Submission Agreement Sample With Sole Proprietor In Texas

Description

Form popularity

FAQ

Forms you may need to file IF you are liable for:THEN use Form: Income tax 1040, U.S. Individual Income Tax Return or 1040-SR, U.S. Tax Return for Seniors and Schedule C (Form 1040 or 1040-SR), Profit or Loss from Business Self-employment tax Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax6 more rows

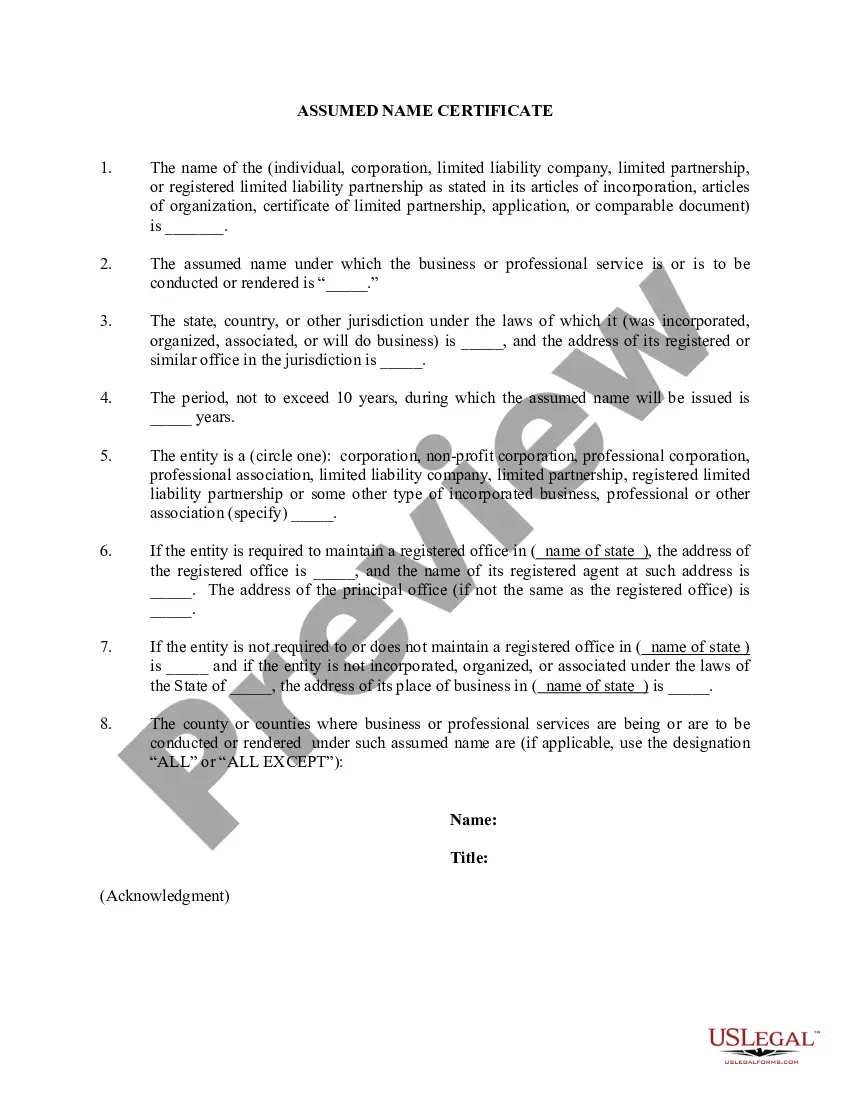

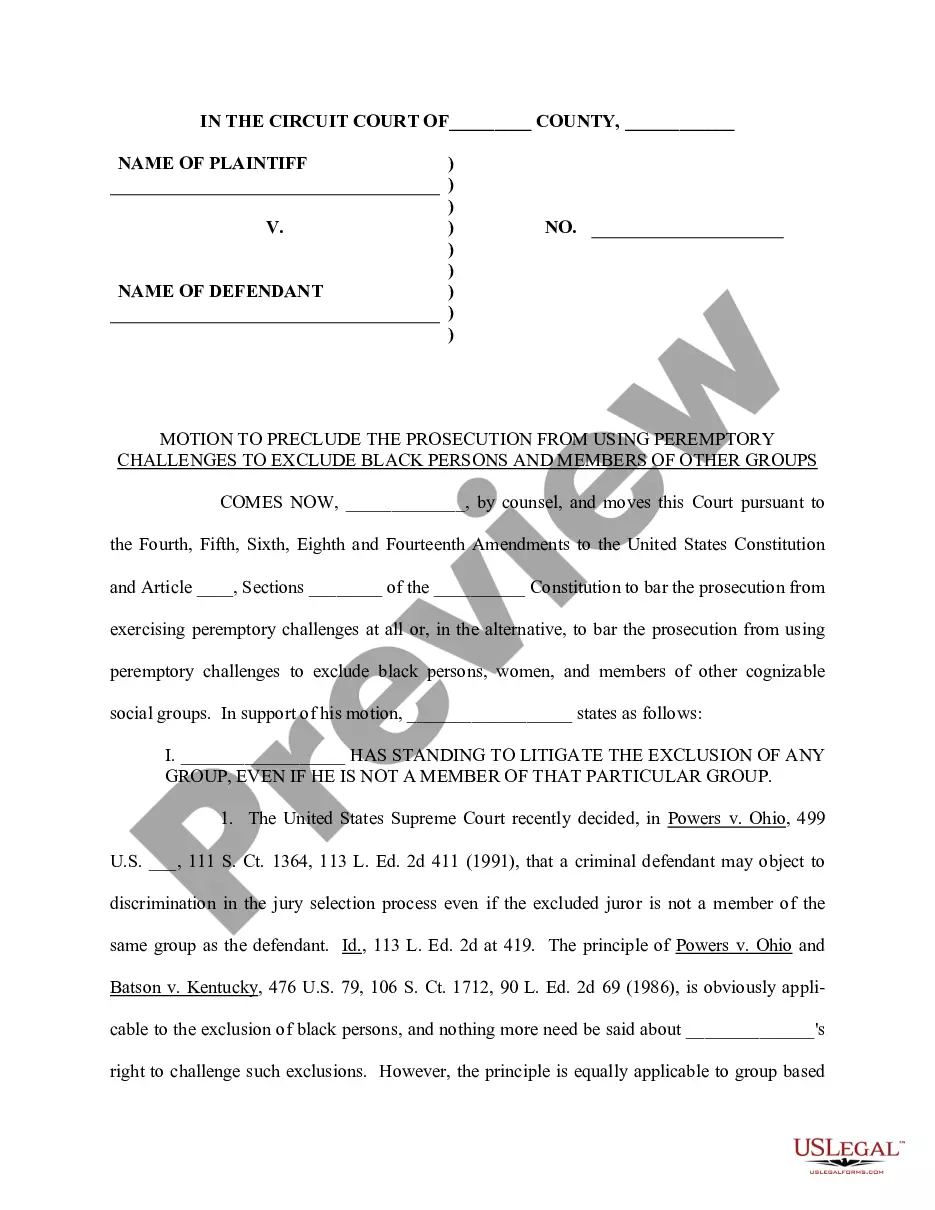

While the sole proprietor is such a simple business classification that Texas doesn't even require a business registration process or any type of fees, depending on how you use your sole proprietorship and what industry you operate in, you still might have some important steps that need to be taken.

The Texas Business Organizations Code states that all domestic or foreign filing entities must designate a registered agent; this means that sole proprietorships don't have to because they do not submit business registration filings with the Texas Secretary of State.

A sole proprietorship is a non-registered, unincorporated business run solely by one individual proprietor with no distinction between the business and the owner. The owner of a sole proprietorship is entitled to all profits but is also responsible for the business's debts, losses, and liabilities.

Do sole proprietors get a 1099? Sole proprietors typically do not receive a Form 1099-NEC. A 1099-NEC form is a tax form that the Internal Revenue Service (IRS) uses to record compensation received by someone other than an employer throughout the year.

