Form with which the board of directors of a corporation accepts the resignation of a corporate officer.

Corporation Personal Held Foreign In New York

Description

Form popularity

FAQ

20 CRR-NY 16-2.7NY-CRR (a) The term doing business is used in a comprehensive sense and includes all activities which occupy the time or labor of people for profit. Every corporation organized for profit and carrying out any of the purposes of its organization is deemed to be doing business for purposes of the tax.

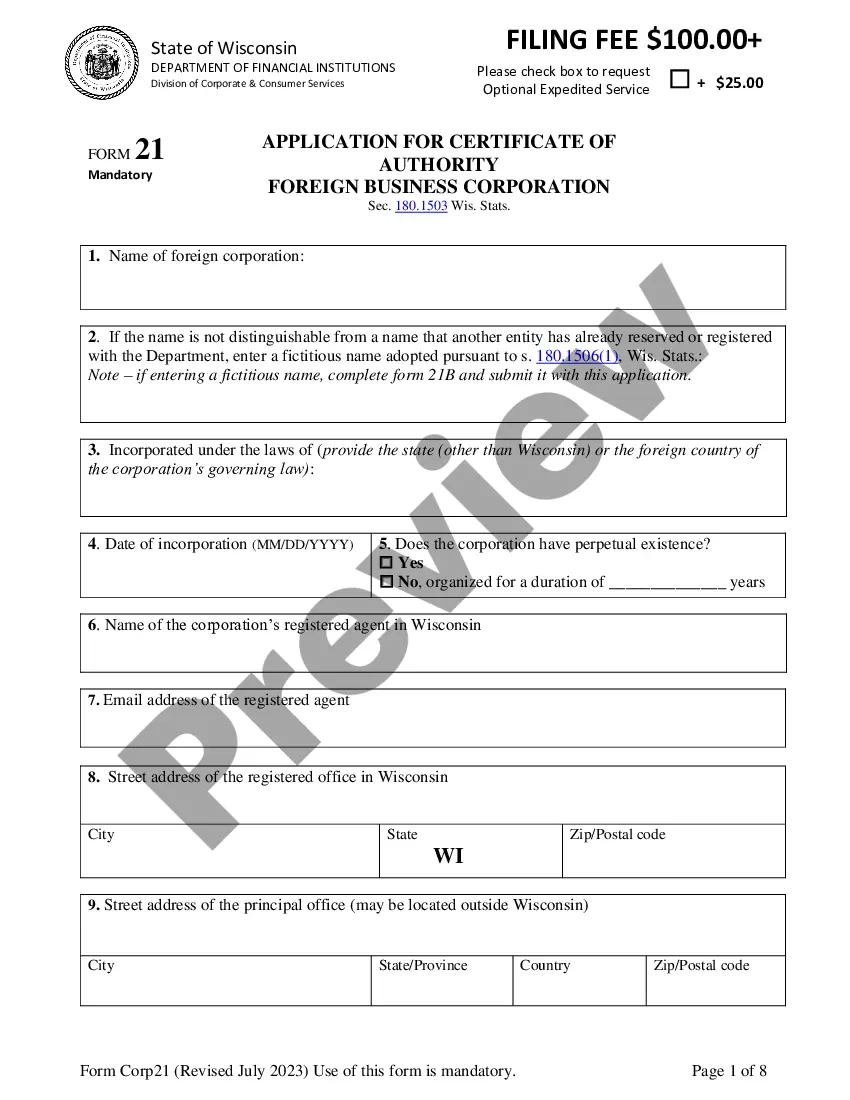

Out-of-state corporations doing business in New York may need a Certificate of Authority. This certificate comes from the New York State Department of State (NYSDOS). Businesses should consult an attorney to learn about legal structures.

