Cancellation Form Fillable With Qr Code In Nevada

Description

Form popularity

FAQ

The process to close Nevada LLC involves filing of dissolution documents with the secretary of state along with liquidating your business assets and settling any liabilities. The process for dissolving Nevada LLC will take 7-10 business days from the day you file the proper documents.

In the case of LLC Partnerships with more than 2 members, the percentages of ownership become most important. To call for a dissolution of the LLC requires a majority vote of the members. In theory, that could be the vote of one of the partners if that partner holds a majority of the ownership.

Dissolving Your LLC in Nevada Step 1: Vote to Dissolve the LLC. Step 2: Wind Up All Business Affairs and Handle Any Other Business Matters. Step 3: Notify Creditors and Claimants About Your LLC's Dissolution. Step 4: Notify Tax Agencies and settle remaining taxes.

Loss of Limited Liability Protection: If you continue to operate under the LLC's name without formally dissolving it, you risk losing the limited liability protection that the LLC structure provides. This could expose your personal assets to business debts or lawsuits.

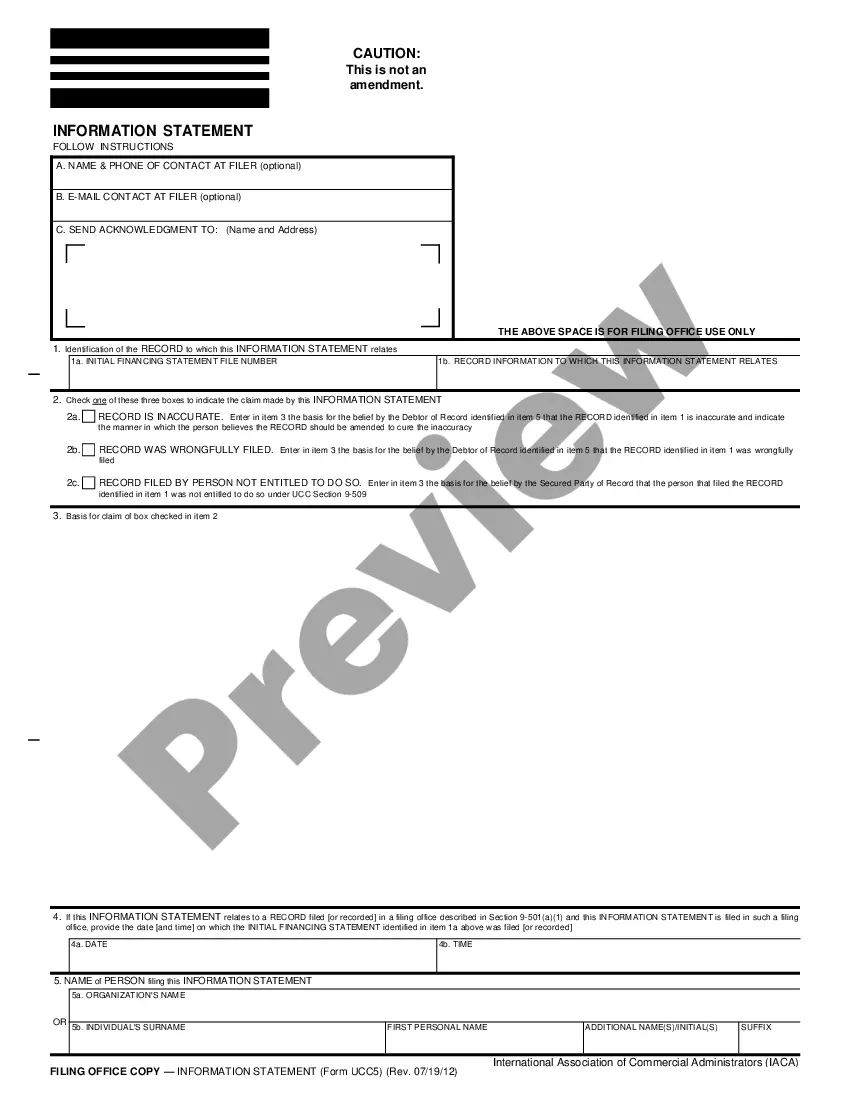

File online at .nvsilverflume or return the completed form to the Secretary of State by fax to (775) 684-5725; by email to newfilings@sos.nv; or, by mail to 202 North Carson Street, Carson City, Nevada 89701-4201.

The “articles of organization” is the basic document required to set up a limited-liability company in Nevada. It is the only formation document required to be filed with the Secretary of State's office to establish the existence of an LLC in Nevada.

A Nevada initial list is the first list that registered business entities need to submit to comply with Nevada regulations. It details a business entity's key people and other information. All Nevada corporations must submit initial lists.