Agreement Form Assignment For Funeral Home In Los Angeles

Description

Form popularity

FAQ

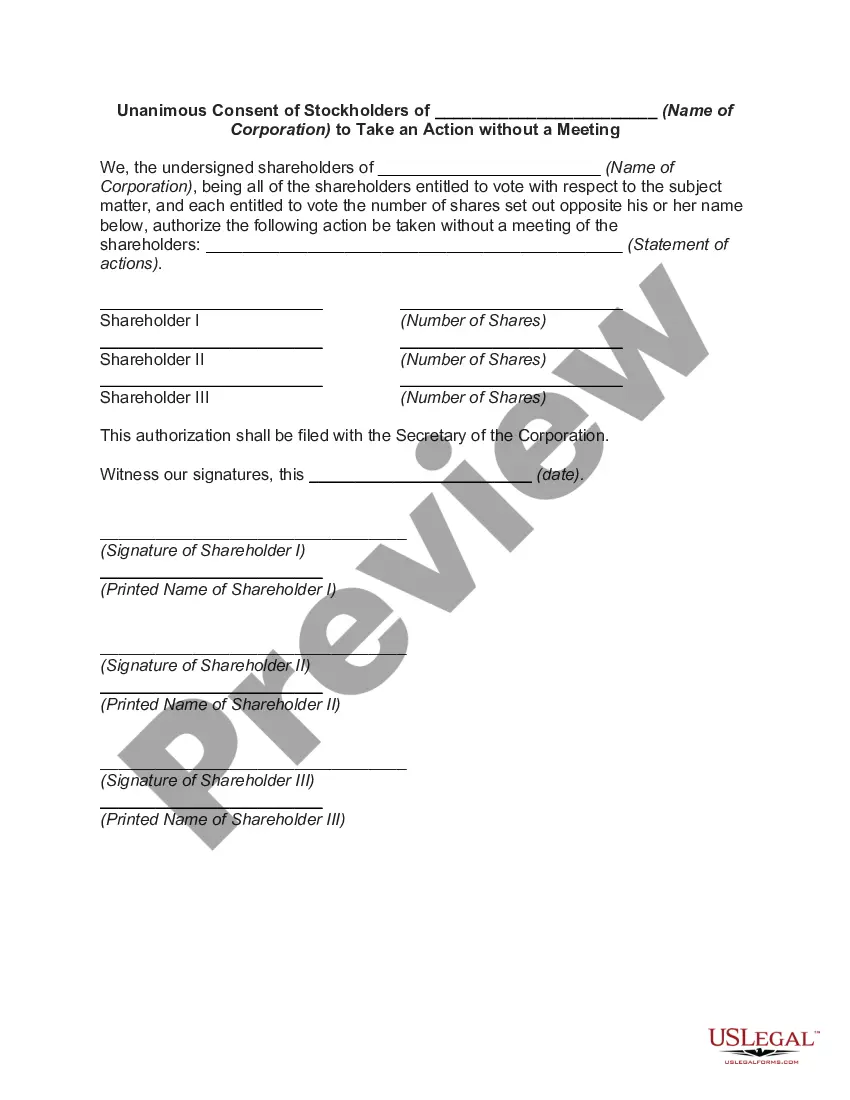

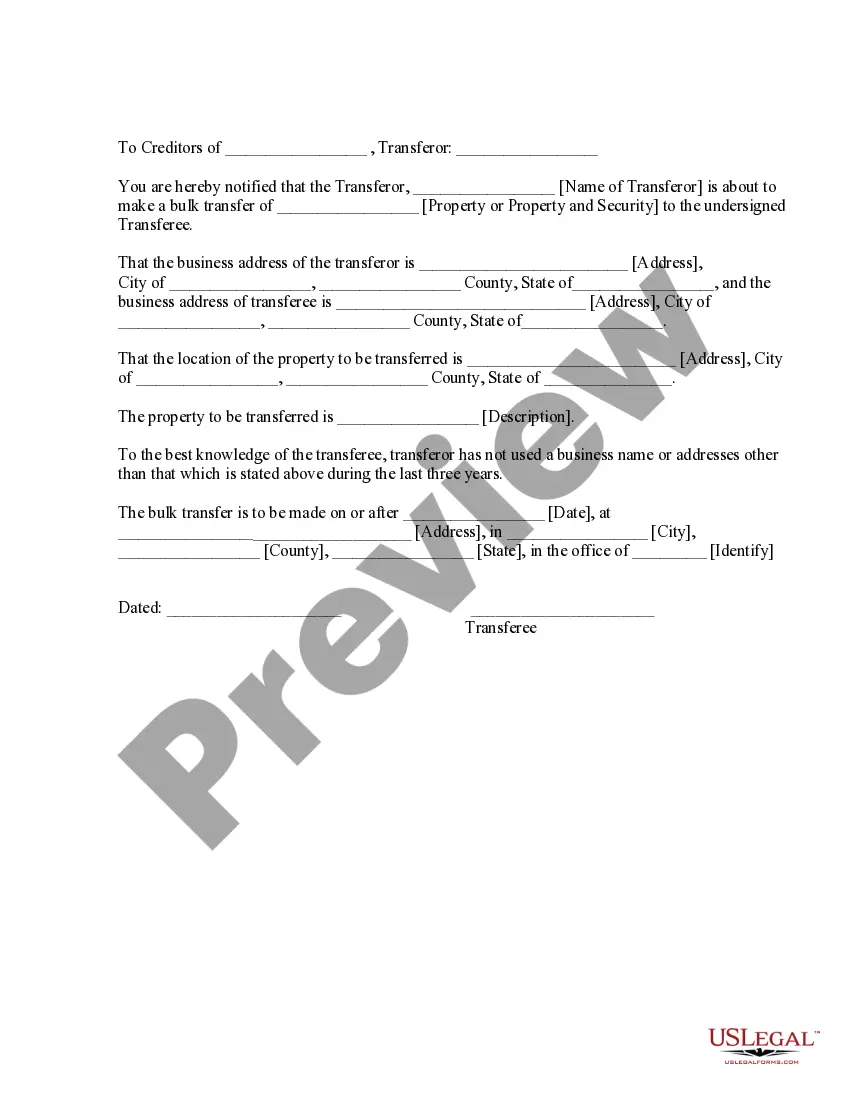

Policy Assignment Options The recipient will complete a form to designate the benefits directly to the funeral provider or a third party, who then files a claim with the life insurance company. Policyholders can choose this option when pre-planning a funeral by naming the funeral home as the primary beneficiary.

Who Has the Right to Make Funeral Arrangements in California? you, if you write down instructions before you die. your health care agent, if you name one in an advance directive. your spouse or registered domestic partner. your adult child, or a majority of your children if you have more than one. your parents. your siblings.