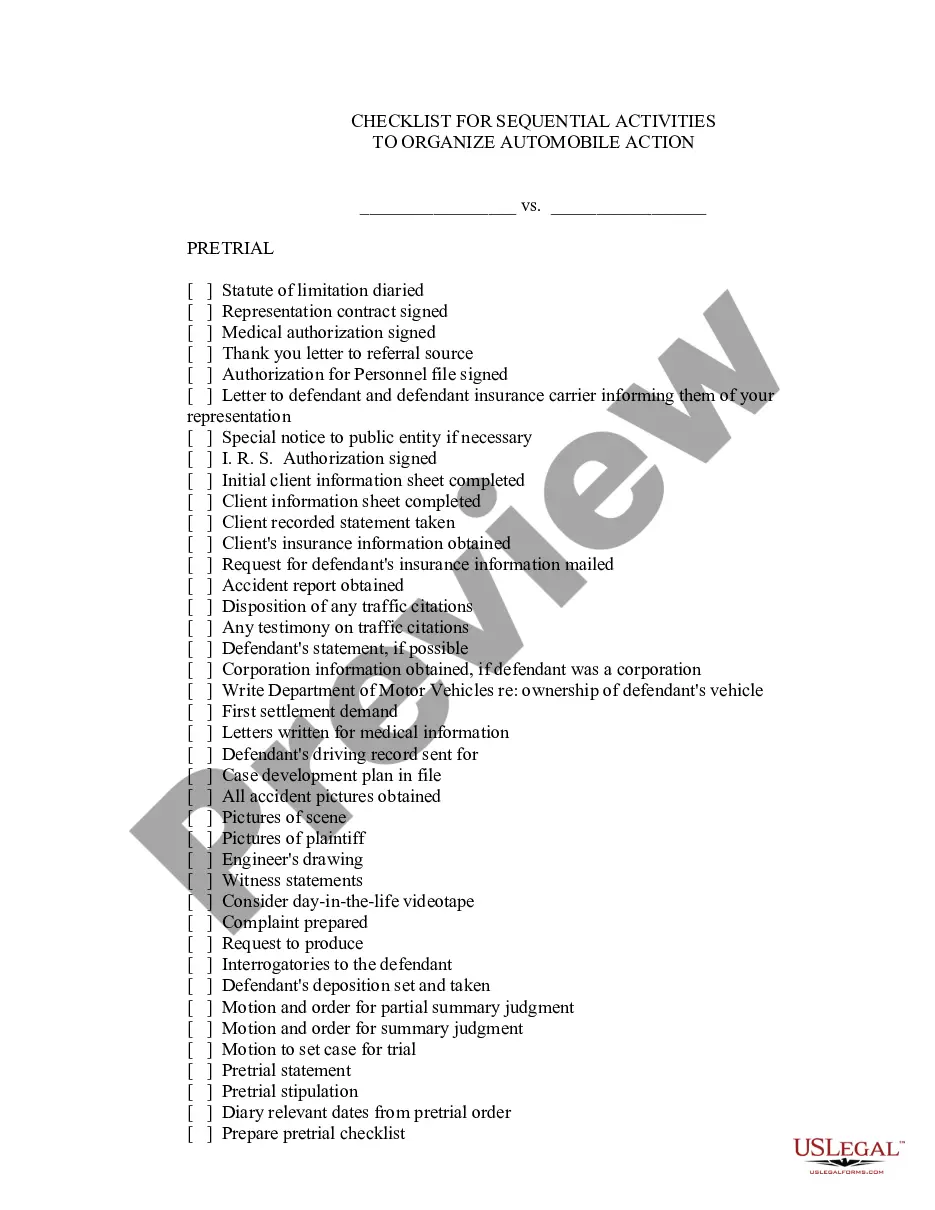

Yes. Even a single-member LLC needs an operating agreement. It's a common belief that, with only one member, such an agreement might be unnecessary. However, having this document offers legal protection and clarity.

While not always legally required, operating agreements play a critical role in the smooth operation, legal protection, and financial clarity of LLCs. Their absence can lead to governance by default state laws, management, and financial disorganization, and increased legal vulnerabilities.

Yes. Even a single-member LLC needs an operating agreement. It's a common belief that, with only one member, such an agreement might be unnecessary. However, having this document offers legal protection and clarity.

Ultimately, if you prioritize simplicity and are comfortable with personal liability, a sole proprietorship might be suitable. Conversely, if liability protection and professional credibility are crucial, an LLC could be the better choice. Checkout NCH on how to start a Nevada LLC.