Employee Form Document For Work In Montgomery

Description

Form popularity

FAQ

Employee's eligibility to work in the United States All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States.

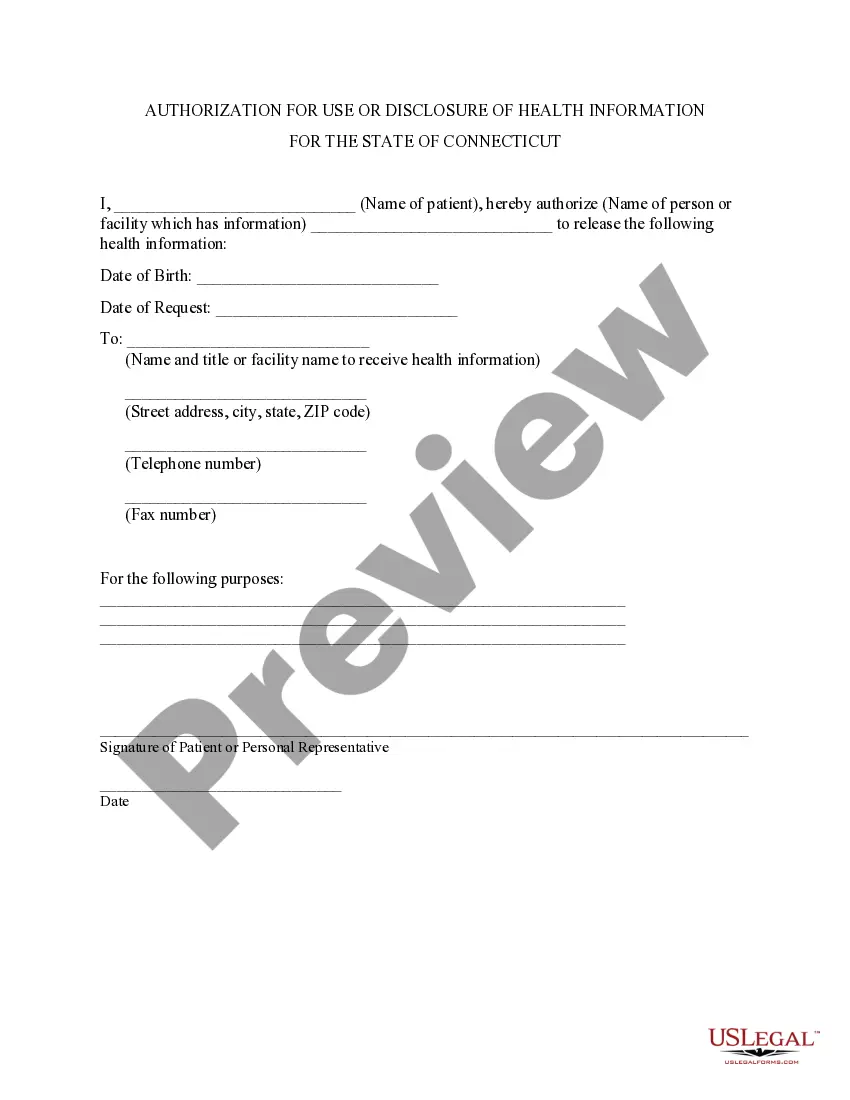

What is an Employee File? An employee file is a document or collection of documents that contain personal and employment-related information about an employee. Files may include, but are not limited to, the employee's name, Social Security number, date of birth, address, job title, salary, and benefits information.

