Employee Form Document With Parameters In Arizona

Description

Form popularity

FAQ

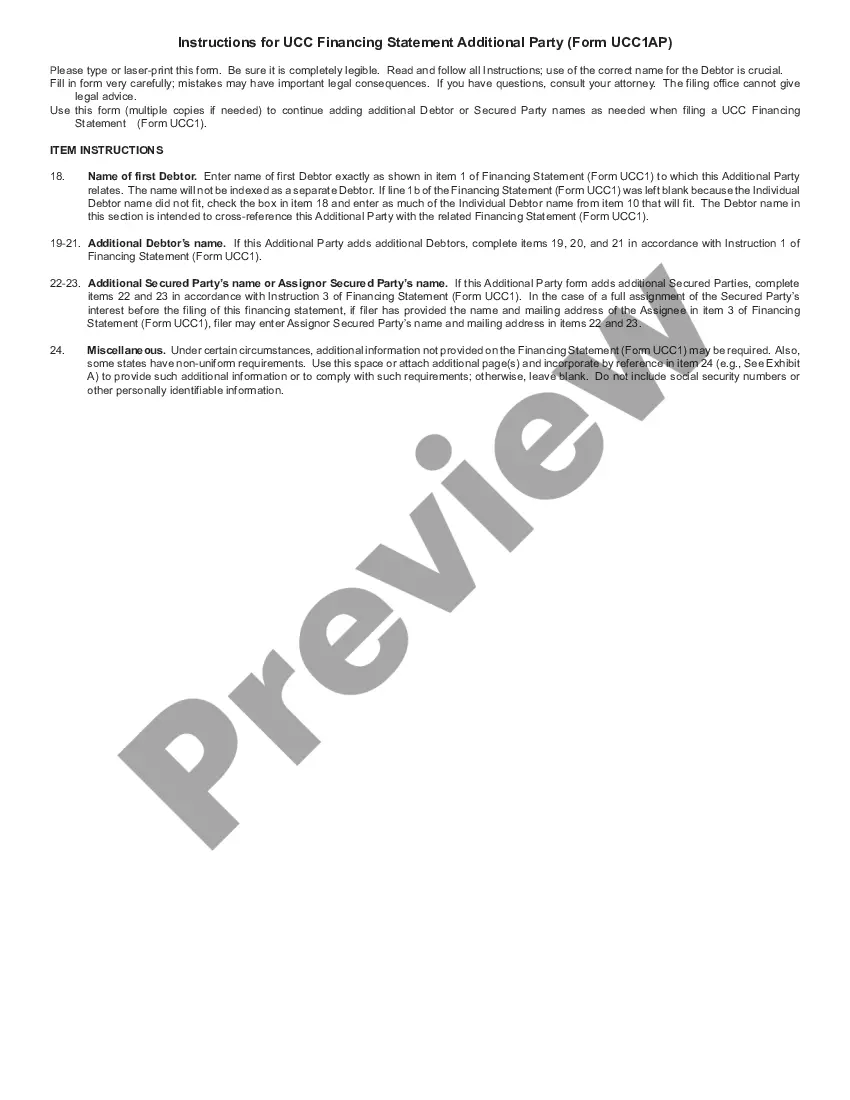

Use Mosey to register for payroll tax in Arizona. Note: When registering a new business for Personal Income Tax Withholding, you can also register for Unemployment Insurance at the same time. Create an account on AZTaxes. Log in to AZTaxes to register for Personal Income Tax Withholdings.

Registration must be done by completing the Arizona Joint Tax Application, (Arizona Form JT-1), available once enrolled for an user account on AZTaxes or here.

Existing Arizona Employer: If you are registered with the Arizona Department of Revenue, your Arizona Tax ID number is the same as your Federal Employer Identification Number (FEIN). If you cannot locate this number, please call the Department of Revenue at (800) 843-7196.

