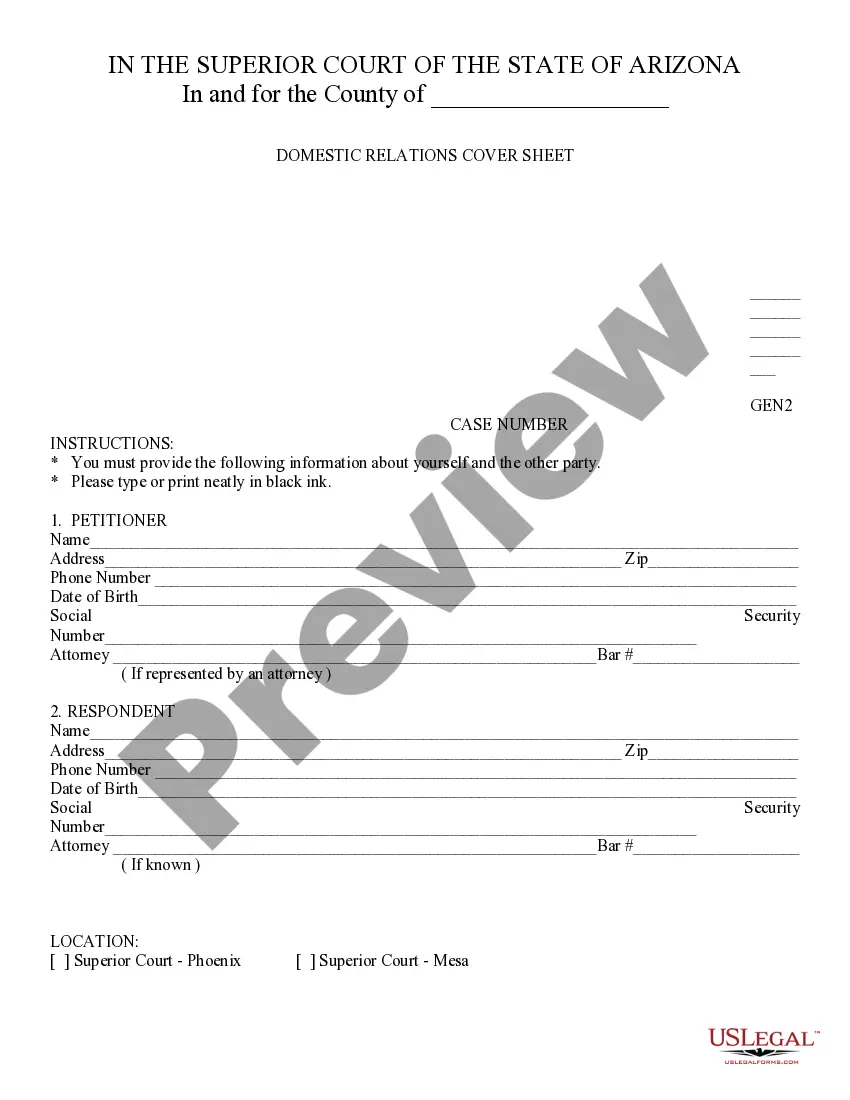

Factoring Agreement Draft With Client In Phoenix

Description

Form popularity

FAQ

The name, bankfactoring, might suggest that it is the bank that provides factoring services, but this is a simplification. It is not the banks, but actually companies specifically delegated by them to use bank capital, that offer factoring.

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.

Phoenix Capital Group is headquartered in Denver, Colorado with satellite offices in Irvine, California; Casper, Wyoming; Dallas, Texas; and Fort Lauderdale, Florida. Our rapidly growing client list of mineral owners and investors stretches across all 50 states.

Call (800) 860-7926 to speak with a customer service representative.

The accuracy of any calculations or rates are not guaranteed, for accurate calculations, rates and advice please call Phoenix Capital Group, 623-298-3450.

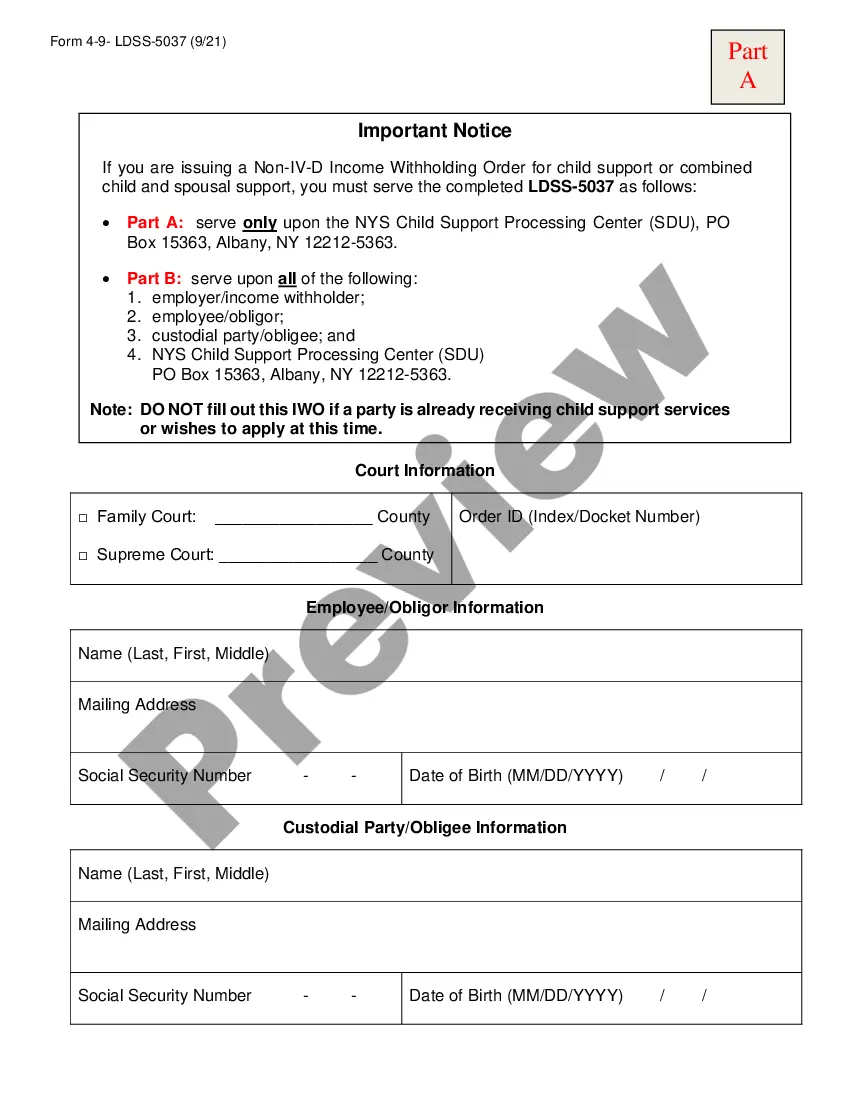

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

Contact eCapital Today at 855.790. 0906 | eCapital.

(800) 421-4225.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.