These consent minutes describe certain special actions taken by the Board of Directors of a corporation in lieu of a special meeting. It is resolved that the president of the corporation may borrow from a bank any sum or sums of money he/she may deem proper. The minutes also state that the bank will be furnished with a certified copy of the resolutions and will be authorized to deal with the officers named within the document.

Officers Certificate Example Withholding In Los Angeles

Description

Form popularity

FAQ

As referenced above, a typical officer's certificate certifies that various closing conditions have been satisfied as of the closing date, whereas the secretary's certificate is necessary during the closing to ensure that the selling entity is duly organized or incorporated and capable of effecting the transaction.

An Officers Certificate is a document signed by a company's officer certifying certain facts about the company. An Officers Certificate is often required as a closing condition to a preferred stock financing or an exit M&A transaction.

A Certificate of Incumbency, also known as an Incumbency Certificate, a Register of Directors, or a Secretary Certificate, is a legal document that names all the current officers and directors of a corporations or the members and managers of an LLC, as well as their position, the extent of their authority, and their ...

Historically, the role of corporate secretary was similar to that of an unsung administrative assistant. The position carried little, if any, authority. Board secretary duties were mostly clerical in nature, serving a support function to the board chair, CEO, or executive director.

An Officers Certificate is a document signed by a company's officer certifying certain facts about the company.

A Secretary's Certificate is a document with copies of certain documents, such as a company's certificate of incorporation and bylaws, which the secretary of the company certifies are true and correct copies. The receipt of a Secretary's Certificate is often a closing condition to a preferred stock financing.

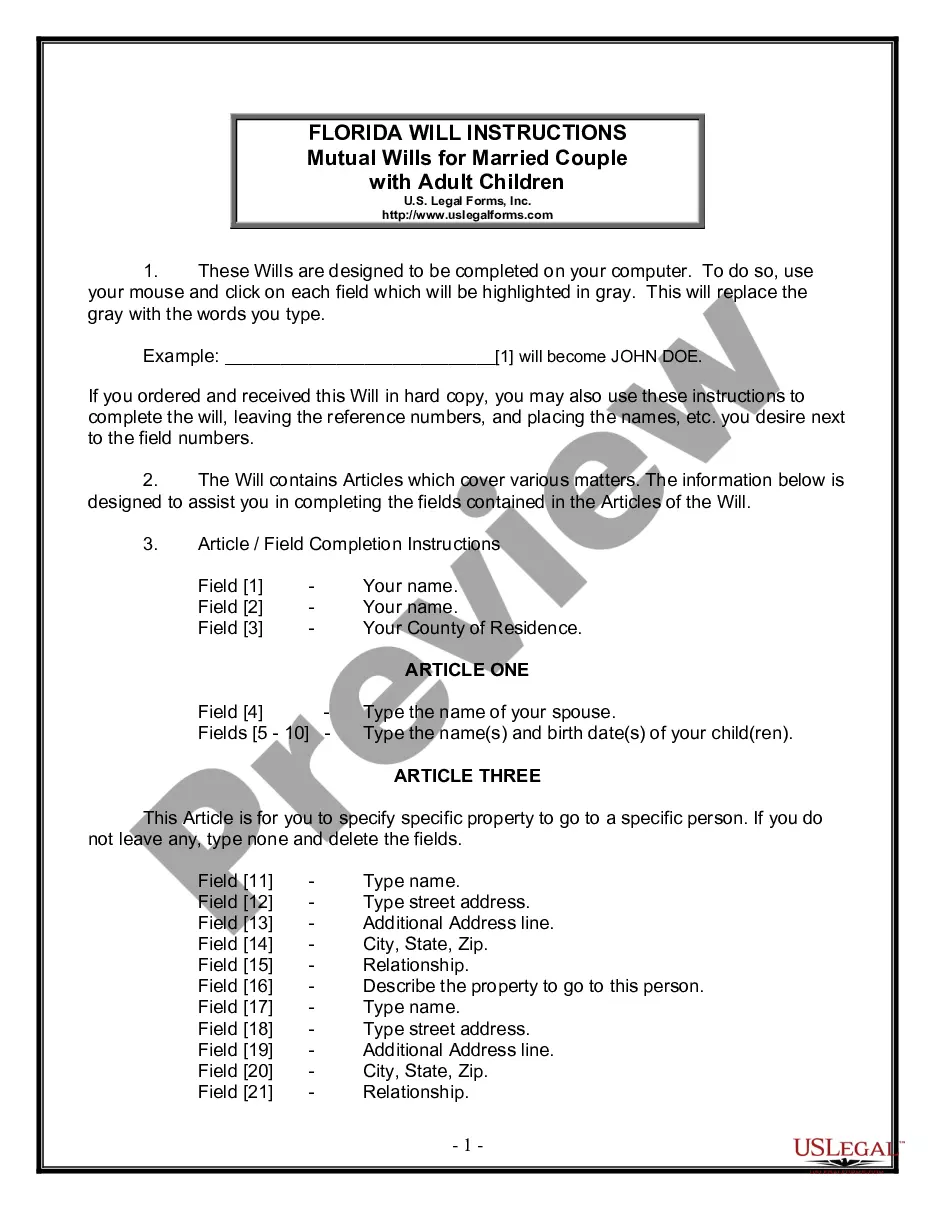

Here's how to complete the form: Step 1: Provide Your Personal Information. Fill out your personal details, including your name, address, Social Security number, and filing status. Step 2: Specify Multiple Jobs or a Working Spouse. Step 3: Claim Dependents. Step 4: Make Additional Adjustments. Step 5: Sign and Date Your W-4.

Here's a five-step guide on how to fill out your W-4. Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.