Factoring Agreement Editable With Bank In Collin

Description

Form popularity

FAQ

The name, bankfactoring, might suggest that it is the bank that provides factoring services, but this is a simplification. It is not the banks, but actually companies specifically delegated by them to use bank capital, that offer factoring.

Overall, the Factoring Master Agreement provides a legal framework for the factoring relationship, ensuring that both parties understand their rights and obligations and helping to minimize the risk of disputes or misunderstandings.

How To Get Out Of Factoring Check your factoring contract. Get some guidance. Identify your problems with factoring. Consider product migration. Plan any product migration. Take over the credit control function. Calculate the residual funding gap. Plan your funding migration.

To cancel or terminate a factoring agreement, first review the terms in your contract regarding notice periods and potential penalties for early termination. You'll need to formally notify your factoring company, usually in writing, of your intention to end the agreement.

To cancel or terminate a factoring agreement, first review the terms in your contract regarding notice periods and potential penalties for early termination. You'll need to formally notify your factoring company, usually in writing, of your intention to end the agreement.

Bank factoring, also known as accounts receivable funding, is a way to collateralize loans and lines of credit by using outstanding invoices as security to ensure payment on the amount borrowed.

Many banks offer factoring services to their business customers as a financing option.

What is bank factoring? The name, bankfactoring, might suggest that it is the bank that provides factoring services, but this is a simplification. It is not the banks, but actually companies specifically delegated by them to use bank capital, that offer factoring.

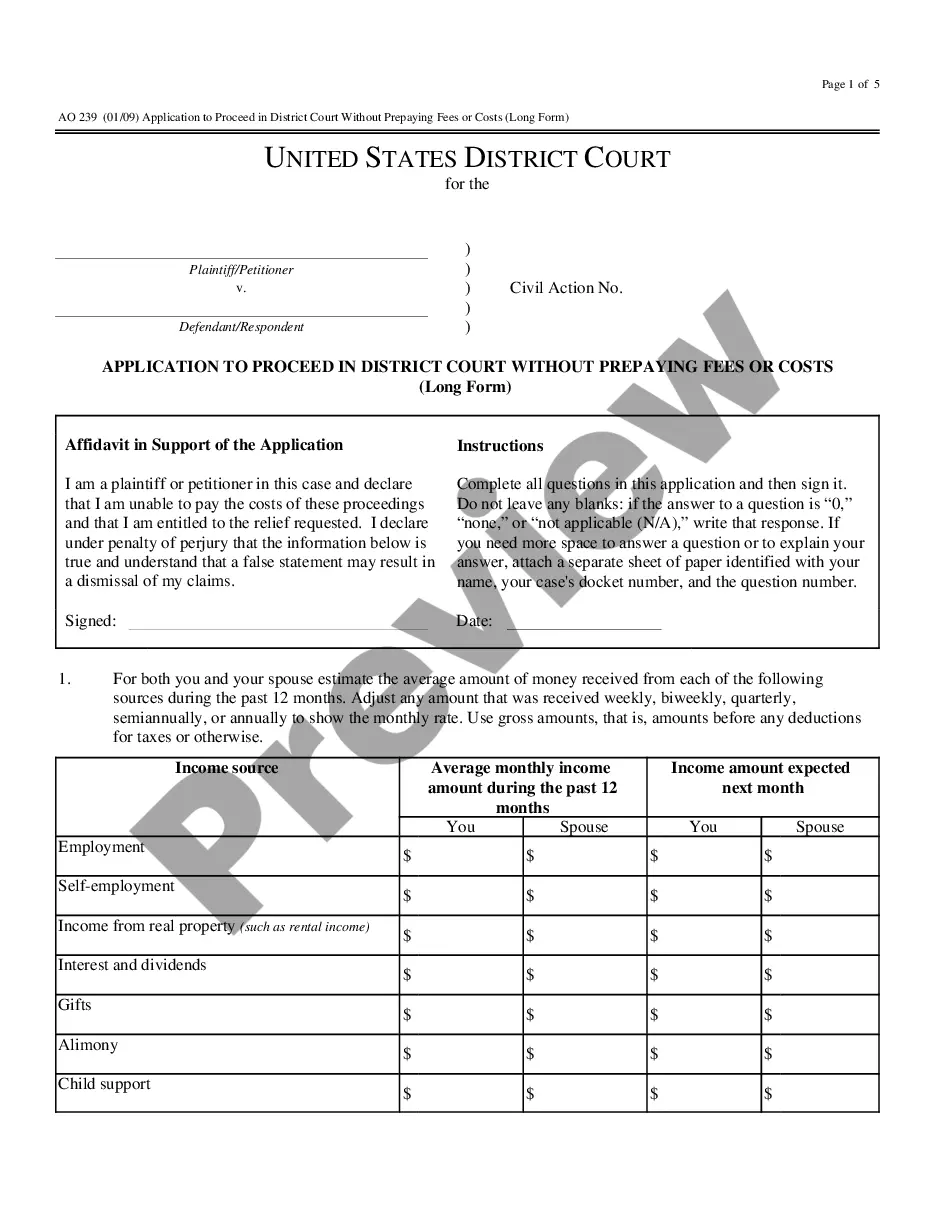

Here's a breakdown of the basic invoice factoring requirements: Bank statements. Factoring application. Invoices you want to factor. Proof of delivery or service. Customer credit information. Accounts receivable aging report. Articles of incorporation or business registration.