Chattel Mortgage Form With Two Points In Riverside

Description

Form popularity

FAQ

The Bottom Line Chattel mortgages are a little-known but potentially good option if you're looking to finance a manufactured home or heavy equipment. These loans are smaller than conventional loans and tend to have higher rates, but they have shorter terms and quicker payoffs.

Recorder Offices County Administrative Center. 4080 Lemon St, 1st floor / PO Box 751, Riverside, California 92501 / 92502-0751. Gateway Office. 2724 Gateway Dr, Riverside, California 92507. Hemet Office. Palm Desert Office. Temecula Office. Blythe Office.

Preparation: The grantor (current owner) must prepare the quitclaim deed document, which includes the names of the grantor and grantee, the legal description of the property, and the words of conveyance.

In California, grant deeds are filed at the county assessor's office with a Preliminary Change of Ownership Request, applicable fees and a Tax Affidavit. All must be notarized for legal transfer and recording.

Step 1: Obtain the Deed. Step 2: Visit the County Recorder or Clerk. Step 3: Identify the Legal Description of the Property. Step 4: Consider Legal Assistance. Step 5: Complete the Quitclaim Form. Step 6: Sign in Front of a Notary. Step 7: File a Preliminary Change of Ownership Report (PCOR) ... Step 8: File the Forms.

To submit the completed Quitclaim Deed, ensure all fields are accurately filled and the deed is notarized. Mail the original document to the Riverside County Recorder's Office at 2724 Gateway Drive, Riverside, CA 92507. You may also submit in person at the same address.

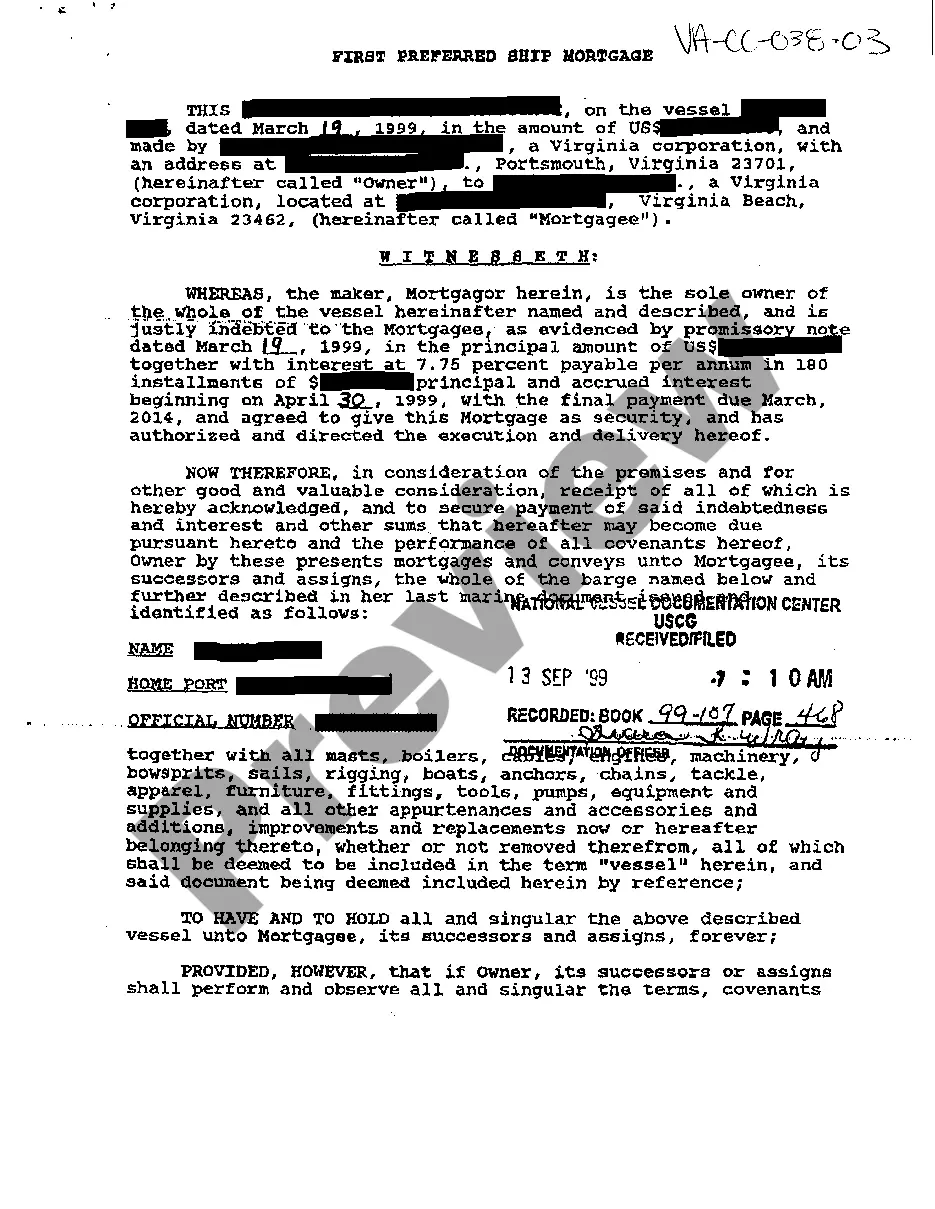

A chattel mortgage shall not be valid against any person except the mortgagor, his executors or administrators, unless the possession of the property is delivered to and retained by the mortgagee or unless the mortgage is recorded in the office of the register of deeds of the province in which the mortgagor resides at ...

Removing the encumbered status of the car on the LTO Certificate of Registration (CR) is done at the LTO. It can't just be any LTO office. It has to be done at the originating LTO branch office (the office where it was originally registered), or the LTO office stated on the Certificate of Registration (CR).

A chattel mortgage shall not be valid against any person except the mortgagor, his executors or administrators, unless the possession of the property is delivered to and retained by the mortgagee or unless the mortgage is recorded in the office of the register of deeds of the province in which the mortgagor resides at ...

LTO MEMORANDUM CIRCULAR NO. 17 of the said manual of operations provides that “In all dealings or transactions on motor vehicles, a chattel mortgage or release thereof shall first be registered with the office of the Register of Deeds before any registration transaction is effected.”