Form Assignment Accounting With Solutions In Middlesex

Description

Form popularity

FAQ

Alternatively, Form 3115 may be submitted by secure electronic facsimile or encrypted electronic mail. File Form 3115 as early as possible during the year of change to provide adequate time for the IRS to respond prior to the due date of the filer's return for the year of change.

One copy of Form 3115 attaches to Form 1120, and the 2nd copy (if necessary) files separately on paper directly to the IRS. The copy filed with Form 1120 is included in the electronic file. The 2nd copy isn't filed electronically; you need to paper file it with the IRS.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Only the desktop version supports the form.

Tips to Write Outstanding Accounting Assignments Comprehend the basics of accounting. Understand the requirements. Basic outlining. Practice a lot. Understand the assignment. Write a proper introduction. Write a thesis statement. Parting words,

When and where to file. There are two methods of requesting change with a Form 3115. You can file in duplicate by attaching the original form to your federal income tax return. You also need to file a copy of the form with the IRS (Internal Revenue Service) National Office after the first day of the year.

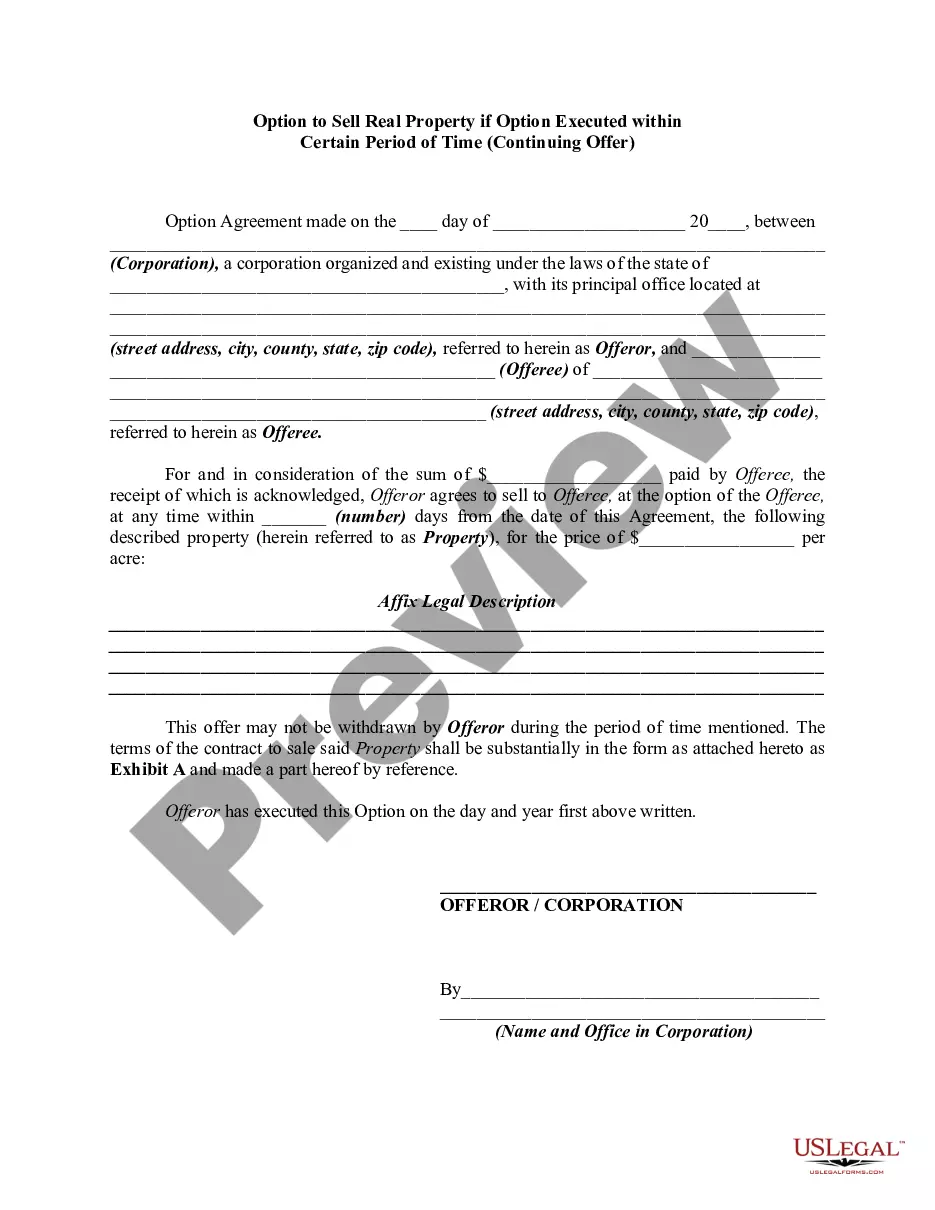

Assignment is a legal term whereby an individual, the “assignor,” transfers rights, property, or other benefits to another known as the “assignee.” This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

How Do You Write an Assignment in Accounting? Expert Tips Instructions Reading with Great Care. Clear your Doubts. Identification of the Assignment Category. Conduct Detailed Research. Collect the Relevant Information. Organise your Research. Collect the Notes. 1.Generating the Outline.