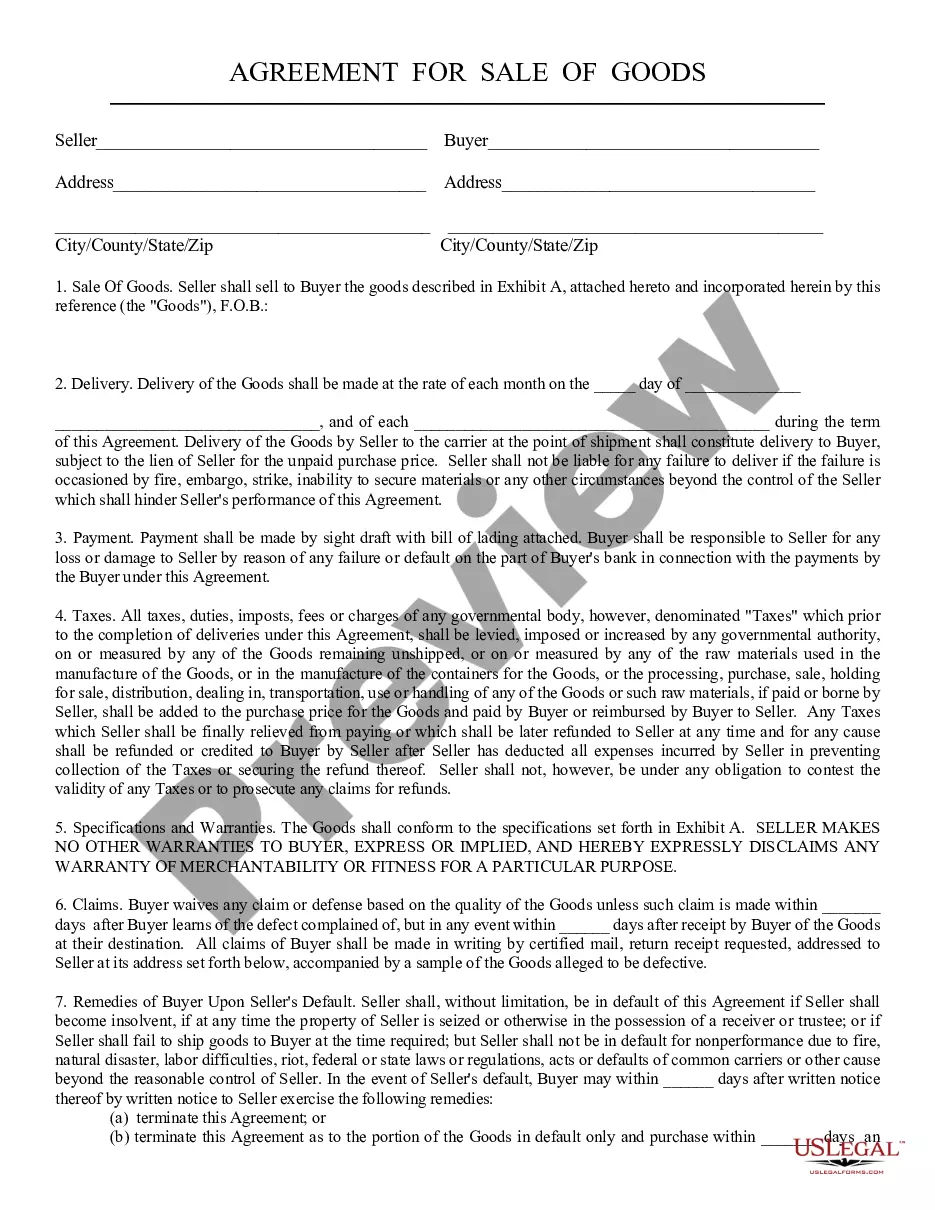

A job application form is an official form given to candidates by the employer asking a wide range of questions about the individual and their skills related to the job. Forms are legally defensible and stand as a way for candidates to introduce themselves to employers.

This form should encompass areas such as personal information (name, address, date of birth), contact details, emergency contact information, employment history, educational background, and any relevant certifications or skills.

How do I fill this out? Begin by entering your personal information in the designated fields. Fill out your spouse's details if applicable. Complete the job information section with your employment details. Provide emergency contact information accurately. Review all information carefully before submitting the form.

Federal and State Tax Withholding Forms Both Federal W-4 Form and California DE 4 Withholding Certificate must be provided to newly hired employees.

New employee forms are documents an onboarding employee completes for a company. Some forms are required by law, such as tax forms, while others may be for a particular company or position. They help verify the new employee understands company policies, compensation payments and benefits.

The W-4 form, also known as the Employee's Withholding Allowance Certificate, tells your employer how much federal income tax to withhold from your paychecks. On the other hand, the I-9 form, or the Employment Eligibility Verification, confirms that you're legally allowed to work in the U.S.

What does "employer name" mean on a job application? Many applications include fields labeled "employer name" in the section about your previous work experience. These fields are where you write the names of the companies you've worked for previously.

Generally, employers are required to file Forms 941 quarterly. However, some small employers (those whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less for the year) may file Form 944 annually instead of Forms 941.