Cancellation Form Fillable For 2023 In Chicago

Description

Form popularity

FAQ

LLC formation timelines in 50 states StateStandard timeline California 2-4 business days for online filings 10-15 business days by mail About 10 business days for in-person filings Colorado Online filings are processed within several days 7-10 business days from the date received for mailed filings49 more rows •

LLC Processing Time by State StateStandard Processing TimeExpedited Processing Time Illinois 2 - 3 weeks 8 - 10 days Indiana 2 - 3 weeks 4 - 6 days Iowa 2 - 3 weeks 4 - 6 days Kansas 2 - 3 weeks 4 - 6 days47 more rows

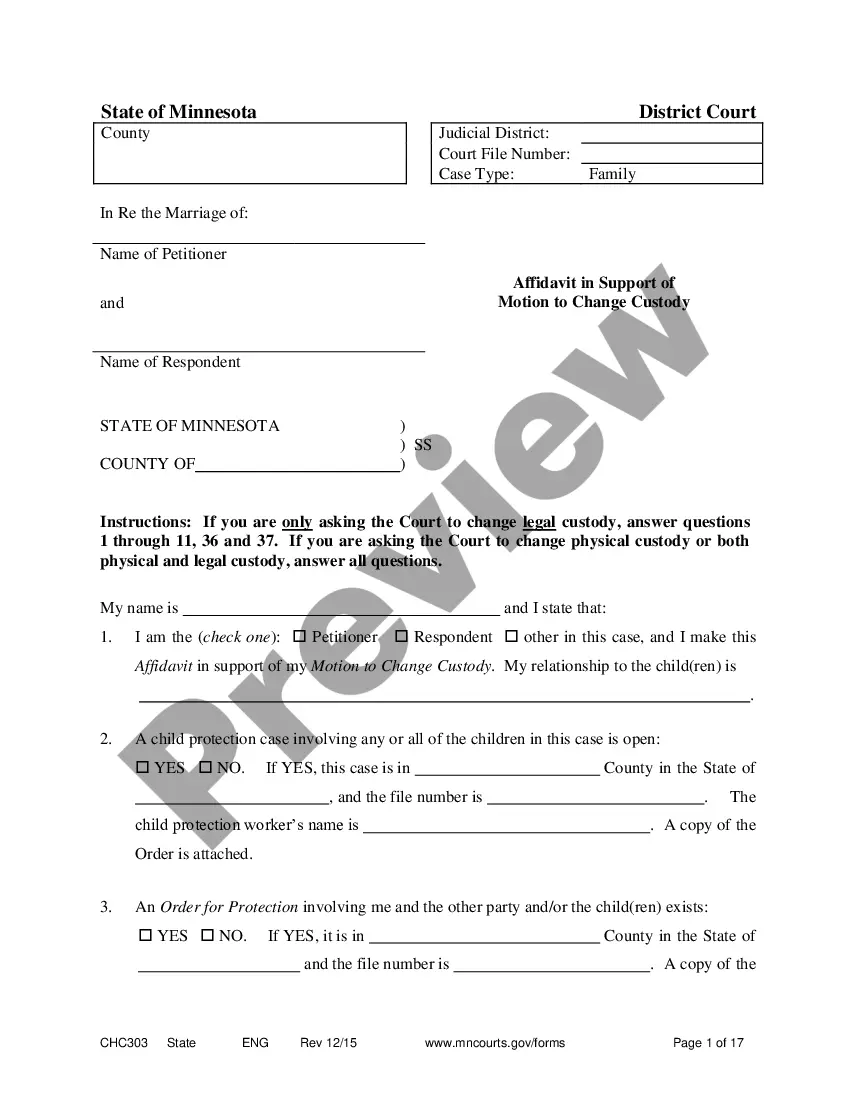

Filing the Motion and Notice of Motion. The Motion and the Notice of Motion need to be e-filed with the Clerk of the Court. The e-Filing system will reject your filing if you do not enter a court date on the form before e-filing it.

A domestic LLC or corporation is a business that is formed within its home (domestic) state. Foreign qualification is when a legal entity conducts business in a state or jurisdiction other than the one in which it was originally formed. (It is not to be confused with being a business in a foreign country.)

Transact Business in Illinois A Foreign Limited Liability Company must complete LLC 45.5, Application for Admission to Transact Business. Forms must be submitted in duplicate and accompanied by a certificate of good standing from the state where the company is organized.

The BCA 13.45 Application for Withdrawal and Final report is required when your company is no longer doing business in Illinois. Filing the BCA 13.45 form ensures that your company will no longer accrue franchise tax, penalties, and interest for missed annual reporting.

To discontinue a business, most account types currently in MyTax Illinois can be closed electronically. You may also call Central Registration at 217 785-3707 or email us at REV.CRD@Illinois.

If you need assistance in obtaining any of these forms, please call our Business Contact Center at 312.747. 4747 or for TTY 312.742. 1974.