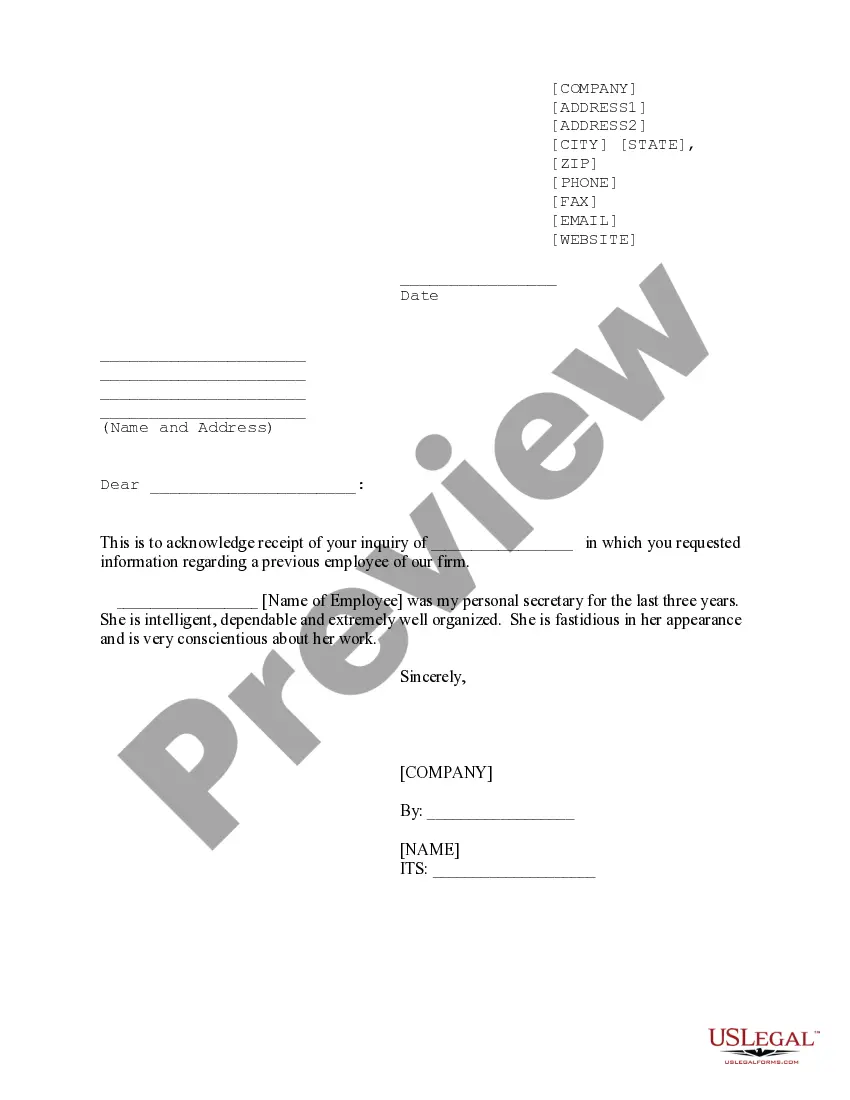

How to Correctly Fill Out an A-4 Form Part I of the the A-4 Form simply requests the employee's personal information, which includes name, social security number, and address. Numbers 1-3: Withholding. Number 4: Dependents. Number 5: Additional Amounts. Number 6: The Employer Confirmation. Signature.

Arizona Form A1-R is due January 31 of the year following the calendar year for which Arizona income tax was withheld. Submit federal Forms W-2 and W-2c reporting Arizona wages and/or Arizona income tax withheld, and federal Forms W-2G and 1099 reporting Arizona income tax withheld, with Arizona Form A1-APR.

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9.

Other nonpayroll payments that withhold Arizona income tax from payments to employees, beneficiaries or payees. NOTE: An amended Form A1-QRT can only be electronically filed through by a PSC or by an employer filing through a registered transmitter.

Other nonpayroll payments that withhold Arizona income tax from payments to employees, beneficiaries or payees. NOTE: An amended Form A1-QRT can only be electronically filed through by a PSC or by an employer filing through a registered transmitter.

The Arizona Form A-4, Employee's Arizona Withholding Percentage Election, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Use the Tax Withholding Estimator on IRS. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.