Cost Sharing Contract Example Withholding Tax In San Diego

Description

Form popularity

FAQ

San Diego County sales tax details The minimum combined 2025 sales tax rate for San Diego County, California is 7.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%. The San Diego County sales tax rate is 0.25%.

An insurance policy is a legal contract between the insurance company (the insurer) and the person(s), business, or entity being insured (the insured). Reading your policy helps you verify that the policy meets your needs and that you understand your and the insurance company's responsibilities if a loss occurs.

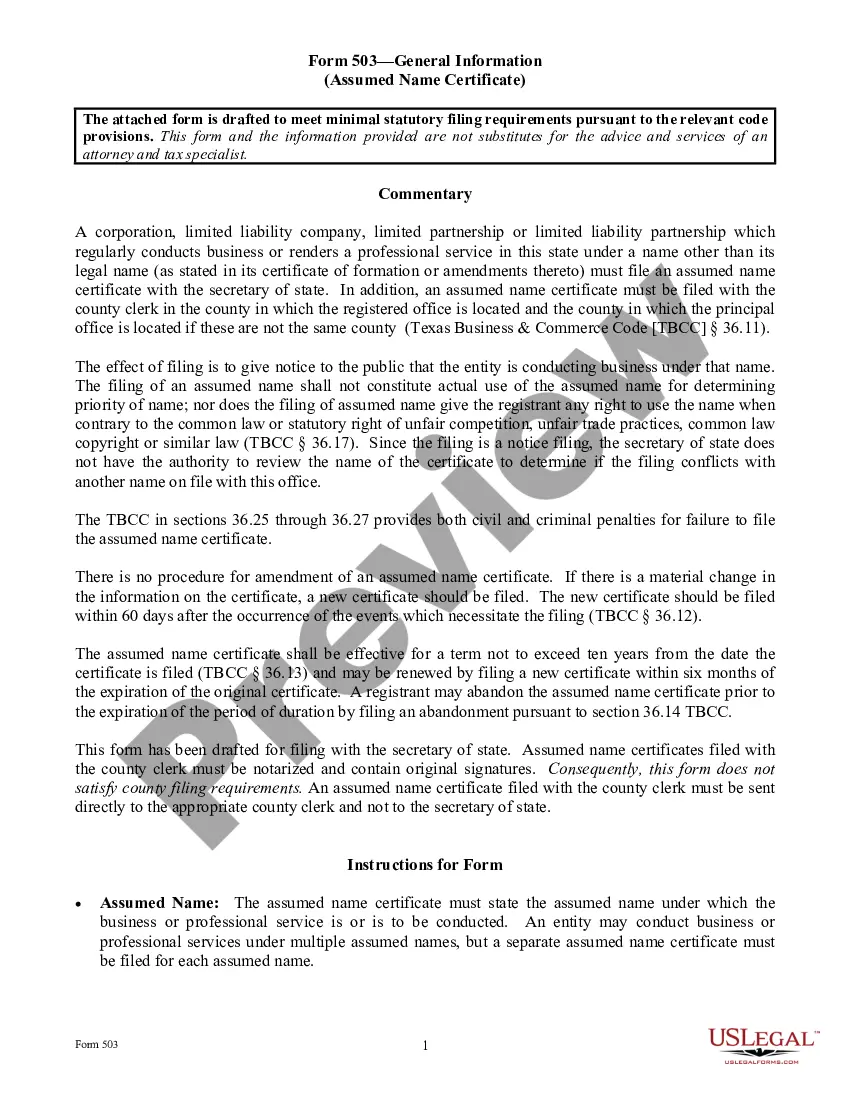

Tax Sharing and Allocation Agreements are contracts that describe and coordinate the allocation of tax responsibility and benefits among the named parties for a particular transaction or for a specific taxable period. Depending on the context, they may be called different names.

An intercompany agreement, or sometimes referred to as an ICA, is a legal document that helps facilitate two or more companies owned by the same parent company in exchange for financing, goods, services, or other exchanges.

An individual would be resident in India if he stays for 182 days or more in India during the previous year or if he stays for 60 days during the previous year and 365 days in the 4 years preceding previous year. If an individual fails to satisfy the above conditions, he will be considered as a non-resident in India.

The amount withheld depends on: The amount of income earned and. Three types of information an employee gives to their employer on Form W–4, Employee's Withholding Allowance Certificate: Filing status: Either the single rate or the lower married rate.

Federal Withholding Tax and Tax Treaties In most cases, a foreign national is subject to federal withholding tax on U.S. source income at a standard flat rate of 30%. A reduced rate, including exemption, may apply if there is a tax treaty between the foreign national's country of residence and the United States.

In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.