Equity For Share Capital In Virginia

Description

Form popularity

FAQ

The share capital is the part of a company's equity that it has raised from issuing common or preferred shares and is different from other types of equity accounts.

Shareholders' equity can be calculated by subtracting a company's total liabilities from its total assets, both of which are itemized on the company's balance sheet.

To calculate equity share capital, use the formula: Equity Share Capital = Number of Shares Issued x Face Value per Share. This calculation helps determine the total funds raised by a company through equity shares for operational and growth activities.

How to fill out the Share Application Form for Equity and Preference Shares? Fill in the personal details of all applicants in the specified sections. Indicate the type and number of shares you are applying for. Specify the amount payable per share as well as the total amount.

There are 4 ways to apply for Rights Issue: Login to your ICICI Direct web account > Click on IPO section > Click on Rights Issue > Apply. Online through ASBA (Applications Supported by Blocked Amount) if your bank supports it just like you do for an IPO. Online through the RTA (Registrar and Transfer Agent) website.

To become a shareholder in a company, one needs to have the consent of the Board of Directors, and a resolution has been passed. The stocks in a private company are recorded in a ledger under the supervision of the corporate secretary.

corporations: Corporations that have elected status for federal purposes are automatically treated as corporations for Virginia purposes, and must file Form 502. Refer to the PassThrough Entities page for information about corporation filing requirements. The tax rate is 6% of Virginia taxable income.

Forming a Virginia S Corp Step 1: Come up with a distinguishable name. Step 2: Select a registered agent. Step 3: Submit formal paperwork. Step 4: Apply for an Employer Identification Number (EIN). Step 5: Issue stock. Step 6: Prepare initial documents. Step 7: Elect the tax status.

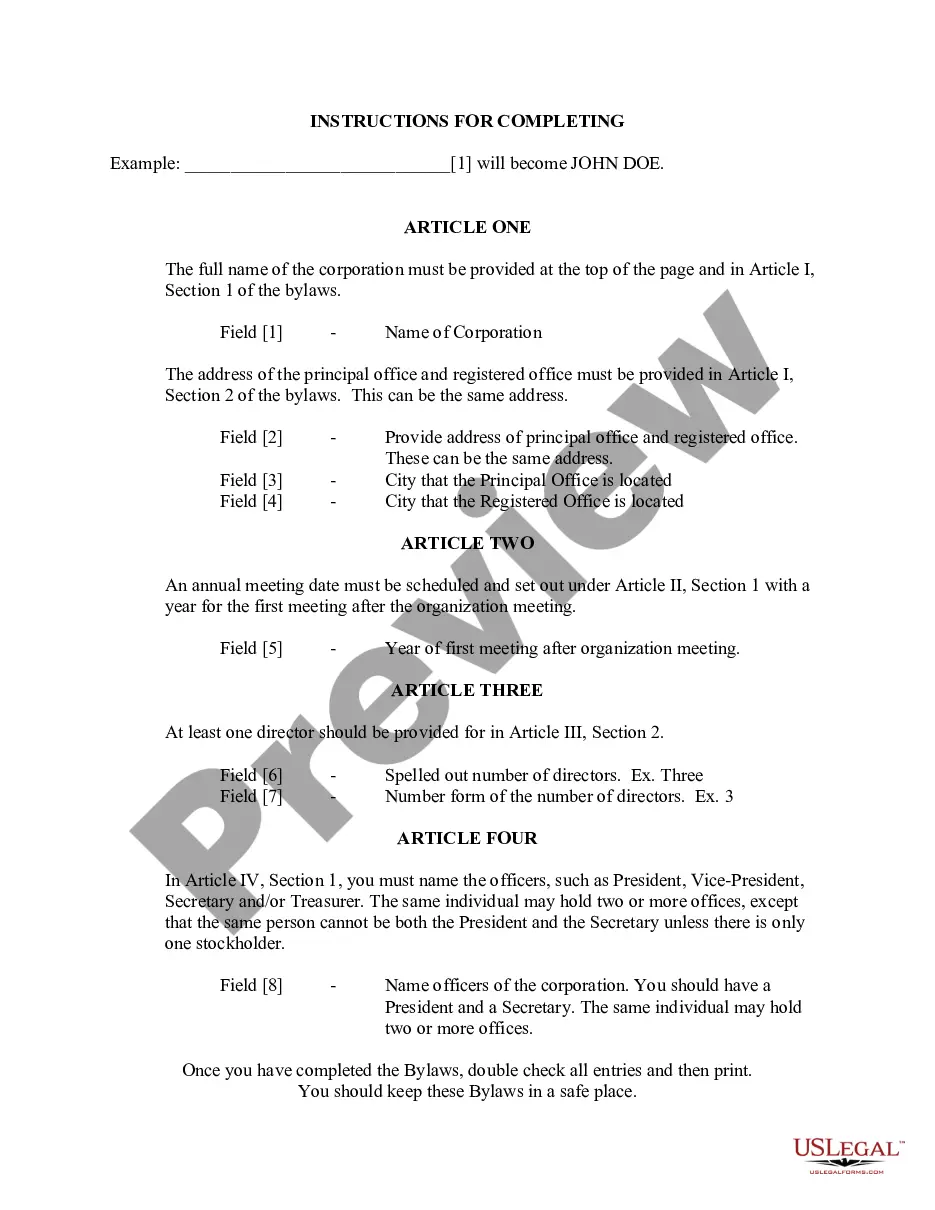

Choose a Corporate Structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Virginia Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

Forming a Virginia S Corp Step 1: Come up with a distinguishable name. Step 2: Select a registered agent. Step 3: Submit formal paperwork. Step 4: Apply for an Employer Identification Number (EIN). Step 5: Issue stock. Step 6: Prepare initial documents. Step 7: Elect the tax status.