Policy Assignment Options The recipient will complete a form to designate the benefits directly to the funeral provider or a third party, who then files a claim with the life insurance company.

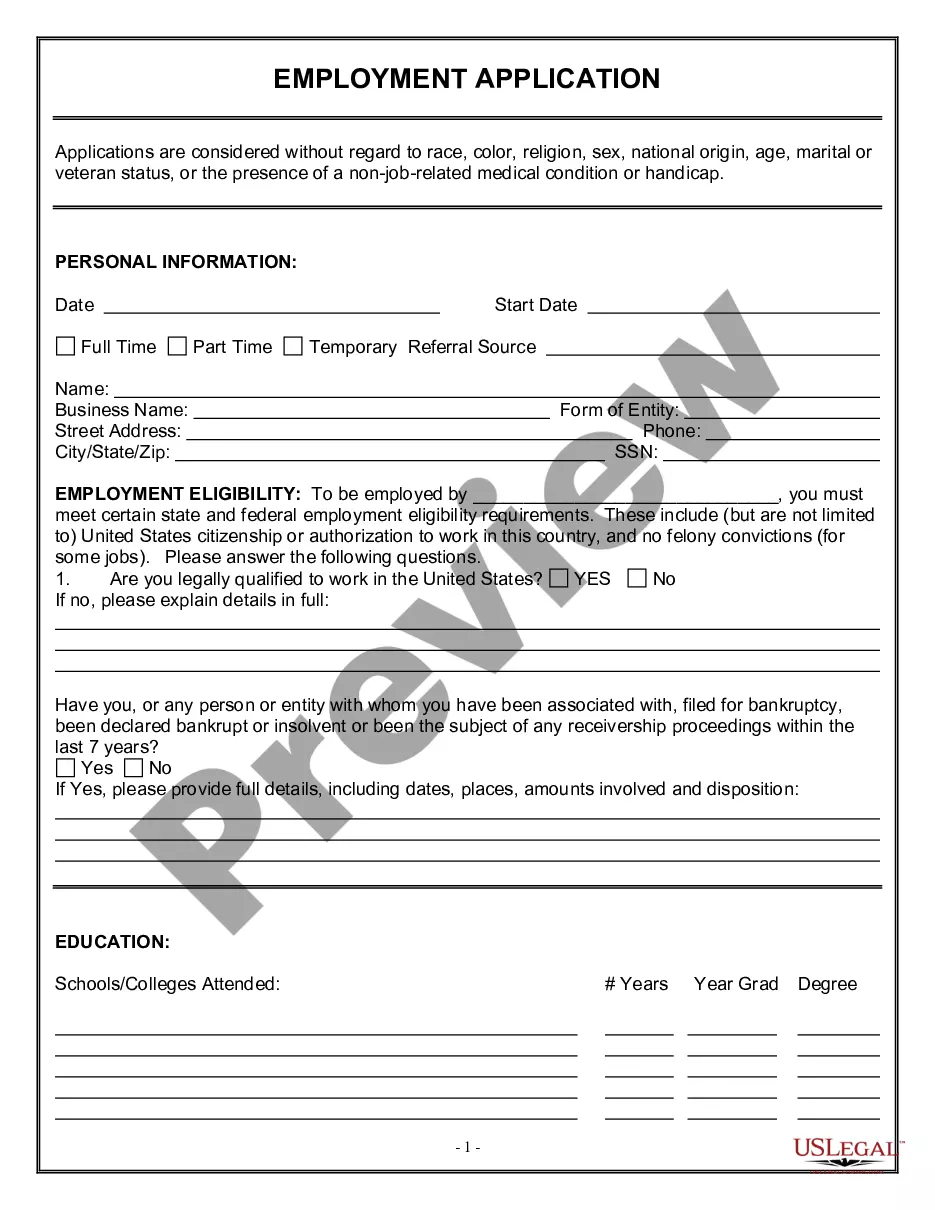

If the insurance company does not have its own form, the funeral home may use the attached Irrevocable Assignment of Policy Ownership form. Fill out the information requested, have the policyowner sign the form before a notary, and submit the form to the insurance company.

Policy Assignment Options The recipient will complete a form to designate the benefits directly to the funeral provider or a third party, who then files a claim with the life insurance company. Policyholders can choose this option when pre-planning a funeral by naming the funeral home as the primary beneficiary.