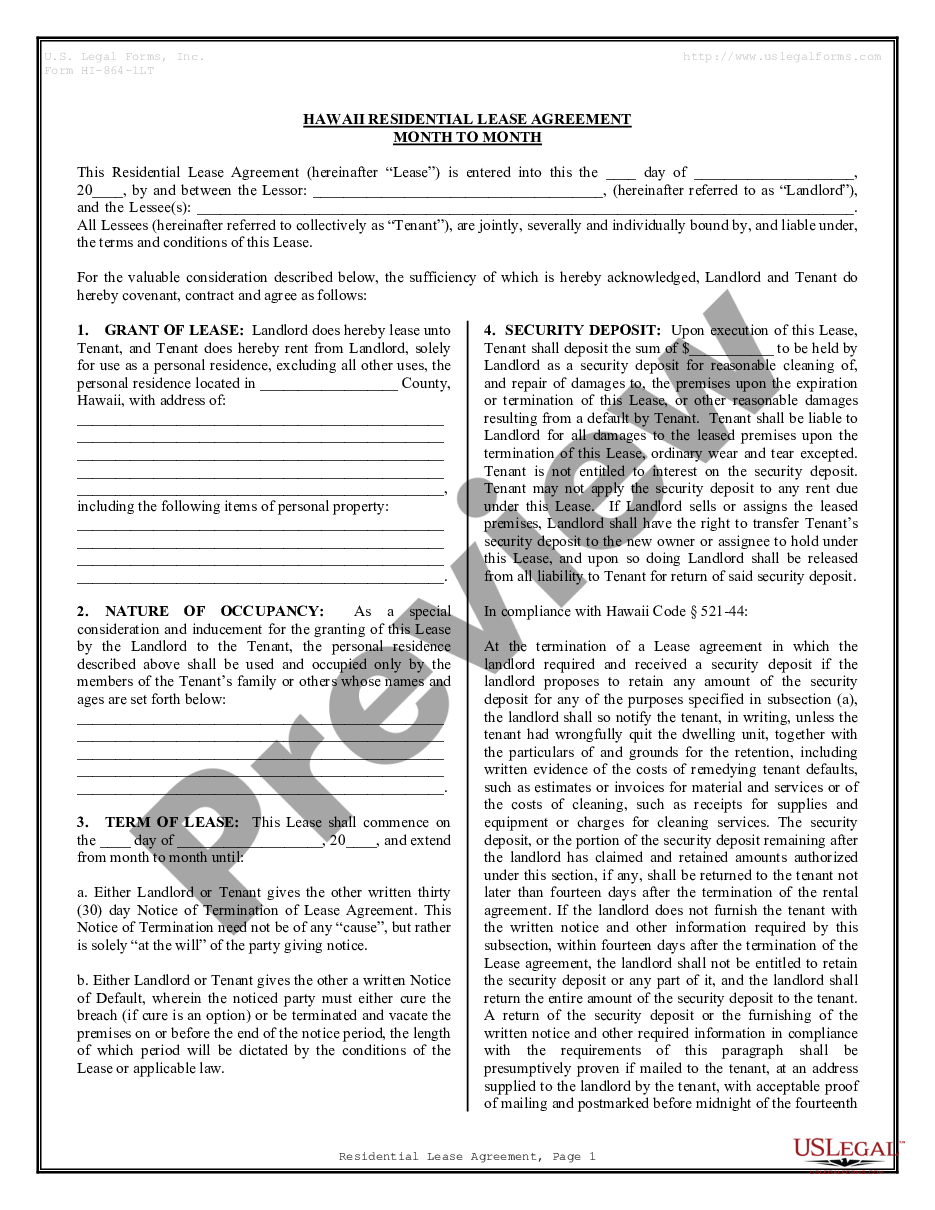

One newspaper must be "printed daily" and the other "printed weekly." The newspapers must be designated by the county clerk of the county in which the LLC has designated as its office location as stated in the application for authority. Publication must be done in New York State.

Complete and file a Certificate of Surrender of Authority with the Department of State. The Certificate of Surrender of Authority requires the consent of the New York State Tax Commission. To request consent, call the New York State Tax Commission at (518) 485-2639.

As a foreign corporation, you are required to register with the Department of State if you are "doing business" in the State of New York. Note: Foreign corporations are not required to have a physical office or a registered agent located within the jurisdiction of New York.

As a foreign corporation, you are required to register with the Department of State if you are "doing business" in the State of New York. Note: Foreign corporations are not required to have a physical office or a registered agent located within the jurisdiction of New York.

Generally, there are no restrictions on foreign ownership of a company formed in the United States. The procedure for a foreign citizen to form a company in the US is the same as for a US resident. It is not necessary to be a US citizen or to have a green card to own a corporation or LLC.

A corporation or LLC that fails to file its Biennial Statement will be reflected in the New York Department of State's records as past due in the filing of its Biennial Statement.

New York doesn't administratively dissolve LLCs. Even if you stop doing business in New York, your LLC will remain active and in existence until you take steps to dissolve it. If you voluntarily dissolved your LLC but want to get it back into business, you'll have to start over and form a new New York LLC.