons (Citizens, or Permanent U.S. Residents) may own and use Night Vision and Thermal Optics. However, it is against the law to take these devices out of the country, unless specifically approved by the U.S. State Department with proper licensing.

Arkansas – LEGAL, but only for feral hogs. They can also be used to hunt raccoons if used in conjunction with a hunting dog. California – ILLEGAL, California law considers all night vision or thermal imaging devices for firearms illegal.

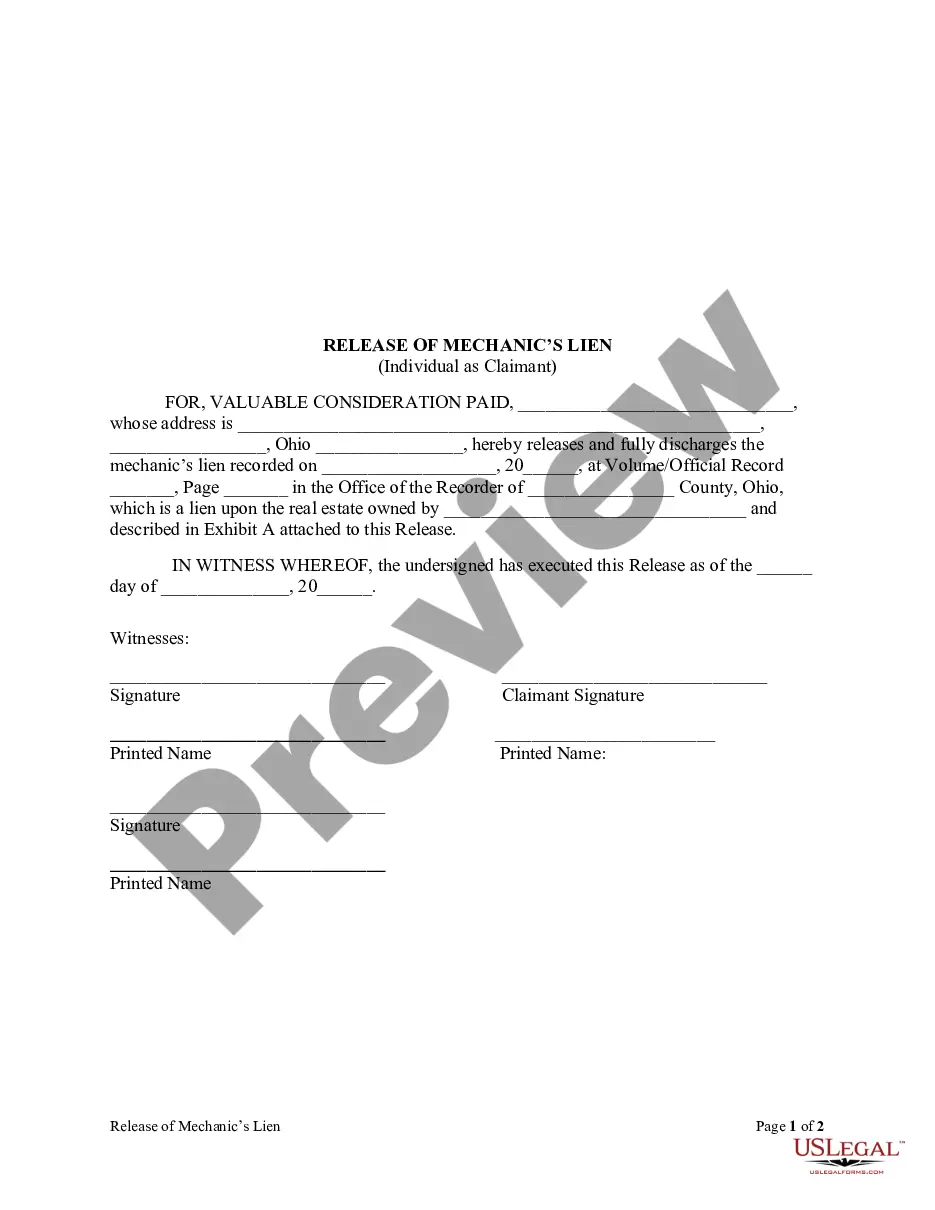

Issuance of a Certificate of Discharge of Property from Federal Tax Lien (IRS Publication 783). In this case, the IRS agrees to release the lien as it applies to specified property only, and the lien will remain valid against all other property owned by the taxpayer.

In some other states, such as California, thermal imaging devices are prohibited for hunting altogether. In addition, some states have restrictions on the use of thermal imaging devices for security purposes.

Arkansas – LEGAL, but only for feral hogs. They can also be used to hunt raccoons if used in conjunction with a hunting dog. California – ILLEGAL, California law considers all night vision or thermal imaging devices for firearms illegal.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien.

IRS & State Tax Attorney Resolving Tax Debt… You're absolutely able to sell property that is subject to an IRS lien.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.