Business Equity Agreement With The Child In Wake

Description

Form popularity

FAQ

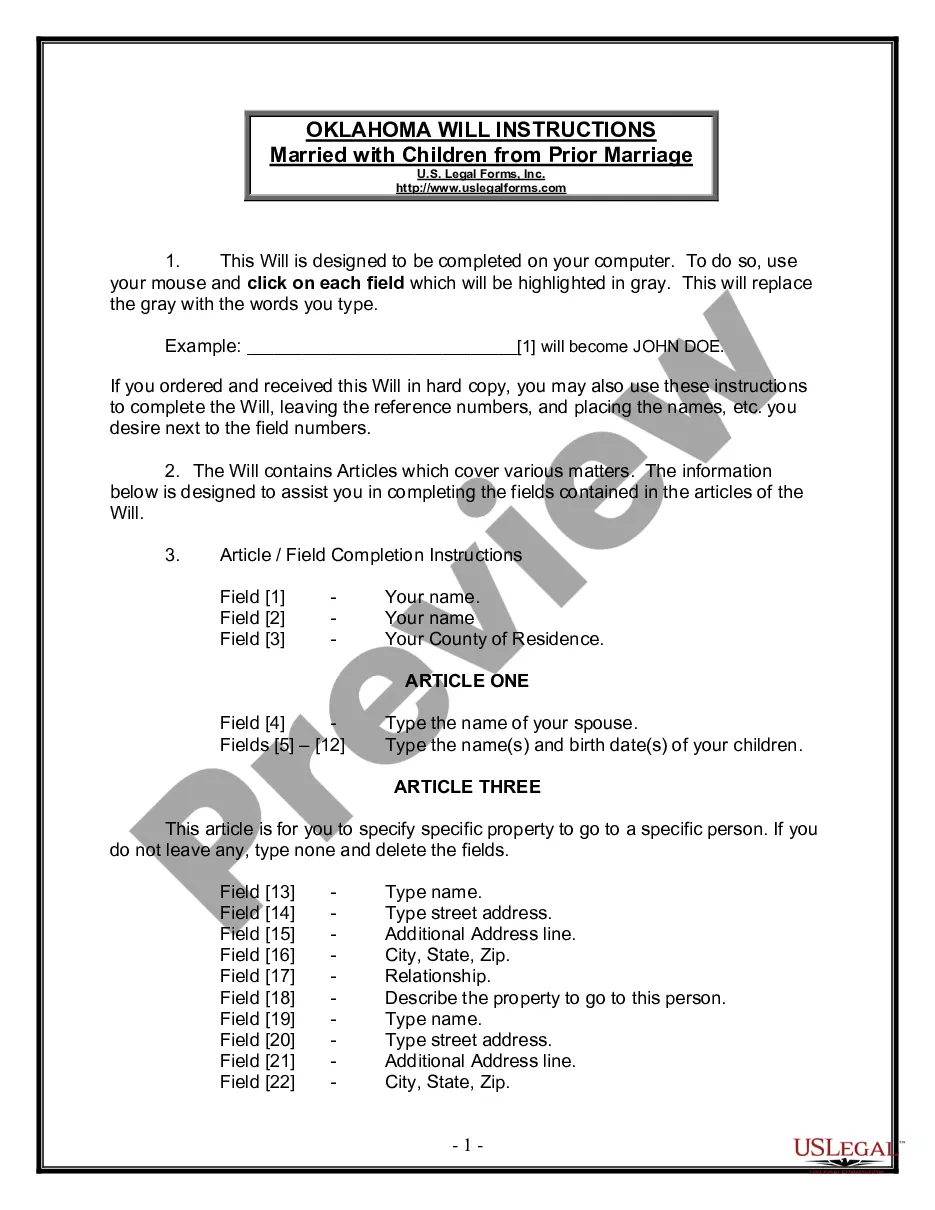

One of the simplest ways to leave your business to your children is through your will. This option is suitable if you don't want to lose control or ownership of the business while you're alive. To put your business in your will, you will need to be clear with your wording.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Generally, you can borrow up to 80% of your home's value minus your remaining home debts, meaning you're not eligible for an HEA until you have at least 20% equity in your home. Debt-to-income (DTI) ratio: Calculate what percentage of your monthly gross income goes toward your debt payments.

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

7 steps for smoothly taking over the family business Use the succession plan. Be patient. Assess your skills. Take care of company culture. Maintain your credibility. Keep the peace. Consider the advice of your peers.

A business owner may gift ownership in the family business to a family member or to a trust established for the benefit of a family member as a one-time gift using (before losing) the increased federal gift and estate tax exemption, a series of gifts as part of an annual gifting program utilizing the annual gift ...

Family business succession planning is the process of creating a plan to transfer control of a family-owned company to new leadership when the current leadership steps down. Succession planning generally can also include protocols to follow if a business owner needs to be removed from their role involuntarily.

It depends on the structure of the business. If your small family business is a sole proprietorship, you can transfer business ownership by selling its assets. If it's a partnership, you could transfer your interest to other partners. If it's a corporation, you can transfer by gifting, selling, or bequeathing shares.