Acta Asamblea Withholding In Massachusetts

Description

Form popularity

FAQ

Your Clients Can Get a W-4V Online To start, change, or stop federal income tax withholding from their Social Security benefits, your clients can sign and submit IRS form W-4V directly to their local Social Security office.

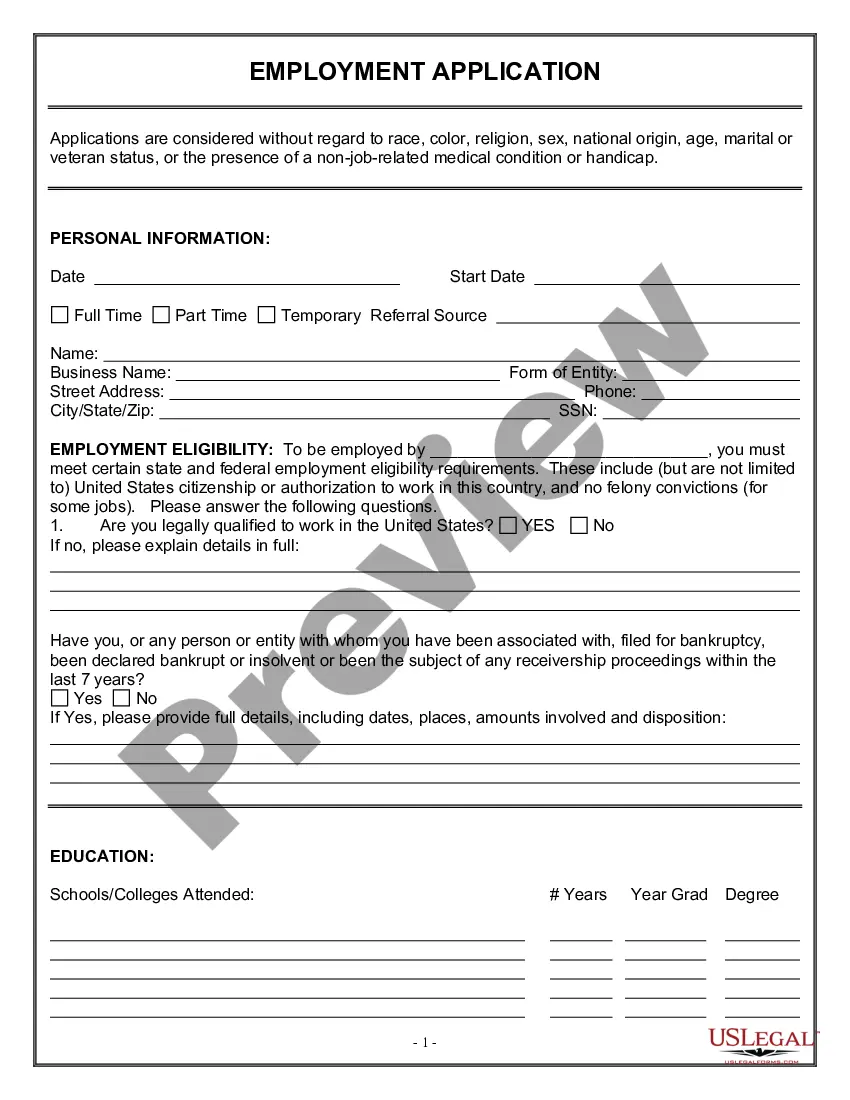

Here's a five-step guide on how to fill out your W-4. Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Mail your Form W2 along with Form M-3 to the following address: Massachusetts Department of Revenue, PO Box 7015, Boston, MA 02204.

Step 4: Other Adjustments (a): Other income (not from jobs). Additional income that might not be subject to withholding, like dividends or retirement income. (b): Deductions. Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction. (c): Extra withholding.

Thus, claiming ``0'' results in the smallest paycheck, but a larger tax refund at tax time. The larger the number (ie 1, 2, 3, etc...) will result in larger paychecks, but will reduce tax withholdings which may result in a smaller tax refund or owing at tax time.

Under IRC section 1446(f)(1), a transferee of an interest in a partnership must withhold 10% of the amount realized on the disposition of an interest in a partnership if any portion of the gain (if any) on the disposition would be treated under IRC section 864(c)(8) as effectively connected with the conduct of a trade ...

U.S. States that Require State Tax Withholding Forms Alabama. Arizona. Arkansas. California. Connecticut. District of Columbia. Georgia. Hawaii.

Withholding on payments of U.S. source income to foreign persons under IRC 1441 to 1443 (Form 1042) Generally, a foreign person is subject to U.S. tax on its U.S. source income. Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%.

As an employer, you must withhold state income taxes from salaries or payments made to employees who live in or are employed in Massachusetts and you must send them in, along with the appropriate form or electronic return, on time.

Summary. The Massachusetts Department of Revenue announced withholding tables for the fiscal year beginning January 1, 2024. The new withholding method includes a surtax on earnings of $1,053,750 or more. While income under $1,053,750 is taxed at 5%, annual income above $1,053,750 will be taxed at 9%.